Ethena Labs’ initiative emerges from the urgent need for a crypto-native form of stable money that can facilitate a truly decentralised financial system, unshackled from the constraints and risks associated with existing stablecoin models tied to the traditional banking system. By leveraging delta-hedging techniques to manage the Ethereum collateral, USDe aspires to provide a stable, scalable, and censorship-resistant medium of exchange and store of value. This method of creating a synthetic dollar circumvents the reliance on centralised financial infrastructures and traditional stablecoin mechanisms, potentially reducing systemic risks within the crypto and DeFi landscapes and offering a robust alternative to existing stablecoin paradigms.

The ‘Internet Bond’ concept introduced by Ethena Labs represents an innovative leap towards democratising access to savings instruments on a global scale. By amalgamating yields from staked Ethereum and the derivatives market, Ethena aims to offer a dollar-denominated savings mechanism that rivals traditional savings instruments like US Treasury bills. This approach not only promises to provide a yield-bearing, stable, and censorship-resistant asset for DeFi applications and centralised exchanges but also addresses the significant market demand for a safer, more accessible form of stable savings and investment options within the crypto space. The ‘Internet Bond’ has the potential to serve as a foundational financial instrument within both centralised and decentralised financial systems, offering a permissionless and democratised alternative to traditional financial products.

At the core of Ethena Labs’ synthetic dollar and ‘Internet Bond’ is a complex yet innovative mechanism for ensuring stability, scalability, and censorship resistance, distinguishing it from existing stablecoins and financial instruments. By employing a delta-neutral strategy, Ethena effectively manages the volatility of its collateral assets, ensuring the stable value of USDe in all market conditions. This strategy, combined with the use of on-chain custody and derivatives for liquidity, positions Ethena Labs at the forefront of financial innovation, offering a novel solution that bridges the gap between traditional finance and the burgeoning digital asset economy. Through Ethena Labs, Ethereum’s potential as a stable form of money is unlocked, facilitating significant capital inflows and supporting the growth and maturation of both centralised and decentralised crypto ecosystems.

What is the ENA Token?

The ENA token is the governance token for Ethena, a DeFi protocol focused on creating a synthetic dollar (USDe) and a DeFi bond system that operates outside the traditional banking framework. Ethena recently announced an airdrop of 750 million ENA tokens, which constitutes 5% of the total supply, as a reward for participants in its shard campaign. This campaign lasted for six weeks, during which users engaged with the protocol to earn shards, a form of participation measurement that would later determine the distribution scale of the ENA airdrop.

This strategic airdrop is designed to incentivise long-term engagement within Ethena’s ecosystem. Small holders of the token will receive their share of the airdrop immediately, without any vesting period. However, the 2000 largest ENA wallet holders will receive half of their allocated tokens at the time of the airdrop, with the remaining half subject to a six-month vesting period. This vesting is contingent upon the condition that these holders maintain at least the same amount of USDe—the protocol’s synthetic dollar—as they held at the time of the airdrop snapshot, reinforcing the protocol’s goal to reward sustained participation and investment in its ecosystem.

Ethena has kicked off the sats campaign following the airdrop announcement, signalling the next phase in the protocol’s development. This new campaign aims to integrate Bitcoin as a backing asset for USDe, with aspirations to expand USDe’s market cap to over $10 billion. This move underscores Ethena’s ambition to grow and diversify the synthetic dollar’s backing assets, enhancing its stability and utility.

The ENA token, besides serving as a governance token, allowing holders to participate in the decision-making processes of the Ethena protocol, marks a significant milestone in the protocol’s journey. With USDe’s market cap experiencing substantial growth and the protocol itself achieving a valuation of over $1.4 billion, the introduction of ENA and the execution of this airdrop are poised to further propel Ethena’s position in the DeFi space, encouraging wider adoption and engagement with its synthetic dollar and decentralised financial instruments.

