How to Manage Risk When Trading Crypto in 2019

In today’s opportunistic financial climate, investors have no shortage of possibility.

Despite global indications that a recession might be imminent, markets continue to climb higher, and investors are the beneficiaries of this moment.

By most accounts, they can hardly go wrong.

The S and P recently breached 3,000 points, and other assets, from currencies to commodities, are making even amateur investors look like adonicies.

Of course, the most prolific returns are reserved for those willing to enter crypto markets where a resurgent Bitcoin has more than quadrupled since the start of the year.

Because of this, many people are getting involved in crypto trading, and participation in the burgeoning crypto economy is swelling once again.

To be sure, cryptocurrencies aren’t lottery tickets, and they’re not without their quirks Most notability, their extreme volatility can be nauseating even for seasoned investors, let alone the numerous novices that occupy the space.

Practically since its inception, Bitcoin has experienced seasons of steady growth coupled with sudden price movements that inspired the term “HODL,” crypto parlance for holding investment positions amid extreme volatility.

At the same time, many of these novel assets lack the tried-and-true staying power that defines most traditional investment vehicles.

While it’s clear that Bitcoin and several other prominent cryptos are here to stay, the altcoin market, where more than 1,300 tokens are competing for market share, is far less secure.

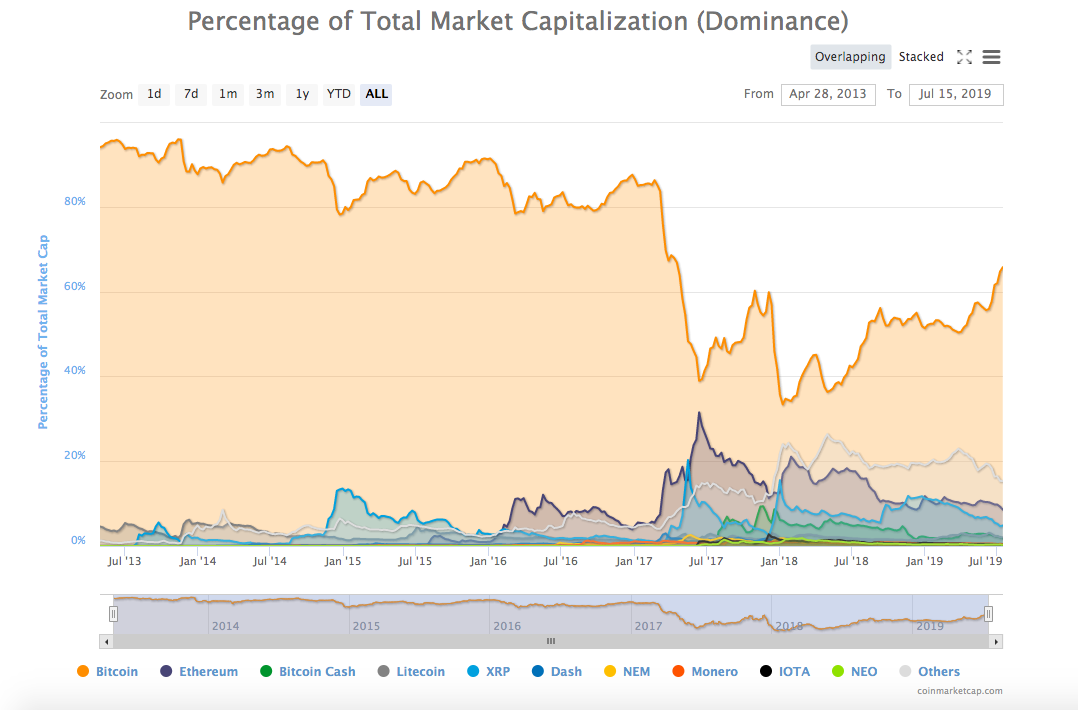

Indeed, after pushing Bitcoin’s market share below 35%, many investors are once again turning to the preeminent token to as the most popular digital investment asset.

