Let Your Automated Strategy Trade For You

At Cryptohopper, we believe in making the complex simple. Making advanced trading methods accessible for everyone comes hand in hand with the main purpose of cryptocurrency: empowering normal people to do great things.

We work every day against the clock to offer you all the trading tools you need in a unique and user-friendly way. Just by simply selecting, dragging and dropping, you will be able to create trading strategies that range from very most simple to extremely powerful and complex.

Whether you are a professional trader or a beginner. Whether it is a simple strategy with one indicator/pattern, or a complex exchange arbitrage and market making strategy.

Cryptohopper allows you to create and automate every single aspect of your trading, so you can let your money work for you in the most effective way.

In this article, you will learn how to easily create a trading strategy with the Cryptohopper strategy designer, one of our most powerful and highly customizable tools.

We will create and backtest a strategy that will use a trend and momentum indicator. For this example, we have selected the Exponential Moving Average (EMA) and the Relative Strength Index (RSI). The idea behind this strategy is to open positions once the price is oversold (signaled by the RSI) in conjunction with the EMA giving a buy signal. This means that the price is beginning to go up (pinpointed by the EMA) after a quick fall (pinpointed by the RSI -oversold zone).

Let’s get started creating the strategy step by step!

First, go to the section Strategy, you can find it in the column at your left-hand side. Then, click on New strategy at the upper right corner of your screen.

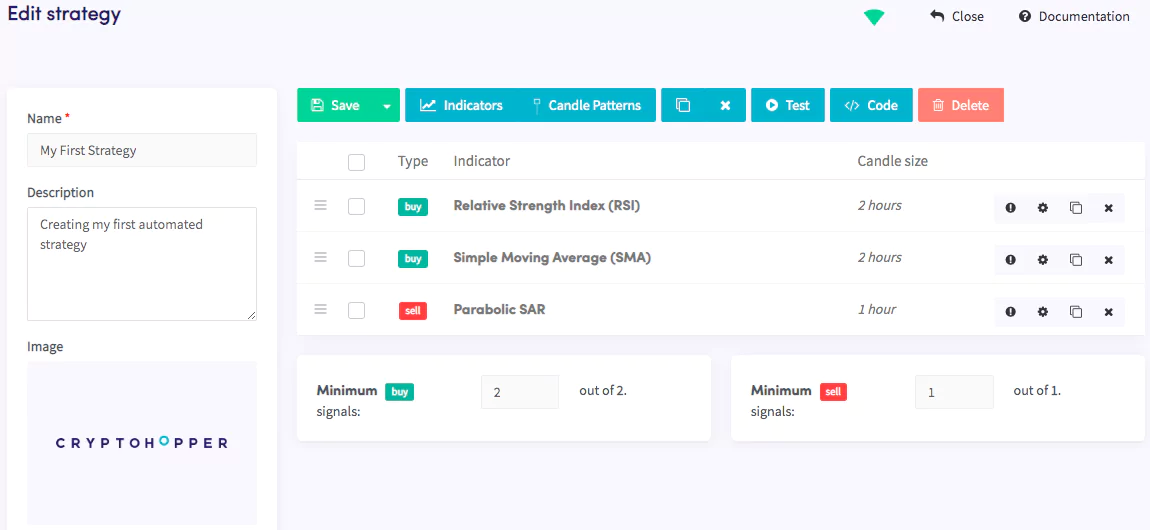

In this menu, you can see that Cryptohopper differentiates between Indicators and Candle Patterns. By clicking on Indicator, you can see all the indicators available on the platform. Just by clicking on any of them, adjusting the indicator settings or leaving the default ones, you can include them in your strategy.

You can do the same with the Candle Patterns. You can choose over 90 different candlestick patterns and include them in your strategy.

Once you have included all the elements of the strategy, the next step is to select how many of those elements (indicators or patterns) are required to actually give a buy or sell signal. Below your selected indicators, you can see two boxes saying “Minimum buy/sell signals:” here, you can specify how many of those elements are required to give a buy signal to actually open a position. For example, if you have selected 3 indicators to buy and your Minimum buy signals are 2, just with 2 indicators signaling a buy, your strategy will open a position.

Strategy designer

If you have followed all these steps, congratulations! You have created your first automated trading strategy.

You can check out this 1-minute video for more info about this Cryptohopper feature!

But this is not all! After you have created your own automated strategy, the only thing that is left is polishing, polishing and polishing it.

For this purpose, you can use the tool “Test”, which will allow you to quickly backtest your strategy based on the market activity of the last few days. This tool will let you spot your strategy’s buy and sell points on a chart, so you can easily see its behavior on the markets that you choose. It is a very visual tool that, without a doubt, will help you polish and improve your strategy’s performance.

After you are done with backtesting, you just need to name your strategy, save it, and select it in the Baseconfig (section Strategy). Then, your strategy will be more than ready to trade any cryptocurrency pair selected by you.

Check out the previous blog "How To Improve Your Results With Triggers" by clicking here!