Evening Star Pattern: What It Is and What It Means

The evening star pattern is a bearish signal in technical analysis indicating a potential reversal after an uptrend. It consists of three candles: a large white one, a small-bodied one, and a large red one, suggesting that the upward trend may be ending.

What Is an Evening Star?

An evening star is a candlestick pattern used in technical analysis to signal a potential reversal at the top of an uptrend. It’s a bearish pattern consisting of three candles: a large green candlestick, a small-bodied candle, and a red candlestick.

When you spot an evening star pattern, it suggests that the upward trend is nearing its end. In contrast, the morning star pattern, which is its bullish counterpart, indicates the potential start of an uptrend.

How an Evening Star Works

Candlestick patterns provide insights into stock price movements, reflecting the open, high, low, and close prices over a specific period. Each candlestick is composed of a body and two wicks, with the body representing the range between the highest and lowest prices for that trading day. A long body indicates a significant price change, while a short body suggests a smaller change.

The evening star pattern is a potent bearish signal of potential price declines and typically forms over three days:

The First Day: A large green candle indicates a strong price rise.

The Second Day: A smaller candle shows a modest increase, signaling potential indecision.

The Third Day: A large red candle opens below the previous day's close and finishes near the midpoint of the first day's candle, confirming a reversal in the trend.

Special Considerations

The evening star pattern is a trusted signal of a potential downward trend, but it can sometimes be challenging to identify due to the surrounding noise in stock price data. To enhance accuracy, traders often use price oscillators and trendlines to confirm the pattern and ensure it has truly formed.

While the evening star is a popular bearish indicator, it’s not the only one traders watch for. Other bearish candlestick patterns, such as the dark cloud cover and the bearish engulfing, also provide signals of trend reversals. Traders may have their own preferred patterns for detecting changes in trends, depending on their strategies and analysis techniques.

Example of an Evening Star Pattern

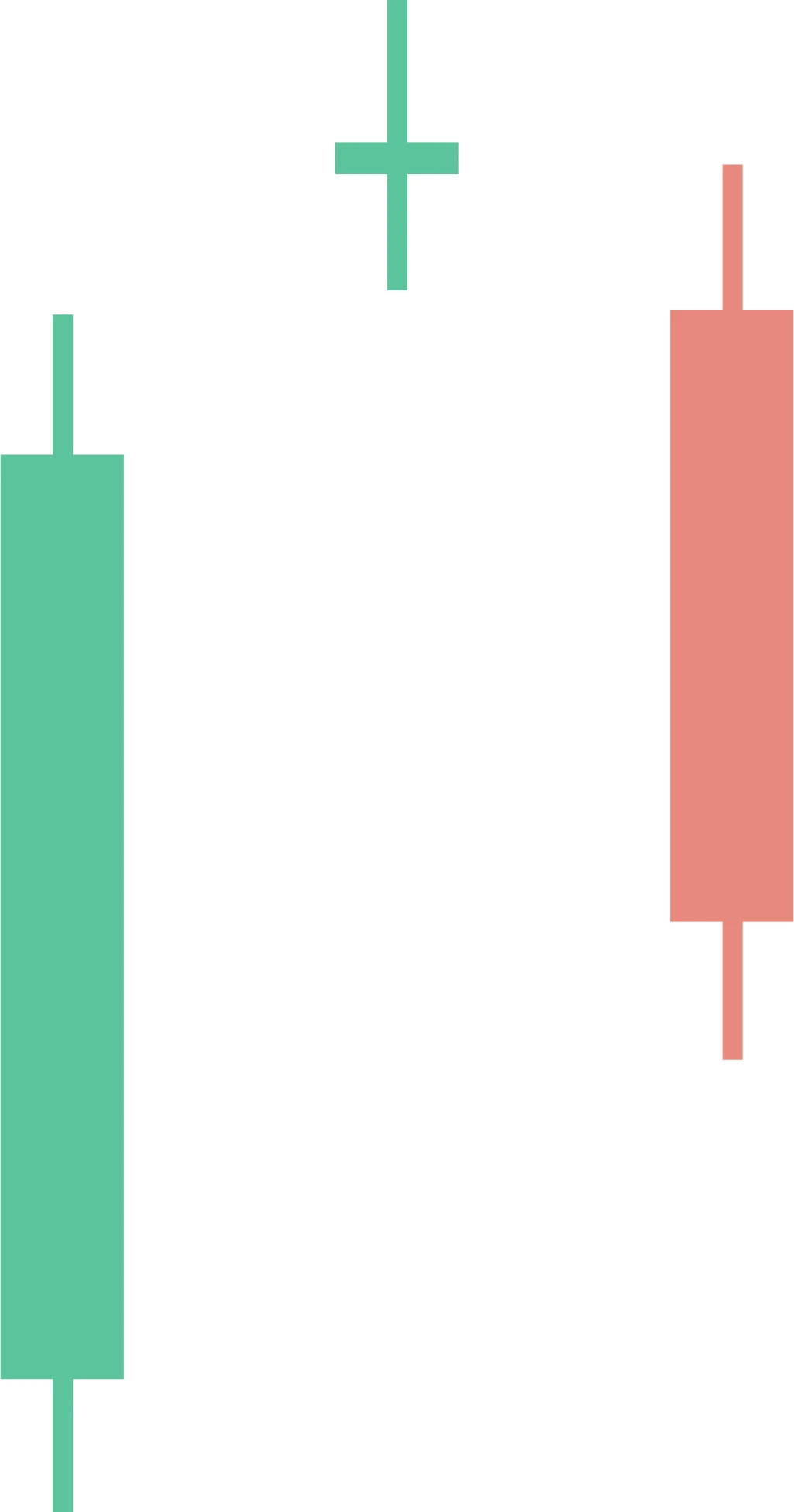

Here is an example of the evening star pattern:

Day 1 features a long green candle, indicating a strong rise in prices due to significant buying pressure.

Day 2 shows a smaller candle, reflecting a more modest increase in prices compared to the previous day.

Day 3 presents a long red candle, where selling pressure has pushed the price down to around the midpoint of Day 1’s range.

What Is the Doji Candlestick Pattern?

The doji candlestick pattern forms when a stock's opening price is almost identical to its closing price. This pattern reflects market indecision. If the stock shows upward movement, it might signal a potential decline ahead.

Conversely, if the stock shows downward movement, it could suggest an upward trend. The doji can provide insight into potential price movements in the following trading session.

Bottom Line

The evening star pattern is a valuable tool in technical analysis, providing traders with a signal of potential reversal in an uptrend. This bearish pattern, characterized by a large green candle, a smaller indecisive candle, and a large red candle, suggests that the upward trend may be ending and a downward shift could be imminent.

While it serves as a strong indicator of potential price declines, traders should corroborate its presence with other tools like price oscillators and trendlines to ensure reliability. The doji candlestick pattern, which signifies market indecision, can also offer insights into future price movements, adding another layer to a trader’s analysis toolkit.

As with all trading signals, it's important to consider the evening star in the context of broader market trends and other technical indicators.