11 Sales

Share

Seller

Additional info

Overview

Bio:

Hi, I am Vegeta, I'm an engineer by profession and a quant in my spare time, developing trading systems and strategies. dreamCatchers are implementations of my long only, trend following strategies optimized for trading BTC and ETH on Cryptohopper platform, which use USDT as the Quote asset, but it should be ok to be used with any other Dollar nominated stablecoin.

Meet dreamCatcher, a battle tested strategy!

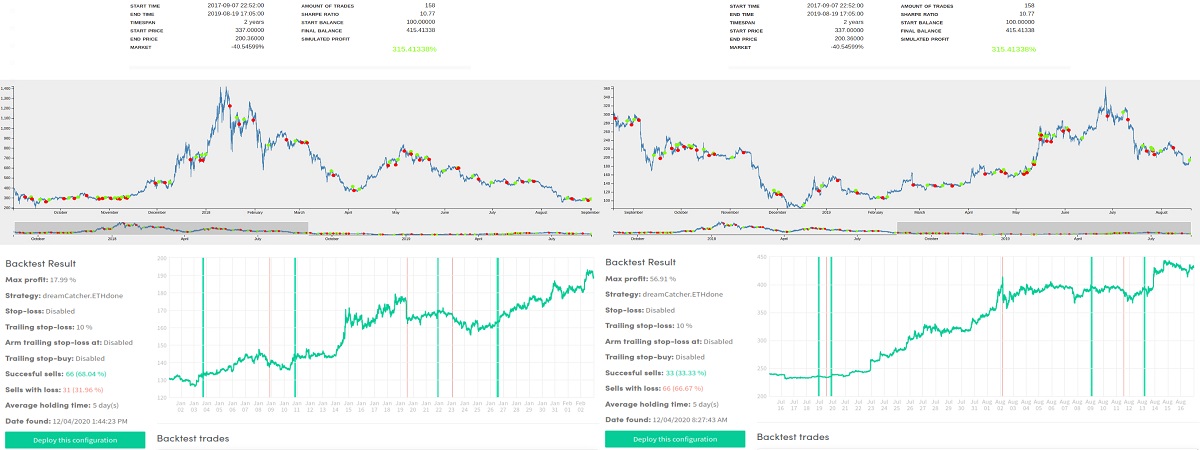

Backtest stats: (1/2021-12/2021):

Exchange: Binance

Trading pair: BTC/USDT

Parameters: multiple EMAs, RSI, Trailing Stop Loss, Take Profit

Expected return: 70%-92%

Max drawdown: -7%

Longest drawdown duration: 1 month

Sharpe ratio: 9.31 (based on 8% risk free return)

Average exposure duration: 4 days (Range: few hours to weeks)

Timeframe: 15min candles

Backtest stats: (1/2022-12/2022):

Exchange: Binance

Trading pair: BTC/USDT

Parameters: multiple EMAs, RSI, Trailing Stop Loss, Take Profit

Expected return: 60%-71%

Max drawdown: -9%

Longest drawdown duration: 1.5 month

Sharpe ratio: 8.6 (based on 8% risk free return)

Average exposure duration: 4 days (Range: few hours to weeks)

Timeframe: 15min candles

Backtest stats: (1/2021-12/2021):

Exchange: Binance

Trading pair: ETH/USDT

Parameters: multiple EMAs, RSI, Trailing Stop Loss, Take Profit

Expected return: 120%-168%

Max drawdown: -6%

Longest drawdown duration: 2 months

Sharpe ratio: 9.03 (based on 8% risk free return)

Average exposure duration: 3 days (Range: few hours to weeks)

Timeframe: 15min candles

Backtest stats: (1/2022-12/2022):

Exchange: Binance

Trading pair: ETH/USDT

Parameters: multiple EMAs, RSI, Trailing Stop Loss, Take Profit

Expected return: 80%-95%

Max drawdown: -11%

Longest drawdown duration: 2 months

Sharpe ratio: 7.21 (based on 8% risk free return)

Average exposure duration: 3 days (Range: few hours to weeks)

Timeframe: 15min candles

** Disclaimer:

The above mentioned stats are backtest results, USE AT YOUR OWN RISK,

* Another implementations of the same logic has passed nearly 2 years of live test, with expected return, sharpe ratio and max drawdown (duration and percentage) nearly identical to the backtest results presented above.

TLDR/FAQ:

1- What is my expected return? A rough estimation would be 100% APY, based on market conditions.

2- What is my expected drawdown? 6%-15% in a time span of 1-2 months.

