Former President Donald Trump has repeatedly expressed support for cryptocurrency, making Bitcoin a “Trump trade,” while Kamala Harris has pledged to support a regulatory framework for crypto, marking a departure from the current administration’s crackdown on the industry.

What could the election’s outcome mean for investor sentiment and crypto market trends?

Perspective 1: Trump Win Most Favorable for Crypto Market

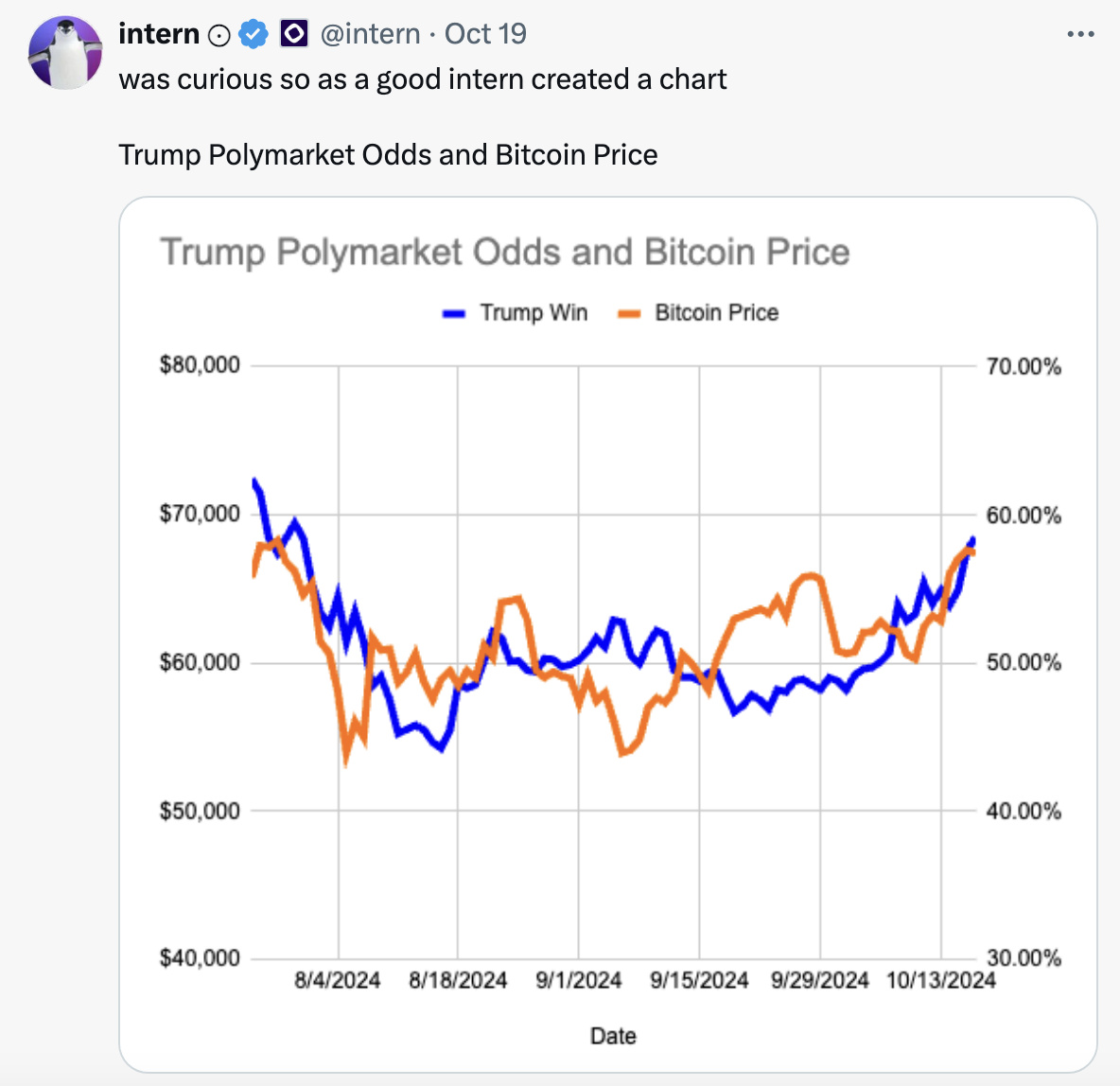

If Trump emerges victorious, Bitcoin prices could see a sharp rise, fueled by his favorable stance on cryptocurrency. Monad’s head of growth, Intern, noted on X that the probability of Trump’s victory on Polymarket shows a strong positive correlation with Bitcoin price movements.

