One of the critical use cases that zkSync addresses is the need for hyper scalability in the blockchain ecosystem. Hyper Scalability refers to the ability to process an unlimited number of transactions without a marginal impact on security or cost. zkSync’s ZK Stack framework supports this by enabling the creation of multiple ZK-powered blockchains that share users and liquidity, thus distributing the load and enhancing overall scalability. This approach ensures that as demand for blockchain applications grows, zkSync can handle the increased load efficiently.

zkSync also focuses on providing a superior user experience (UX). The protocol supports native account abstraction, which allows developers to create user-friendly applications that can abstract away complex processes like seed phrase management and gas fee payments. For example, users can schedule and automate payments or pay gas fees in any token, or even have the gas fees paid on their behalf. These features are designed to make blockchain technology more accessible and intuitive, paving the way for broader adoption.

Security remains a top priority for zkSync. The protocol employs a multi-dimensional approach to protect users against bugs, exploits, scams, and hacks. The zkSync testnet ran for a full year, during which extensive audits and stress tests were conducted to ensure robustness. By inheriting Ethereum’s security through ZK-rollups and employing additional security measures, zkSync aims to provide a highly secure environment for decentralised finance (DeFi) applications. This combination of scalability, UX improvements, and security positions zkSync as a pivotal player in the effort to bring Ethereum to a global scale.

What is the ZK Token?

The ZK token serves as the native utility and governance token within the zkSync ecosystem, playing a crucial role in maintaining and enhancing the protocol’s operations. One of its primary use cases is to pay for transaction fees on the zkSync network. By utilising ZK tokens for fees, users benefit from lower costs compared to the main Ethereum network, thanks to zkSync’s efficient Layer-2 scaling solutions. This incentivizes users to adopt zkSync for their transactions, thereby increasing network activity and liquidity.

In addition to transaction fees, the ZK token is central to zkSync’s governance framework. Token holders can participate in the decision-making process by voting on key proposals that affect the future direction of the protocol. This decentralised governance model ensures that the zkSync ecosystem evolves in a manner that reflects the collective interests of its community. Decisions on protocol upgrades, parameter adjustments, and the introduction of new features are made more transparent and democratic through the active involvement of ZK token holders.

The ZK token also plays a vital role in incentivizing network security and participation. Users can stake their ZK tokens to support the network’s security infrastructure. Stakers are rewarded with additional ZK tokens, providing them with a financial incentive to contribute to the network’s resilience and stability. This staking mechanism not only enhances security but also encourages long-term commitment from participants, fostering a more robust and engaged community.

Lastly, the ZK token is used to incentivize liquidity provision within the zkSync ecosystem. Liquidity providers are rewarded with ZK tokens for adding liquidity to various pools, which is essential for the smooth functioning of decentralised exchanges (DEXs) and other DeFi applications running on zkSync. By offering rewards in ZK tokens, zkSync ensures that there is sufficient liquidity available to support high-volume trading and other financial activities, thus enhancing the overall utility and attractiveness of the platform. This comprehensive use of the ZK token across multiple facets of the ecosystem underscores its importance in driving the adoption and success of zkSync.

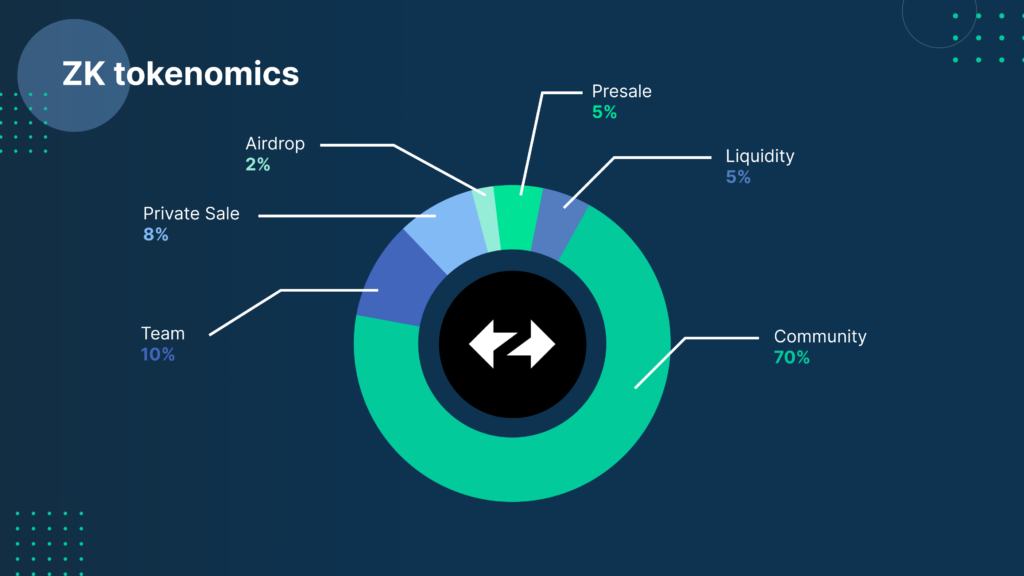

ZK Tokenomics

How to buy ZK with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy ZK with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for ZK. Learn how to trade on Bitfinex here.

How to buy ZK with fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy ZK.

Also, we have Bitfinex on mobile, so you can easily buy ZK currency while on-the-go.

[ AppStore] [ Google Play]

ZK Community Channels

Website | X (Twitter) | Discord | Blog

The post appeared first on Bitfinex blog.