3- What is my risk adjusted return (sharpe ratio)? 8-9 for BTC/USDT and ETH/USDT

4- What trading pairs can be used ? This bot is optimized for BTC and ETH vs a USDStableCoin trading pairs, so you could use it for BTC/USDT, BTC/BUSD, BTC/USDC, BTC/TUSD, BTC/DAI and BTC/PAX and also ETH/USDT, ETH/BUSD, ETH/USDC, ETH/TUSD, ETH/DAI and ETH/PAX. (if you want to use with other coin pairs, first backtest to see the results, and only then deploy)

5- What exchanges can be used? Any spot exchange that supports these pairs and have a sufficient liquidity for your trading size. (Binance, Kraken, Coinbase, Bitfinex, Huobi to name a few)

6- Can I use leverage with this strategy? No, this strategy is "long only" and is designed so that it buys when the trend is to the upside and sells (removes exposure) when the market is going down, I don't know what happens if you add negative delta instead of just removing exposure (short selling instead of removing exposure).

7- Will I make money on the first day of using this strategy? or For how many months should I subscribe to this strategy to be profitable? This strategy is a mid- to longterm strategy, anything less than 3 months is considered short term, and you might (and probably will) lose money in the short term, that is perfectly normal. (up to 2 months of drawdown is not far fetched)

8- How do I know that I am experiencing a drawdown? Well you are not making money, that's ofcourse your first clue! but the other thing that tells you that the strategy is going through a drawdown, is the fact that the trades are being closed on average in less than 2 days, or in other words we are in a choppy market (consolidation phase) and since this is a trend following strategy, there is no trend to ride out.

9- Do I need to know if we are bullish or bearish before deploying this bot?

No, that's the whole point of having a trading bot, not worrying about anticipation of future market conditions.

10- What are bad market conditions? This strategy uses established trends as trade signals, that means a "sine function graph"-like chart pattern (consolidation or sideways price action) would result in a loss.

11- Can I lose money using this bot? You definitely will! but the trick is you lose less than you make in the long run, you might experience a drawdown and lose up to 15% of your capital before making any profit, it all depends on the market condition and the time you start your bot, what the bot will do is to trade like the House in a casino not like a Gambler, it places many bets where the probability of a potential return is more than the probability of a potential loss.

12- How many times a day does this strategy signal a trade? On average 6 times a month. (that means once every 3-4 days (for each trading pair))

13- I want to do something to improve the performance of the bot, what should i do? There is nothing you can do to improve the strategy itself, but mathematically (NOT INVESTMENT ADVICE) one could add more capital when the strategy hits a drawdown, this way the starting point right after a drawdown would be from 100% position size (full exposure).

14- What should I do first? Backtest to see the last trade of the bot, if it has sold, start with stablecoins and wait for the bot to issue a buy, else if it has lastly issued a buy signal, start with your account all in BTC and/or ETH, then go on with you life and check back in 3 month and harvest the spoils! (just kidding! it's best practice to check if the issued signals are being carried out successfully in the exchange account.)

15- If this is such a great bot, why aren't you making money off of it yourself? Well I am and have been playing with this strategy in open source Gekko (https://github.com/askmike/gekko/) for nearly 3 years now and have a bunch of other strategies that work more or less similar to these presented here, so don't worry about me, I'm just here to collect some subscription fee before market regime changes!

16- What will you do if the bot gets overcrowded and all of a sudden it's not profitable? I would change the parameters combination and since markets are dynamic, I would try to find new ones and present them to you in form of new updates.

17- I am a noob, what advice do you have for me? Backtest the strategy and fully understand the strategy and consequences of being subscribed to it, put yourself in shoes of yourself, if you were watching these trades being made live. For example in ETH/USDT trading pair, in June/2020, 98% of the all trades resulted in a loss! That amounts to nearly 10% of your account's balance, but if you look closely, the trades were being closed on average in less than a day, these two facts combined are the clue that this is a drawdown and the next month (July) portfolio would have experienced a 52% profit. (this kind of drawdown condition could and have lasted for up to 2 months before, so be mentally prepared for it.)

Here, we are looking for trends using multiple EMAs and the RSI gives us the confirmation to enter or exit a trade, see what the bot would have done in the past, see that the trends are there to profit from, corrections (dumps) are to be protected from and consolidations are Mr. Market's way of extracting imaginary taxes from you!

You might not agree with a lot of bot's decisions and think to yourself: This is definitely a bad trade to take, but remember that this algorithm has a proven track record (do you?!). Once you have activated trading, let the bot run its course for at least 3-6 months and don't interfere with its actions, otherwise you might lose out on an important entry (or exit).

Last but definitely not least, know that the strategy might go out of sync with the market and give a totally different result compared to the stats mentioned above, as the saying goes: past performance is no garanttee of future results and I am by no means responsible for any losses you might experience, you are trusting math and probabilities here, not me.)

*** dreamCatcher, a torch in the dark road of price action!

The best thing to do with your Bitcoin is to just HODL and the best way to enter the market is DCA, right? or is it? What if you wanted your Sats to work for you and generate a passive, reliable and sustainable income? What if you DCAed and bought Bitcoin in Feb 2020 and then the next month market tanked 50%, leaving you with less Sats than you could have? It would be great if you had a bot that sold right before the selloff and bought back a month later at half that price, right? well this strategy (other implementation, see Disclaimer above) did just that and even generated a 11% profit in BTC/USDT pair and 6% in ETH/USDT pair in March while operational on live test, just backtest and see for yourself!

