Top 5 Crypto Whale Tracker Tools to Buy the Dip in 2022

Several factors contribute to the volatility of the crypto market. One such factor is the group of investors categorized as “crypto whales.”

Crypto whales are major stakeholders in the market and influence price fluctuations. There are several whale tracking tools available that can help you anticipate crypto market movements, handle fluctuations, and “buy the dip” at the right time.

Who is a crypto whale?

A crypto whale is a trader, a group of traders, or an organization that holds a significant amount of a cryptocurrency.

They are known as “whales” because they are large players in the crypto market, and the amount they hold is enough to influence the market value of a particular cryptocurrency. A trader is called a whale if he holds a substantial amount of any cryptocurrency in his crypto wallet, like Ethereum. A big transaction from this one whale could affect the valuation of Ethereum in the market.

Why do we need whale tracker tools?

Crypto whales are big investors who hold large chunks of cryptocurrencies. They can artificially inflate or deflate an asset’s valuation, and use this power to cause ripples in the market or confuse small investors.

Since they hold such large amounts of a token, they can limit the total market supply. This can limit token liquidity and the number of tokens available to trade or swap for the general traders.

Crypto whales can move the price of tokens in two ways. They can:

Stage a dump by selling off a substantial number of coins on the crypto exchange, which stimulates a market sell-off. The available supply of tokens will increase, causing a drop in the token price, and if other traders follow suit, this can lead to a significant drop in value.

Pull in a huge volume of tokens from crypto exchanges by buying cryptocurrencies and limiting their token supply in the market, which will eventually cause an increase in the price.

How to track crypto whale activities?

Tracking whale transactions is important in order to understand the market and price movements, anticipate changes, and look out for ways to benefit from market fluctuations.

On-Chain Analysis

The on-chain analysis is the simple process of tracking crypto whale transactions through the blockchain transactions themselves. Often, traders rank their wallet addresses in terms of the number of crypto coins they hold in their wallets.

If the block size is large, showing millions of token transactions, then there is going to be a significant shift in the market.

There are three types of wallet transactions:

Wallet-to-exchange: If the wallet holder shifts a large block of tokens to a trading wallet or to a crypto exchange, then the holder is most likely going to sell it. This may prompt smaller traders to sell off their tokens, creating a favorable opportunity for whale traders to “buy the dip”. The situation is different in the case of stablecoins like USDT. If the wallet holder moves millions of tokens to a crypto exchange, then it is an indication that they are looking to buy tokens that can increase the market price.

Exchange-to-wallet: If there is a movement of a large number of tokens from the crypto exchange to the crypto wallet, this means that there will be a scarcity in the supply of tokens that will inflate the price in the market. The whales may use this opportunity to make huge profits to sell the tokens later as the prices shoot up.

Wallet-to-wallet: These trades signify crypto movements from one wallet to another or over-the-counter (OTC) trades and do not have any effect on the token prices.

How does a crypto whale tracker work?

All information, data, and transactions are recorded on the blockchain network in binary format, i.e., numbers and letters.

Whale tracker tools collect this raw data and convert them into readable numbers and words that the trader can understand easily. Traders can analyze these reports and make their trading decisions.

