Bitcoin Halving Explained

Every crypto trader and hodler has been eagerly waiting for 2020. All the hopes of seeing new heights for most of the cryptocurrencies are put in the greatest event of the year, the third Bitcoin halving in history.

This huge event for the crypto market will be taking place in April , 2024. Probably, many of you have heard of it and know that it consists of a reduction in the supply of new Bitcoins. However, do you really know all the consequences that it will trigger? In this article, we will explore and measure all the potential effects of this unique event.

What will happen after the Bitcoin halving?

The main and most immediate aspect affected by the Bitcoin halving will be the supply of newly created Bitcoins.

Currently, 1,800 new Bitcoins are generated per day. Right after the halving takes place, this amount will be cut in half, therefore, having a new supply of 900 new Bitcoins every day until the 4th halving.

In BTC block terms, the number of Bitcoins generated in every block will be reduced from the current 6.25 BTC to 3.125 BTC.

All economic manuals very clearly state that reductions in the supply of an asset while keeping the demand constant will always lead to an increase in the assets price. But, does this apply to cryptocurrencies?

Although there are skeptics that think that the price won’t be affected by the reduction of its supply, the majority of the crypto community is very convinced that it will skyrocket the price.

Let’s keep digging a bit deeper.

One of the main assumptions of this hypothesis is that the demand must not decrease to the same degree as the supply reduction. In such a volatile market where the Bitcoin price can reach double-digit percent changes in less than a day, this can happen. Therefore, unless the demand is following an increasing trend at the time of the halving, the effect could be highly reduced.

Another factor to take into account is the percentage of BTCs that have already been mined. Over 85% of the total Bitcoin supply is already in circulation. Which raises the following question: Will a reduction of 900 BTC per day is enough to affect the price of more than 18,180,000 circulating Bitcoins?