3 years ago when I entered the crypto market, I didn't choose the best time to enter the market and as I bought Bitcoin, the market crashed. Since then I have been working on strategies to beat the "buy and hold" strategy in the long run. I have spent 3 years making and perfecting this strategy using genetic algorithm and Bayesian evolution (https://github.com/Gab0/japonicus) to come up with the best parameters combination to maximize the profit and reduce the drawdowns (duration and percentage) to an acceptable level. I have tested all the period combinations from 1-1000 (for 5m, 10m, 15m, 1h, 4h, 12h, 1D candles) for a combination of 1-10 EMAs to best recognize an established trend and then using RSI (changing the RSI parameters and testing different overbought and oversold limits) with various mechanisms and combinations of stoploss and takeprofit levels to optimally enter and exit the market.

This strategy is best suited for those that want to trade a portion of their portfolio to generate a passive income. If you are not a professional trader, do not trade more than 30% of your portfolio. (or even 5%-10% if you are dealing with a sizable amount)

Don't put all your eggs in one basket, use this strategy with multiple coins and use other strategies too and remember this is not a get rich quick bot, but a professional trading bot so use it accordingly. You won't 10X your money in a year (unless BTC or ETH price 10Xs, then you would probably make something in that vicinity!), but you are aiming to have a passive income. Use 3-month (one Quarter) timeframes at the very least. I check the parameters every quarter but won't change anything unless I have compared the new parameters with the originals in another 3-month live test timeframe, that means no more that 1-2 times a year will there be an update and you will certainly have access to the new parameters once they are found, if you are still subscribed. Upgrades will be logged and you will be given the option to use them or not.

Patience is key with this and in general with any decent strategy, I know if you subscribe to this bot you want to see the bot in action, but trust me when I say money is made sitting on your winners and having dry powder for the rainy day, that is ofcourse if you want a SUSTAINABLE income. This is not a boom or bust trading bot, but a 24/7 companion who scans the market and reacts accordingly to it for you, so that you can do other more productive stuff than staring at charts all day/night long, waiting for an entry.

You do not need to change any configuration, as the parameters are the secret sauce, that is what you are paying for, I have backtested countless times so that you don't need to change anything, just set the bot and forget it!

If you feel you want to use leverage, just remember that the next number after 1X is 1.1X not 2X! Don't use anything more than 3X otherwise you are risking losing everything. As I mentioned earlier, this strategy is "long only", that means the only "loss" that can occur when you have sold your asset (here: BTC or ETH), is opportunity cost but when you short sell instead of removing exposure, you are risking money as the price goes up, this might add to the max drawdown and by using leverage you are amplifying that loss once again. So using leverage with this strategy is a risky proposition.

Keep track of your Dollar and BTC and ETH balance and take your profit off the table every quarter regardless of BTC’s or ETH's price with ease of mind and buy yourself or your loved ones something nice, preferably with Bitcoin to support the merchants and keep the B-economy alive and growing, since most people prefer to just HODL their precious Sats.

** A note about positive alpha:

Don't expect to always beat the index, that means there might be timeframes where the algo would underperform the price of the underlying asset (here BTCUSD or ETHUSD), especially when price is going sideways, remember that here we are aiming for a positive expectancy, a consistent return and protection from downside moves regardless of the market condition, think of the difference as an insurance fee on your gains!

* A note about win rate:

The winrate of this strategy is 40-45%, that means the odds are that the next trade will result in a loss! But that doesn’t mean we can’t make money and remember that the sharpe ratio (risk adjusted return) and max drawdown are far more important metrics for evaluating trading strategies (sharpe ratio usually hovers around 1 and 2, but this algo has consistently showed a sharpe ratio of 9!)

If you have any questions or other trading pair requests (any coin or token as base or quote), feel free to contact me on my email at [email protected] for formal inquiries, or hit me up on Telegram t.me/VegetaThe4th or on Discord @Vegeta#2472 for a friendly chat and remember that I don't (and won't) have a paid group or signal channel, also if you are a serious trader with sizable balance, reach out so that I fine tune the parameters for your special needs. (You might also want to scale in and out of positions instead of just market buying)

If you've been using this strategy for more than a month now, please consider rating and writing a review.

Reviews (0)

The product provided on this page is not provided by Cryptohopper, but by external advisors and trading professionals. Although we check and validate each marketplace seller, Cryptohopper will not be liable or responsible for any loss or damage due to the use of these templates, strategies and/or copy bots. Past performance is not a guarantee or indicative for future results.

* All prices on this website are excluding VAT and excluding payment provider fees (if applicable).