Bitcoin to $100,000: Short-Term Holder Confidence Signal Reversal

Bitcoin's struggle to hold the $100,000 level may soon change, as reduced selling and stronger short-term holder confidence hint at a potential rally toward new highs.This all depends on the 90k support level holding.

Bitcoin has faced challenges in establishing $100,000 as a solid support level over the past six weeks, despite multiple attempts. However, recent market dynamics suggest that a shift could be on the horizon.

A notable reduction in selling activity, coupled with a change in investor sentiment, presents a promising setup for Bitcoin’s price to push toward new heights.

Shifting Sentiment Among Bitcoin Investors

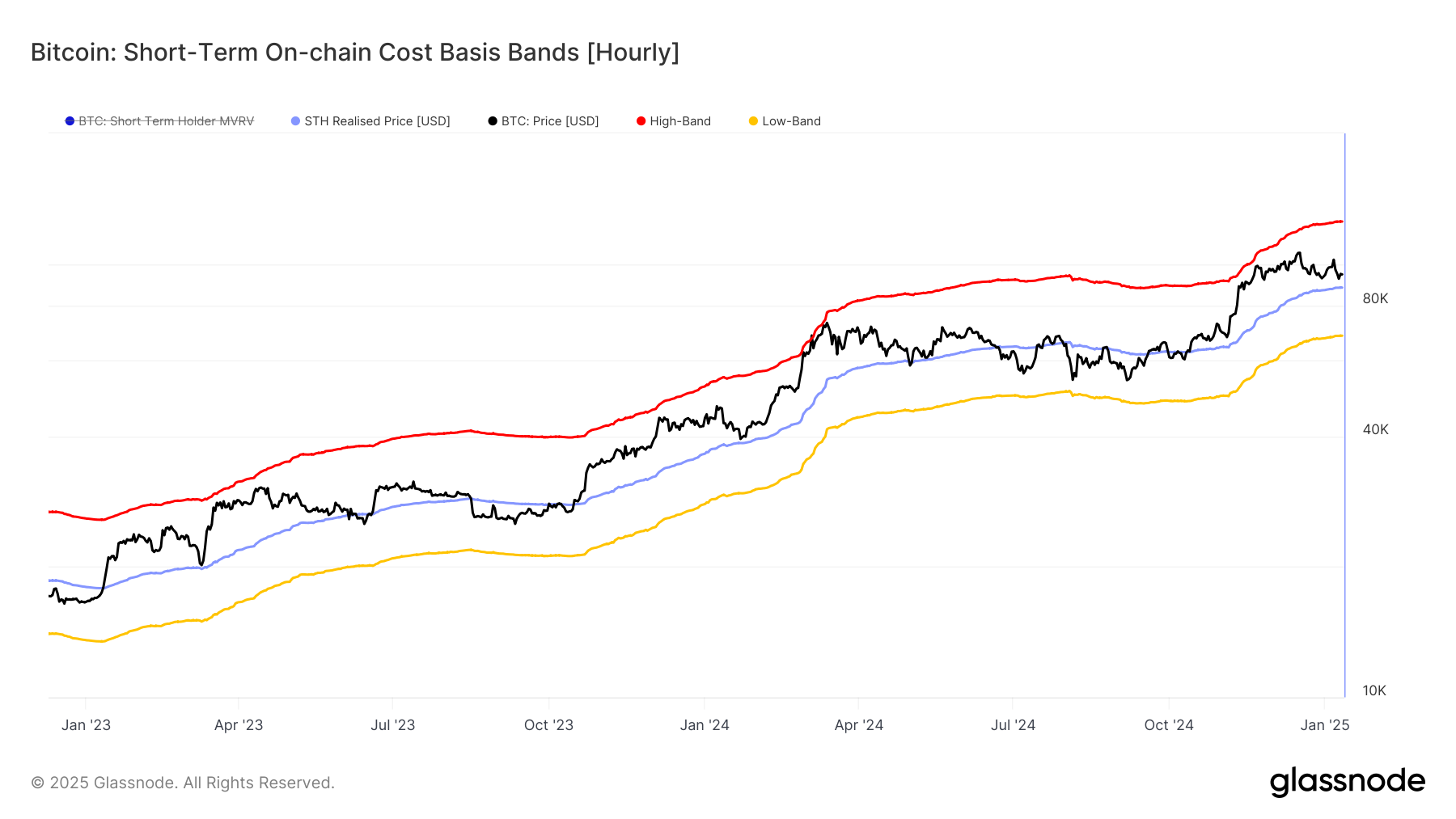

Bitcoin’s short-term on-chain cost basis reveals a significant shift in market conditions. At present, Bitcoin is trading approximately 7% above the short-term holder (STH) cost basis of $88,135, indicating growing confidence among new investors. If Bitcoin manages to maintain levels above this threshold, it could signal that short-term holders are willing to hold their positions, strengthening the bullish sentiment.

However, if the price falls below this cost basis, it could suggest hesitation among short-term holders, potentially triggering broader market corrections.

Macro indicators further support Bitcoin’s recovery potential. Realized profits have dropped to a three-month low, signaling reduced selling pressure. As fewer investors are choosing to exit, this decline in selling activity suggests that bearish sentiment is subsiding, creating a window for buying pressure to take the lead.

This shift in market behavior could help Bitcoin regain momentum and pave the way for a sustained recovery toward key resistance levels.

Bitcoin is currently trading at $90,422, and the next resistance level stands at $95,000. Breaking through this barrier could spark a renewed bullish rally, bringing Bitcoin closer to the psychological $100,000 mark.

Looking Ahead: If Bitcoin can hold above $95,668, it could continue to surge. Currently Bitcoin is testing the $90,000 support. A decline below this support could send Bitcoin further down to around $84,000, which would delay its recovery and create uncertainty in the market.