Five Top Whale Tracker Tools

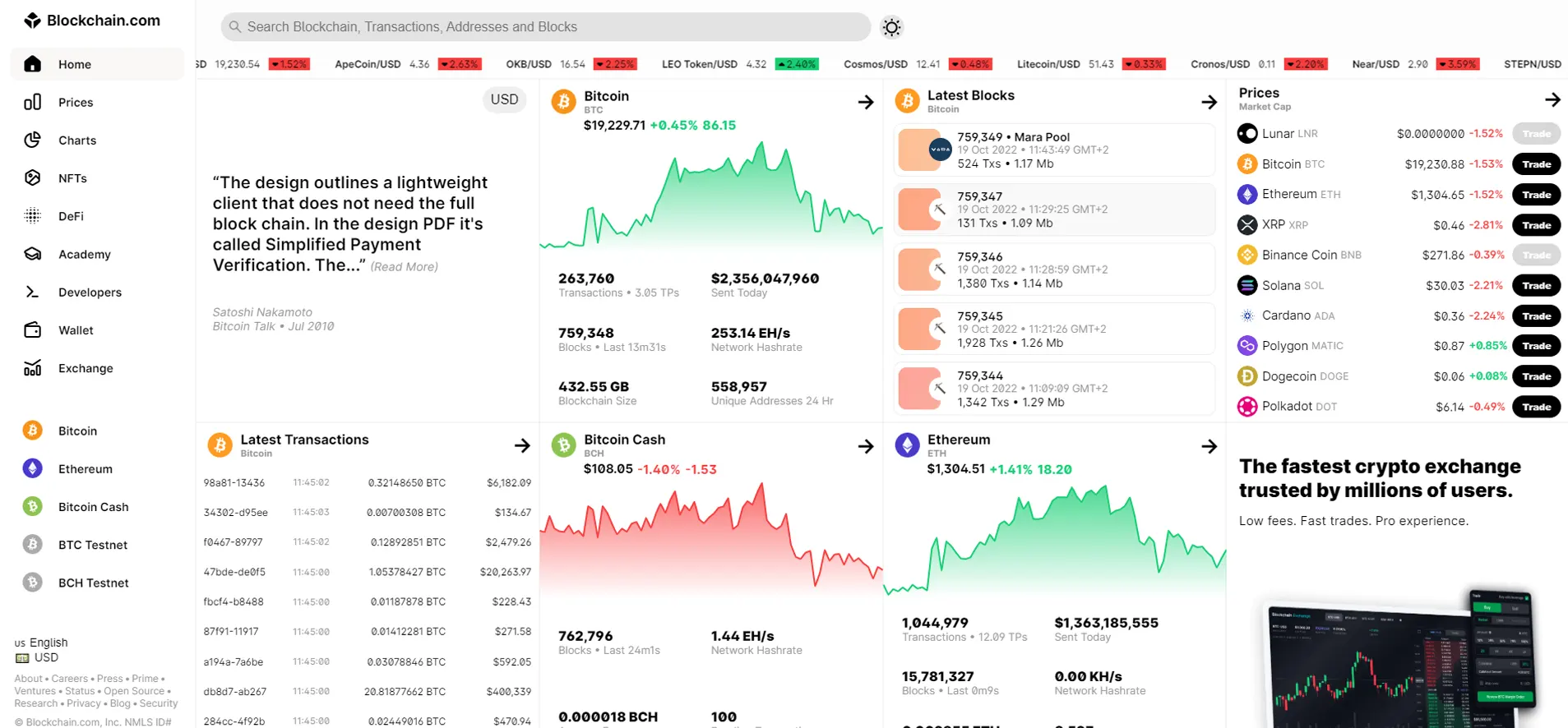

Blockchain Explorers

Blockchain Explorers operate like wallet search engines to see how much a wallet holds, token transactions, and transaction history.

Blockchain explorers give real-time information about the largest transactions and help traders track and understand what the whales are up to. However, this tool can only track popular searchable wallets.

