“Bitcoin is dead” has been declared 400+

Although we don’t know when the crypto winter comes to an end, we know that any financial product or economic system will experience the four stages of an economic cycle: expansion, peak, recession and trough. As the largest cryptocurrencies by market capitalization (or market cap), Bitcoin (BTC) has been declared dead more than 450 times over the course of its thirteen-year lifespan and its “ obituary” has been widely, and repeatedly, spread around the globe, but it’s still alive.

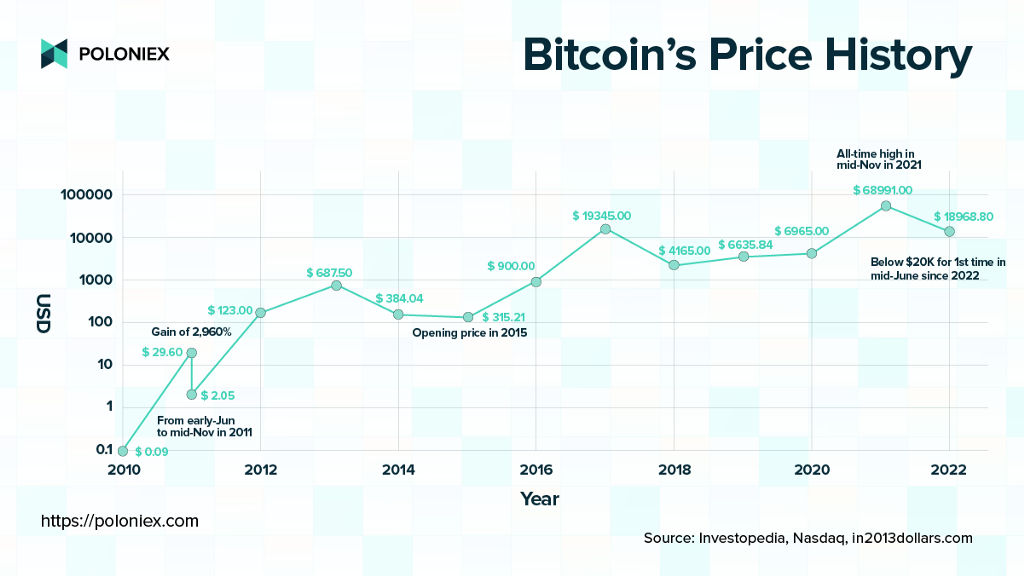

Starting from a price of zero since its inception in 2009, Bitcoin’s price didn’t see a big jump and it always stayed at a single digit USD (all units are the same as below). Until June 2011, its price rose to around $30, a gain of 2,960% within three months, according to Investopedia.

For those who have been in the crypto markets for a while, they won’t be surprised with the bear market. The first recession in the crypto world was in 2011 when Mt. Gox, the then-largest cryptocurrency exchange, got hacked for the first time, causing Bitcoin’s price to plunge to $2.05 to end its month-long upward trajectory from its peak of around $30.

The phoenix back above $20K after the struggles

As shown in the SoFi Learn data, 2012 was relatively quiet in the crypto markets even if Bitcoin’s price fluctuated, but 2013 was a decisive year for Bitcoin as its price soared to four digits, at around $1,238, by December from $13 at the beginning of the year, an increase of 98%. In the following two years, Bitcoin’s price saw ups and downs again. While 2017 was another positive moment for Bitcoin as its price shooted up to over $19,000 in December 2017 compared to only $900 in the same period of the previous year. However, 2018 and 2019 were volatile again, not until 2020 during the worldwide outbreak of COVID-19 pandemic.

The year-long pandemic attracted more outsiders to study the crypto markets, making Bitcoin’s price burst into action. As stated in Investopedia, Bitcoin reached an all-time high of around $69,000 in November 2021 from around $19,000 in the same month in the previous year. Nevertheless, Bitcoin didn’t start off well in 2022 that its price was seen downward most of the time and June was one of the most volatile months in the crypto world’s history that Bitcoin closed the month under $20K. Nevertheless, as mentioned earlier, the headline “Bitcoin is dead” was seen more than 450 times and the phoenix is back to above $20,000 in early July.

Buy the dip before ETH’s migration

Because of the resilience of Bitcoin and the growing community, the mainstream entities jumped on the bandwagon to develop other cryptocurrencies since 2014, including Ethereum (ETH), the second largest cryptocurrency by market cap.

Officially launched in 2015, Ethereum’s trading history is relatively steady, but its price skyrocketed to all-time high at $4,800 thanks to the Non-fungible Token (NFT) boom and the smart contracts application. Although Ethereum’s price has dropped to below $900 in the past few weeks, it went back to a steady increase and stayed above $1,000 in early July.

With Beacon Chain, a brand-new and Proof-of-Stake (PoS) blockchain, to be migrated into the existing Ethereum later this year after the “dress rehearsals”, a cheaper, faster, and more eco-friendly PoS model will be introduced to the market and that is what the community has been anticipating, hence some commentators believed that now it’s the right time to buy the dips.

To hedge investment risks, investors and traders also move to altcoins, such as Tether (USDT), TRON (TRX), Cardano (ADA) and beyond. And, the current situation doesn’t deter experienced crypto investors, including MicroStrategy CEO Michael Saylor, nicknamed the Bitcoin believer by the media. The cloud software company announced on June 30 that it spent $10 million to acquire more Bitcoin with an accumulation of 129,699 digital coins after spending over $3.98 billion altogether. Besides, El Salvador’s president, Nayib Bukele, has also spent another $1 million in Bitcoin to add 80 more to the existing stash of over 2,000 Bitcoins.

In spite of the crashes and redundancy in the crypto industry, H.E. Mr. Justin Sun, the founder of TRON, reassured in a monthly staff meeting on July 7 that its partner, Poloniex, has’t focused too much on leverage trading.

Most importantly, Poloniex’s capital and customer funds are very strong and safe that the current situation has no impact on the exchange. With a 100% risk reserve, Mr. Sun believed that Poloniex is capable of navigating any risks amid uncertainty.

As the technology trendsetter, Poloniex will continue to recruit more talents globally to optimize its products and services with the goal of getting a new trading system launched in August.

For media enquiries:

Please contact Sana Fong

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.