How Many People Are Really Trading Cryptocurrency?

After a disappointing 2018, crypto markets are booming once again.

Backed by institutional investors, growing numbers of individual enthusiasts, and broad support for its underlying technology, the blockchain, the entire crypto sector is seeing a resurgence.

According to data collected by CoinMarketCap, the collective crypto cap has nearly tripled since the start of the year. Led by Bitcoin (which has also tripled its value since its low point in 2018) cryptocurrencies are crypto outperforming many others outperforming many other investment assets, including stocks, bonds, gold, and oil.

For those who witnessed crypto’s meteoric rise in 2017, this year’s activity might seem incredibly familiar.

Naturally, now that cryptos are once again an intriguing investment vehicle, exchanges are experiencing a deluge activity. Daily trading volumes have exceeded $70 billion, up from just $18 billion at the start of the year.

At the same time, some are questioning the legitimacy of this data, contending that it may be exaggerated or overblown. With individual and institutional investors alike flooding into crypto markets, now is an excellent time to evaluate the trading landscape and to consider how crypto trading really gets done.

Most importantly, it’s the right time to evaluate how these factors can help investors capitalize on the most recent crypto boon.

People Aren’t Pushing the Buttons

Although cryptocurrencies are a compelling investment opportunity with the potential for creating robust returns, many traditional financial loyalists are incredulous of their efficacy.

For instance, several mainstream institutions offer crypto-related investment products, but buying and selling cryptos is still restricted to crypto exchanges.

Of course, that doesn’t mean that investors can’t derive profits on crypto exchanges; it just might not be happening in the way that many people expect.

Activity on crypto exchanges has been scrutinized practically since their inception. In 2014, a theft at Mt. Gox, the most prominent Bitcoin exchange at the time, left a degree of skepticism that has lingered over these institutions ever since.