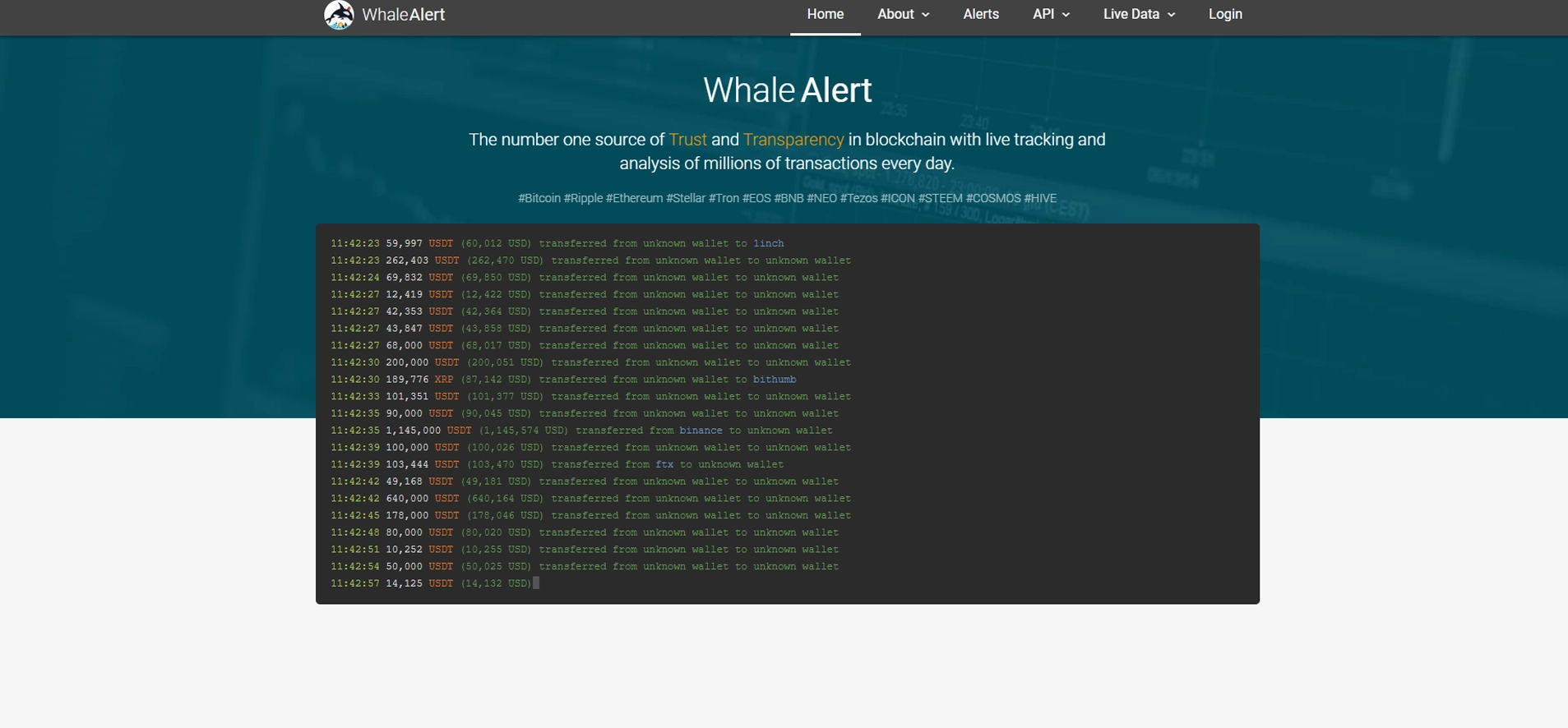

Whale Alert

With more than 1.2 million followers, Whale Alert is a community platform that gives live updates and alerts on whale movements and transactions.

The alerts are shared on Twitter and Telegram feeds. The basic plan comes at $9.95 per month for personalized wallets. There is also a version available for $29.95 per month that gives a full-day comprehensive tracking history.