According to CoinMarketCap, Bitcoin now approaches 65%, signaling participants’ desire to invest in cryptocurrencies while avoiding the risks of the altcoin market.

In other words, if the crypto and blockchain movement is comparable to the early days of the internet, then many investors rightly worry that altcoins could be the Pets.com of our modern moment. They could also be investing in the next Amazon.

That’s the primary challenge when striving to navigate the crypto space. Investors must be ready to take on risk in a relatively nascent asset, but they must manage this risk to protect against volatility or worse.

Here’s how it can be done.

Differentiate Investments

In traditional financial markets, a diversified portfolio is the cornerstone of any investment strategy.

This includes diversification across asset classes and within them.

Diversification allows investors to capitalize on many different market movements while hedging against volatility. It’s the right strategy for the opportunist and the conservative, which is why investment juggernaut Fidelity believes that “Choosing a mix of different kinds of investments and maintaining that mix are among the most important ingredients in your long-term investment success.”

For crypto investors looking to manage risk, these same principles apply, something that can be difficult to remember when Bitcoin is getting most of the headlines.

The crypto ecosystem is broad and wide, consisting of hundreds of digital assets that reflect the industry’s incredible ingenuity.

In general, these tokens fall into one of several distinct categories representing their intended use cases, including

Currency

Infrastructure

Financial

Services

Entertainment

As a burgeoning technology, many tokens are mostly unproven, and they have varying degrees of merit and upside.

Therefore, to develop a crypto investment portfolio that effectively manages risk, diversifies your assets among these different categories, and further differentiate by buying into the various token offerings within each group.

Remember, investment decisions should never be made haphazardly. Research projects to see if they are worthy of your investment, and, when you are ready to invest, spread the wealth to Bitcoin and beyond.

Prioritize Strategy Over Emotion

Sometimes, managing risk means staying the course, and that’s something that can be especially difficult in nascent markets where volatility and consumer sentiment can fluctuate wildly.

Consequently, crypto investors striving to manage their risk should develop an investment strategy and stick with it, even when market volatility and the latest trends can encourage rapid participation in various projects.

For most people, this is easier said than done. That’s why Cryptohopper’s automated trading platform can help investors at any level of the spectrum effectively prioritize their strategy over their emotions.

For example, investors can practice their approach using the paper trading feature, or they can mirror trade based on the expertise of more experienced crypto users.

It’s an easy way to develop an investment viable investment strategy that can withstand the crypto market’s idiosyncrasies.

To put it simply, managing risk is a matter of the head, not the heart, and those looking to flourish in this investment space will prioritize their investment strategy over their immediate emotions.

Establish a Basement Price

Needless to say, effective risk management doesn’t mean ignoring market movements entirely, and sometimes the best strategy is to abandon ship and sell.

For years, crypto investors lacked many of the tools that allowed traditional investors to manage risk within their portfolios. Fortunately, today’s technology allows crypto investors to apply many of these features to their digital assets.

More specifically, functions like trailing stop loss orders allow investors to set a basement price for their assets, ensuring that losses are mitigated in the event of a sudden, spectacular price drop.

In this way, investors can determine the amount of risk that they are willing to endure, knowing that there is only so much that they can lose from any one position.

Similarly, short and long positions serve as a version of differentiation that offers a hedge against sudden losses.

Taken together, these features equip investors to operate with confidence in their portfolio constitutions and market strategies.

As everyone from interested individuals to opportunistic institutions enter crypto markets, there will be plenty of opportunities to turn a profit, and managing risk will inevitably be on most people’s minds.

Like any investment, there is a risk when investing in crypto assets. By diversifying their portfolios, balancing their emotions with sound strategy, and establishing a reasonable basement price for their assets, any investor can effectively manage risk when trading crypto in 2019.

Check out our last blog: Why You Should Fully Automate Your Trading Strategy.