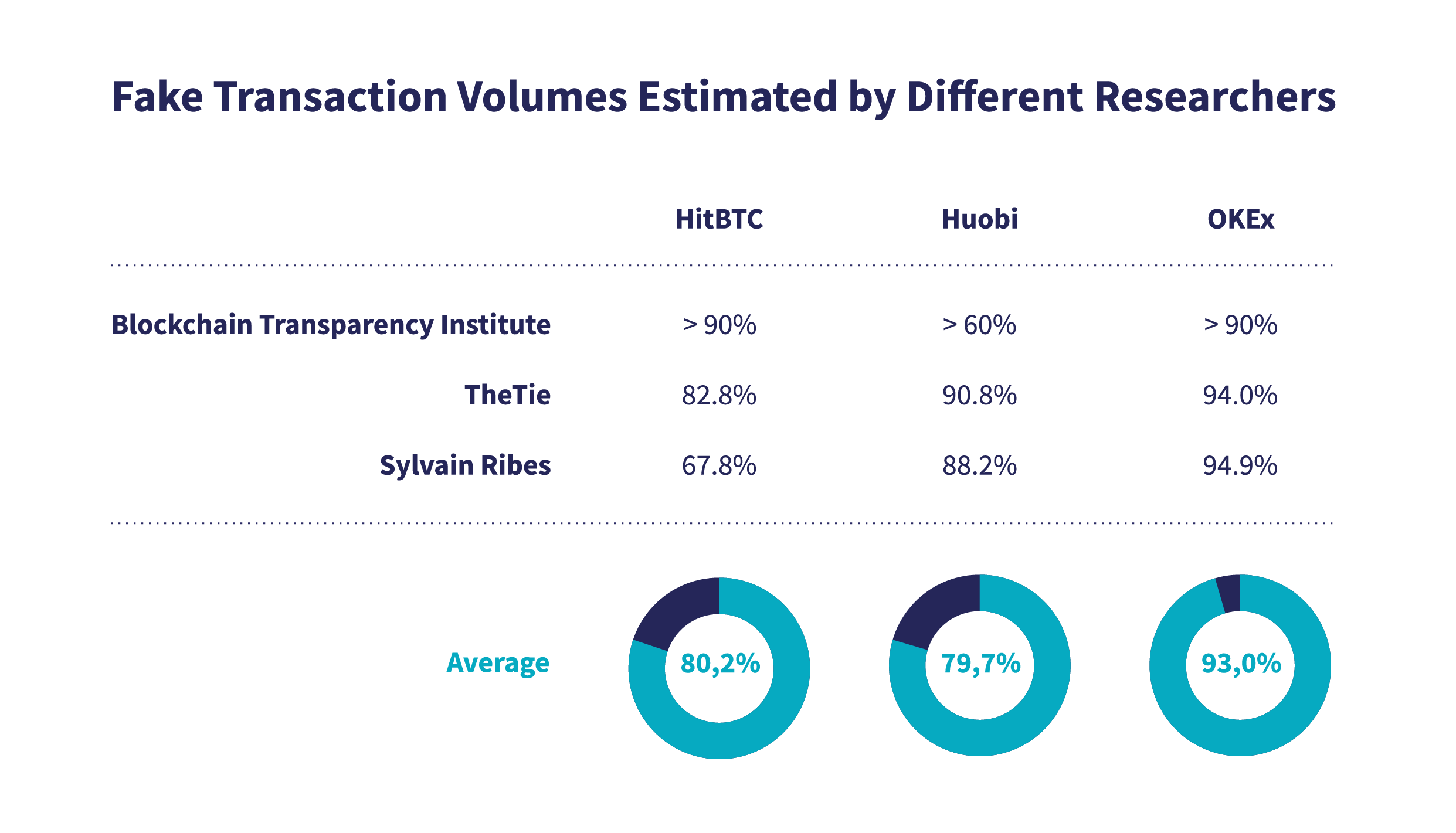

More recently, a May white paper by crypto exchange Bitwise contends that as much as 95% of reported Bitcoin trading volume is fake, perpetrated by budding exchanges striving to carve out an increasingly competitive market share.

Since high trading volume can serve as an enticement for traders to trust and try these new platforms, there is an inherent incentive to cook the books in this way.

However, as Tim Enneking, managing director of Digital Capital Management, told Forbes most of the reported cryto appears to be fake volume, “most of the largest exchanges appear to have a much lower level of ‘fake’ volume, so the 95% number is hardly evenly spread across exchanges.”

What’s more, the white paper didn’t account for low-latency or algorithmic trading that is prevalent in both traditional financial markets and throughout the crypto ecosystem.

In this case, traders pay higher fees that offer them priority on exchanges, allowing them to practice things like front running and aggressive latency optimization, according to Bloomberg. When coupled with specialized trading bots that anticipate and profit from the trading tendencies of average investors to derive margin, it’s clear that crypto markets aren’t just populated by forward-thinking day traders.

While some of this activity is insultingly described as “Flash Boys”-like trading (a title derived from the Michael Lewis book describing this activity in traditional financial markets), not all algorithmic trading is manipulating markets.

Fortunately, when the inflated numbers from alternative exchanges are eliminated, crypto markets look especially compelling. Commenting on their competence, Matthew Hougan, global head of research at Bitwise, told CNBC, “When you cut away the echo chamber of these nonsense numbers, it should be an efficient, well-arbitraged market.”

Indeed, for those looking to capitalize on the recalibrated crypto assets, it’s clear that there is an opportunity to apply the latest technology to these ambitions.

The Opportunities in Automated Trading

It’s evident that automated trading will play a prominent role in the investment aspect of the digital currency ecosystem. For investors willing to explore the technology, this is undoubtedly a good thing.

Algorithmic trading presents users with several distinct advantages that are especially prescient in crypto markets.

Investors in traditional financial markets are already taking advantage of automated bot trading. It’s estimated that more than 80% of all trading volume on U.S. stocks is executed by computers. In contrast, Marko Kolanovic, global head of quantitative and derivative research at JP Morgan Chase, notes that fundamental discretionary traders only participate in 10% of daily trading volume.

In other words, automated trading bots are playing an important role in the investment ecosystem, both in traditional markets and on crypto exchanges.

Even so, that doesn’t mean that people aren’t involved. They are both the ones building the algorithms that automate trading, and they are the beneficiaries of its success.

For starters, cryptocurrencies are a unique asset in that they are a global technology. Therefore, unlike traditional investment vehicles that are bought and sold on exchanges with standard operating hours, cryptocurrency exchanges never close.

An automated trading bot allows crypto investors to trade 24/7 as it executes predetermined, data-driven trades. It’s indefatigable, and that’s an important quality when operating in a market that never sleeps.

In addition, the crypto ecosystem consists of hundreds of different currencies around the world. They are spread out among different crypto exchanges, making it difficult to manage digital assets. With the right automated trading platform, investors can execute trading strategies across multiple platforms in a way that allows them to capitalize on many different digital currencies.

Perhaps most importantly, automated trading bots can provide the cryptocurrency trading tools that they need to be successful in this burgeoning market. These can include:

The lesson, it seems, is that much of the trading volume in any financial market is automated and algorithmically driven, and this isn’t a bad thing. Capitalizing on technology to make the most-informed, data-driven decisions isn’t just a smart investment strategy. It can also equip more people to derive the benefits of investment markets, allowing them to harness technology to participate in markets that reflect the future of money and technological development.

Check out our last blog: Cryptohopper and KuCoin Announce New Partnership.