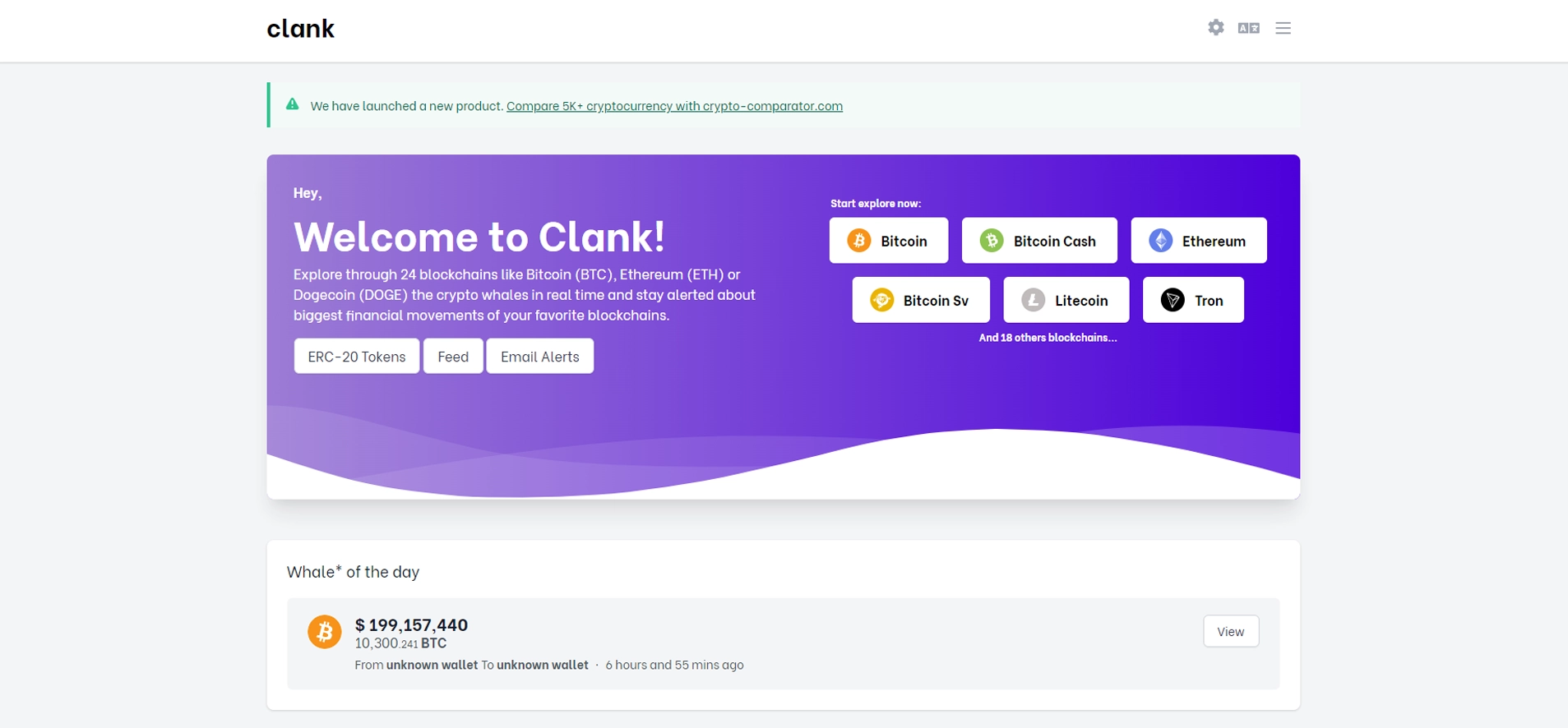

ClankApp

ClankApp tracks real-time whale transactions on social media platforms like Telegram and Twitter.

There are push notifications, email alerts, as well as subscription packages. This tool is free to use and allows users to track 24 blockchains without any cost, and is the best option for beginners.

One of the biggest hurdles of this tool is that since it is free, it does not provide detailed information through graphs or charts, so seasoned traders might not find it quite as useful.

Whalemap

Whalemap is a free app but unlike ClankApp, it comes with comprehensive reading material, charts, and data.

There are also free blockchain courses which is an excellent way for beginners to start with crypto trading.

Whale Watchers

This is one of the best tools for tracking NFT activities. Whale Watchers has both a free version and their “Captain Club” paid package.

The Captain Club provides push notifications, faster alerts, a private discord server, and community chat options. The Captain Club is a boarding pass with a one-time charge that ranges anywhere between $90-$115.

Pros & Cons of using Crypto Whale Tracker Tools

Crypto whale tracker tools are very helpful, especially for novice traders who want to understand the market sentiment in a highly volatile market. But like any other technical tool, whale trackers also have their own share of benefits and drawbacks.

Whale Tracker Pros

Saves time and effort, since the tracker apps do most of the work.

Get real-time authentic data that can take hours or even days to research manually, especially for new traders.

Graph representation and charts give a closer view and help traders easily understand the whale movements.

Leverage profits by making fast decisions based on raw data.

Whale Tracker Cons

Whale activities should not be trusted all the time. Whales often take reverse movements just to confuse small traders.

Big whale transactions may be overwhelming for small investors.

Tracking tools can be expensive. The free versions sometimes lack real-time data and comprehensive details.

Bottom line

Crypto whale trackers are reliable indicators that help traders understand the market sentiment and trade better. For new traders, there are several free whale trackers that provide an edge over the market. As always, it is best to analyze the features of any product before buying a paid version.