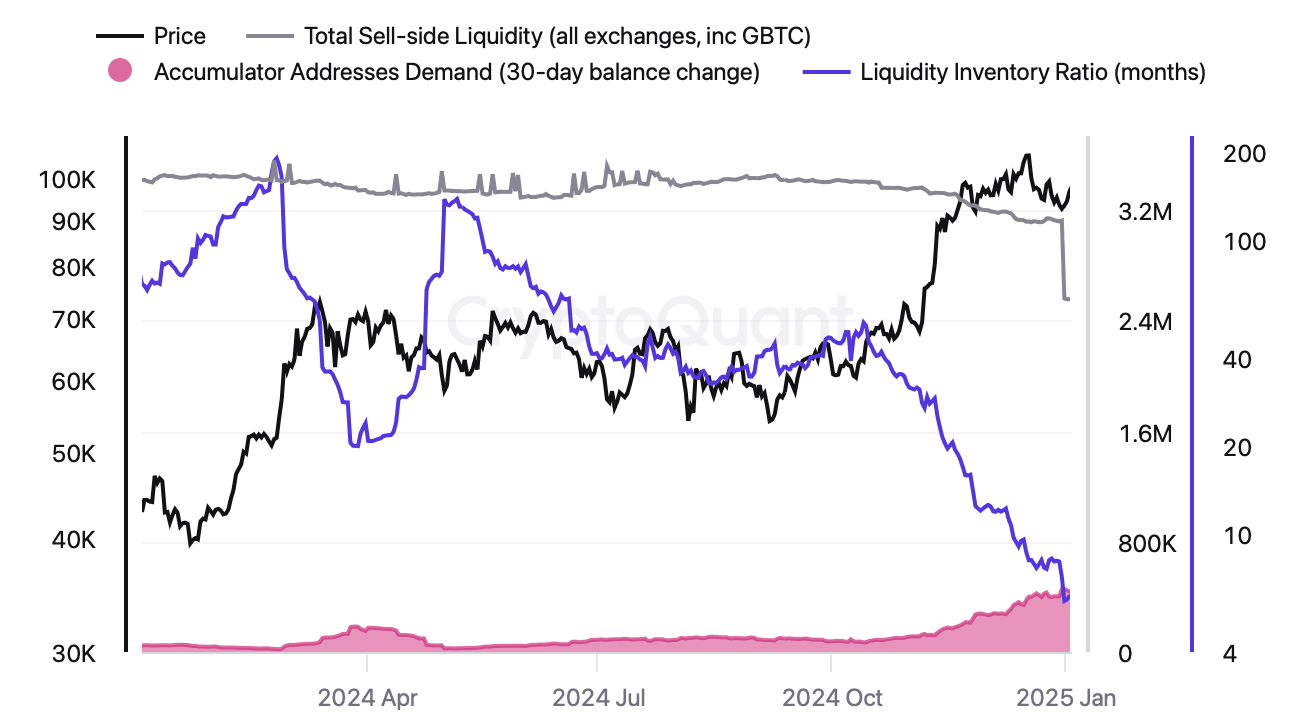

The Liquidity Inventory Ratio, which tracks how long existing supply can meet demand, has plummeted from 41 months in October to just 6.6 months. This indicates a rapid tightening of available Bitcoin liquidity, and has been particularly evident during the strong rallies seen in Q1 and Q4 of 2024.

Bitcoin miners, historically significant sellers during halving years, have also slowed their BTC flows to exchanges since April 2024. Miner-to-exchange flows are at multi-year lows, as miners operate with strong unrealized profits, and hold their BTC rather than sell.

The overall selling pressure across miners, long-term holders, and other cohorts has eased significantly. The reduction in supply entering the market has tempered the impact of the recent correction.

The US economy closed 2024 with continued evidence of economic resilience, however, this is also mixed with some lingering uncertainty across some key sectors. The labour market remained robust, as jobless claims fell to an eight-month low of 211,000 in late December, defying expectations and reinforcing confidence in the economy’s strength. This unexpected decline, coupled with a drop in continuing claims, suggests that the labour market is cooling at a measured pace without signalling a broader downturn. The positive labour data bolstered market sentiment, strengthening the dollar and prompting modest gains on Wall Street.

