This prolonged range-bound action, however, reflects Bitcoin’s increasing maturity as an asset, and annualised realised volatility has hit an all-time low. Despite this, BTC remains highly reactive to macroeconomic developments, notably tumbling after Trump’s tariff announcements targeting Mexico, Canada, and China.

Recent trends suggest that BTC is increasingly being treated as a risk-on asset rather than a pure store of value. Its correlation with the S&P 500 remains strong, while its relationship with gold has weakened. While Bitcoin has gained 3.5 percent so far this year, gold is up 9 percent, hitting a new all-time high of $2,880 per ounce. The gold rally has added $1.5 trillion to its market cap this year, dwarfing Bitcoin’s $66.5 billion increase. This divergence is driven by institutional and sovereign wealth fund purchases, which have largely bypassed Bitcoin due to regulatory concerns and volatility.

However, a shift may be underway. Over $196 billion worth of Bitcoin is now held by ETFs, public and private companies, and even nation states. With central banks expanding money supply and fiat devaluation risks rising, Bitcoin’s fixed-supply narrative is becoming increasingly attractive.

We expect BTC’s range-bound behaviour to persist in the near term, with potential downside pressure if macro conditions worsen. However, in our view, even as gold continues to rise and institutional sentiment around Bitcoin shifts, the long-term store-of-value narrative for Bitcoin remains intact.

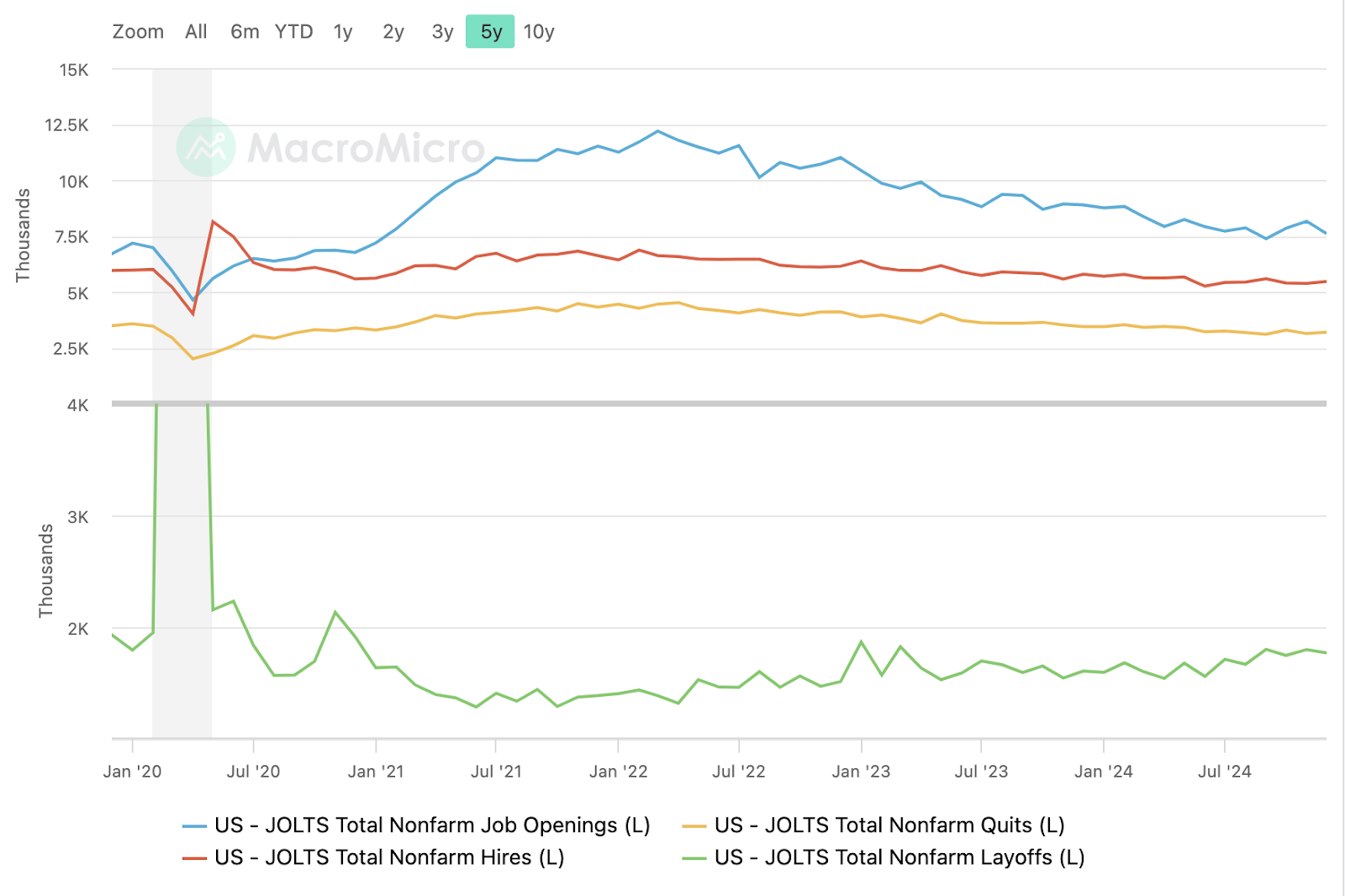

Data that will influence future central bank moves, continue to be closely watched. The US job market showed signs of slowing in January, with 143,000 new jobs added, though upward revisions to previous months’ figures reinforced labour market resilience. Unemployment remained steady at 4 percent, reflecting a stable workforce supported by immigration-driven growth. Wage gains of 0.5 percent in January, marking a 4.1 percent annual increase, continue to fuel consumer spending, which remains a key driver of economic activity.

However, higher labour costs and slowing productivity growth could contribute to inflationary pressures, complicating the Federal Reserve’s decision on interest rates. Meanwhile, trade tensions between the US and Canada have temporarily eased following a 30-day tariff pause, but uncertainty remains as unresolved trade disputes could disrupt supply chains and raise consumer prices.

With job growth moderating, unemployment claims rising, and trade risks continuing to cast uncertainty on future economic prospects, policymakers face growing challenges in balancing economic stability, control over inflation, and managing the impact of workforce dynamics in the months ahead.

The crypto industry remains bullish, however. Following the departure of SEC Chairman Gary Gensler, there has been a surge in crypto-related ETF applications, with over 45 active filings, including spot ETFs and futures products on assets like Solana ( SOL) and Ripple ( XRP). The SEC’s evaluation of these applications will focus on market stability, particularly liquidity and susceptibility to manipulation. Meanwhile, the Commodity Futures Trading Commission is also ramping up regulatory discussions, organising a CEO Forum with industry players including Circle, Coinbase, and Ripple.

This initiative aims to gather insights on a proposed stablecoin and collateral management pilot program, reflecting a broader push for structured regulatory oversight in the digital asset space.

As regulatory discussions progress, crypto adoption continues to expand into traditional industries. In the UAE, Tether has partnered with Reelly Tech to introduce USDt stablecoin payments in real estate transactions, a move that will allow over 30,000 agents to facilitate cross-border property purchases efficiently. This partnership aligns with the UAE’s growing reputation as a global crypto hub, where off-plan real estate sales have surged, reflecting strong investor interest in digital asset integration.

On the recovery front, FTX has announced the commencement of its initial distributions to creditors following the approval of its Chapter 11 reorganisation plan. Payments will begin on February 18, 2025, through BitGo and Kraken, marking a critical milestone in the exchange’s efforts to compensate affected customers. While asset recovery remains ongoing, this development signals progress in addressing the fallout of FTX’s collapse.

The post appeared first on Bitfinex blog.