Crypto trading 101: How to Trade Inside Bars in the Crypto Market

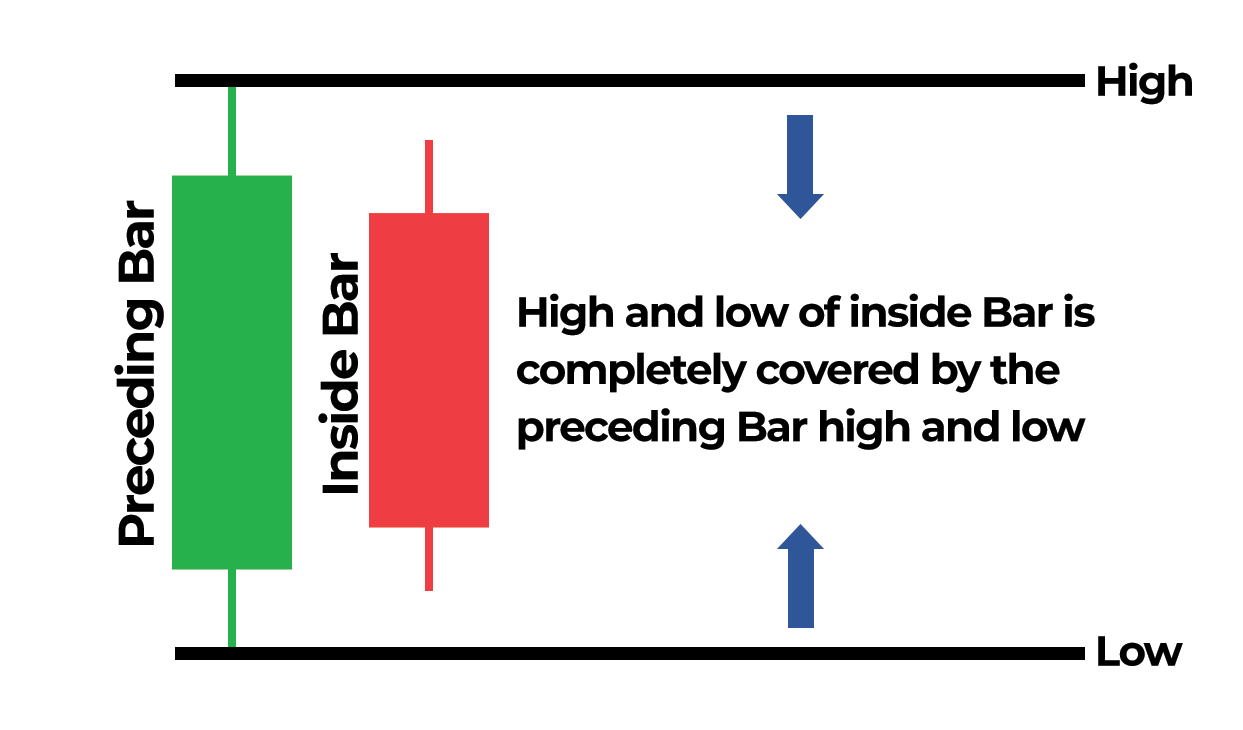

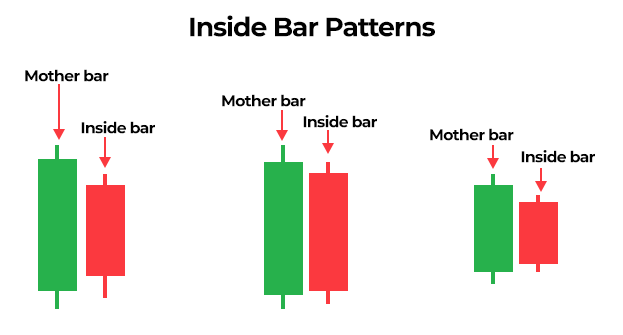

The inside bar is a two candlestick reversal or continuation chart pattern showing a period of market consolidation. When the inside bar pattern develops at the end of a trend, it can signal a trend reversal. At the same time, if it develops in the middle of the trend, it can potentially signal a trend continuation.

Inside Bar Features

The Inside Bar candlestick pattern has the following key characteristics:

The first candle within the inside bar pattern is a big, bold bullish/bearish candle, also referred to as the mother candle

The first candle has a large body and small wicks

The second candle is a relative small bullish/bearish candle whose wicks and body are fully contained within the range of the first candle

The second candle is also known as the Harami (Japanese term for pregnancy)

Trading Inside Bars

The steps to trade the inside bar pattern if it develops during the last stages of a bearish trend:

Buy the pair when the price breaks above the highest point of the Harami candle

Alternatively, a more conservative approach is to wait for a break of the mother candle

The stop-loss is placed on the opposite side, i.e., below the mother candle's low

How to Trade with Inside Bars

The inside bar pattern can be a very powerful price action setup if you understand how to trade it properly. In this lesson we will discuss the basics of the inside bar pattern, including what makes a valid inside bar and the best way to trade the inside bar strategy in the forex market.

Tips on Trading the Inside Bar Pattern

Wait for the pattern to complete.

Avoid inside bars that form on or near significant support or resistance levels.

Avoid inside bars that form on or near moving averages.

Avoid inside bars that form on or near the high or low of the day.

Avoid inside bars that form on the daily chart when the daily chart is in a tight trading range.

Be careful trading the inside bar pattern with other technical indicators.

Be careful when trading the inside bar pattern in high impact news events.