A recent research report by Citi also suggests a Republican sweep would be “the most bullish result for both Coinbase (COIN) and the wider crypto market,” with a Harris victory and divided Congress likely leading to increased uncertainty in the digital asset space.

The report states: “The Trump/Vance ticket has publicly endorsed digital asset reform. The Republican control of the Senate would be important for passing bills like FIT21 and confirming pro-crypto agency leaders. The pace of digital asset reform would likely move faster with both chambers of Congress aligned.”

Perspective 2: Harris Victory Likely to Stall XRP, SOL ETF Approvals

In contrast, Harris has taken a more measured approach toward the crypto industry. Although she recently announced plans to establish a regulatory framework for digital assets, her focus seems to be limited, especially concerning Black men. Details on her support for the crypto sector are scarce.

According to a CoinDesk report, ETF analysts suggest that an XRP or SOL ETF is unlikely under a Harris administration.

“It won’t happen if Harris wins, regardless of the issuer,” Bloomberg Senior ETF Analyst Eric Balchunas remarked, echoing The ETF Store President Nate Geraci’s belief that “It seems highly unlikely that a Harris administration would approve additional spot crypto ETFs, at least not anytime soon after the election.”

Perspective 3: Bullish Outlook for Crypto Market Regardless of Election Winner

Many crypto investors are accepting the view that despite the increasingly partisan sentiment in the cryptocurrency industry, Bitcoin will thrive over the long term regardless of who wins the U.S. presidential election in November.

Data from Deribit, the largest crypto options exchange, shows a decline in the ratio of Bitcoin puts to calls as the election approaches, with most traders opting for call options—particularly with $80,000 strike prices set to expire on November 29.

David Lawant, head of research at crypto brokerage FalconX, noted, “I believe the market consensus is that Bitcoin is likely to perform well regardless of the election outcome.”

Similarly, Standard Chartered’s head of forex and digital asset research Geoff Kendrick expects Bitcoin to set new highs by late 2024. Kendrick said, “Bitcoin could climb to an unprecedented $125,000 by year-end, provided Republicans win control of Congress during the U.S. elections on Nov. 5. Bitcoin could achieve major gains even with a Kamala Harris presidency—to $75,000 by the end of the year.” He adds that a favorable regulatory shift, regardless of the election’s outcome, will be key to Bitcoin’s price growth. No matter who takes office in the White House, relaxing regulations on digital assets—particularly the repeal of SAB 121—is expected to continue in 2025.

Dan Tapiero, founder of 10T Holdings, also sees Bitcoin reaching $100,000 regardless of the election result, affirming that the bullish trajectory of cryptocurrencies is resilient to political changes.

Matrixport pointed out that while attention is focused on the next U.S. president’s influence on Bitcoin, the real impact may be more pronounced in the regulatory landscape surrounding the cryptocurrency ecosystem. Both Republican (2016-2020) and Democratic (2020-2024) administrations have coincided with strong growth in cryptocurrency markets, suggesting that Bitcoin is likely to remain robust no matter who takes office next.

Looking beyond Bitcoin, some analysts believe the U.S. election could boost crypto IPO opportunities.

Haseeb Qureshi, managing partner at crypto VC fund Dragonfly Capital, noted that, “Regardless of who wins, the post-election environment should be better for potential crypto IPOs.” While Trump could push the SEC to a more pro-crypto stance, Harris might “swap out Gensler for one of her own picks, which should result in more moderate crypto regulation in the US,” he said.

While the election will undoubtedly influence crypto regulation and policy, its long-term market impact may be limited. However, as November 5 approaches, volatility is likely to increase, presenting both opportunities and risks for investors.

The post first appeared on HTX Square.