In contrast, however, the construction sector presented a more subdued picture, with spending stagnating in November after modest growth in October. Gains in single-family homebuilding were offset by declines in multi-family housing and public investment. Elevated mortgage rates, driven by market anticipation of fiscal policy changes under the incoming administration, are weighing on housing demand and new projects. The construction sector faces additional headwinds, including potential tariffs, labour shortages, and trade uncertainties, which could hinder sustained growth despite possible boosts from future infrastructure spending.

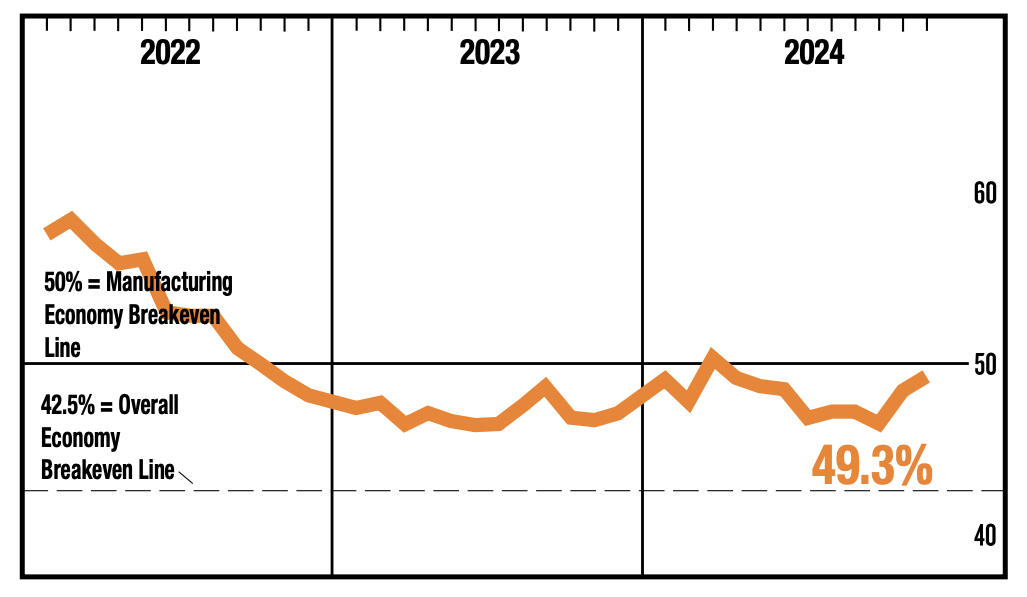

Meanwhile, the manufacturing sector showed signs of recovery but remained under pressure. The Purchasing Managers Index (PMI) rose to 49.3 in December, its highest level since March, yet still below the growth threshold of 50. Although production and new orders improved, manufacturing has struggled to fully rebound from a prolonged contraction exacerbated by higher borrowing costs from earlier Federal Reserve rate hikes. Recent rate cuts and the prospect of fiscal stimulus under the incoming administration offer a glimmer of hope, but concerns over trade policies and fluctuating global demand continue to cloud the sector’s outlook.

In cryptocurrency news last week: US Congressman Mike Collins disclosed investments in the cryptocurrency Ski Mask Dog (SKI), with purchases totalling between $1,001 and $15,000. His filing, one of the first for 2025, underscores the growing intersection of digital assets and politics, raising questions about transparency and regulatory oversight. Meanwhile, the defunct crypto exchange FTX has initiated its reorganisation plan to repay former users affected by its 2022 collapse. Customers who filed claims can expect repayments within 60 days, with smaller claims receiving priority. MicroStrategy has also announced plans to raise up to $2 billion through perpetual preferred stock offerings. This initiative is part of its ambitious “21/21 Plan” to secure $42 billion over three years for Bitcoin acquisitions. Already the largest corporate holder of Bitcoin, with over 145,000 BTC, the company continues to solidify its position in the digital asset market.

Have a great trading week!

The post appeared first on Bitfinex blog.