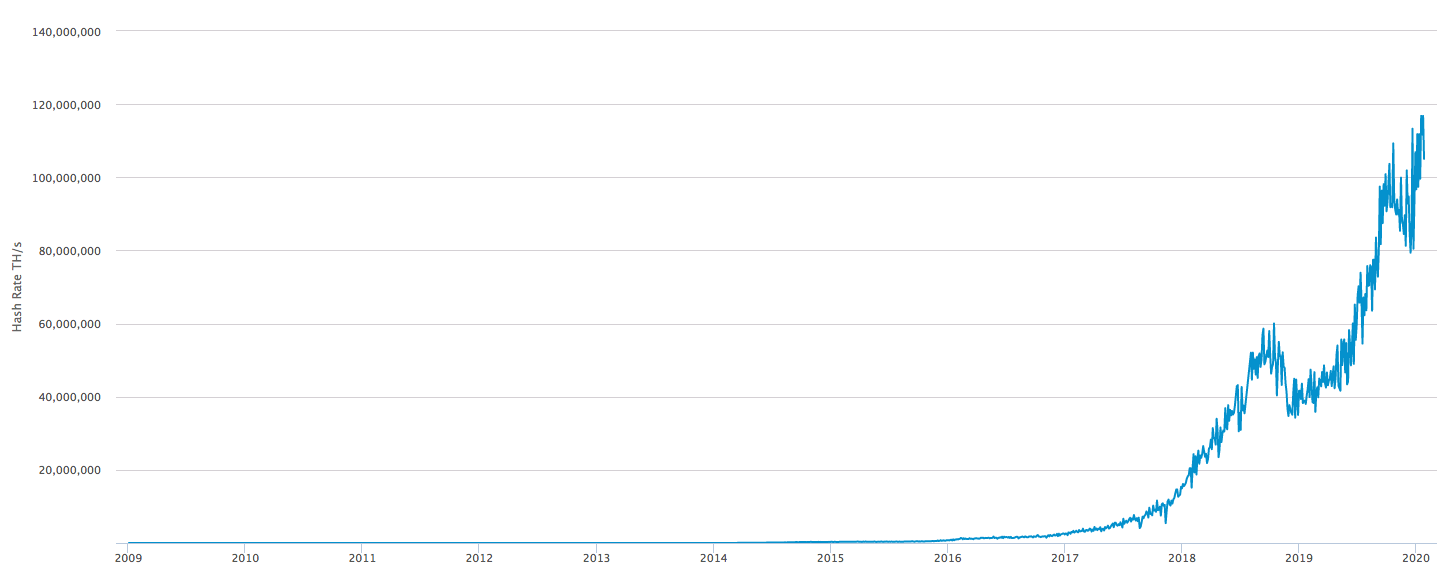

Finally, what will happen with the miners? Businesses have been created with the sole purpose of mining Bitcoin, normal people have invested large sums of money to get Bitcoin rewards when confirming blocks keeping hash rates at an all-time high.

However, as of April, their BTC rewards will be reduced by half in a second. How will their reaction be? Will this affect the price?

Theoretically, the halving should be an important shock to their Bitcoin returns. Therefore, many miners will drop out, the hash rate will decrease and BTC transactions will be slower due to a lack of miners confirming transactions. However, looking at past data, this is basically untrue.

As can be seen in the image below, the hash rate has been increasing exponentially over the last ten years.

Even though the Bitcoin has had two halvings in the past and the BTC price has crumbled multiple times, the hash rate has always kept increasing. But, why? What does the hash rate depend on? The answer is easy, increasing Bitcoin price.

Source: Blockchain.com

After all, what matters to the miners is the monetary gain of their mining efforts. The BTC rewards themselves might be lower, but with an increasing Bitcoin price, their profits will keep increasing in value. Therefore, even more people will jump into mining and the hash rate will rise again.

These are factors that, without any doubt, will affect the Bitcoin price. Even at first glance, the BTC price has a big chance to increase after the halving, none of these elements can clearly determine the future BTC price.

If the halving would increase the Bitcoin price, the market would automatically start raising it today to anticipate the shock of this event. However, this does not seem to be the case for now.

Nevertheless, past halvings and its aftermath can give us crucial hints about its potential effect. In the following section, we will show what were the effects that the previous halvings could have had on the Bitcoin price to infer what could happen in the upcoming one.

What happened in the previous Bitcoin halvings?

The first and most capitalized cryptocurrency has already undertaken three reductions in their supply of new Bitcoins. The first one took place at the end of 2012 and the second in 2016, and the last one in 2020. All of them preceded long and powerful bullish markets that set new all-time highs. But there are more similarities.

There’s something interesting in these three events, none of the halvings had an immediate effect on the Bitcoin price. On all occasions, it took the price from two to three months to start assimilating the supply reduction before the price began its bullish trend.

Moreover, every time the price was coming from a bearish market that already started recovering, as you can see in the rainbow chart below.

.webp)

Last but not least, the bull market after the previous halvings. In the previous two events, a large and prolonged uptrend took place a couple of months afterward.

Many analysts argue that the halving’s effect on the price starts kicking in several months before it actually takes place. This is due to the market anticipates this shock in the supply of new Bitcoins and the economic agents start foreseeing that the price could increase.

Therefore, the demand rises and drives the price up even before the halving takes place.

Can we confirm that Bitcoin will increase?

No, we can’t. As it’s been mentioned before, if there would be strong evidence confirming that the Bitcoin price will increase, it will do so before the halving. However, there are many factors pointing to a specific direction, a bullish one.

The crypto community expectations for the halving are so high that, very likely, the price will increase even before it happens. The much anticipated Bitcoin ETF also fuels these expectations.

There are many coincidences with previous halvings that invite us to think that by the second half of 2024 a bull run will take place.

Back in June 2019, the price made a yearly maximum at $13,800, and in case a new potential uptrend could break this two years high, the Bitcoin price will target its all-time high, $69,045.00. And, without any doubt, the push that the halving will give, will make it possible to break even that level.

We hope you fount it interesting! Check out the previous blog by clicking here.