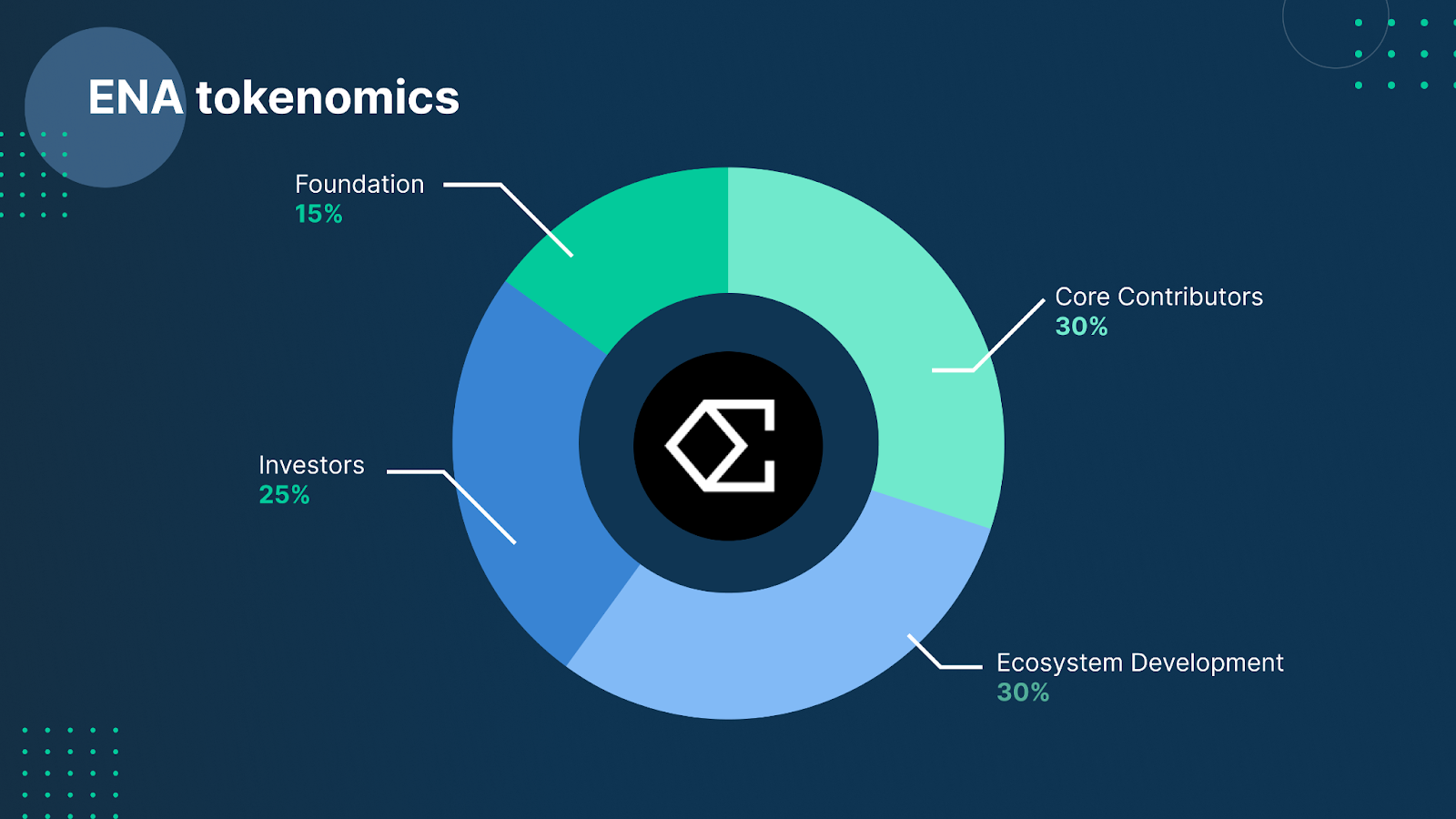

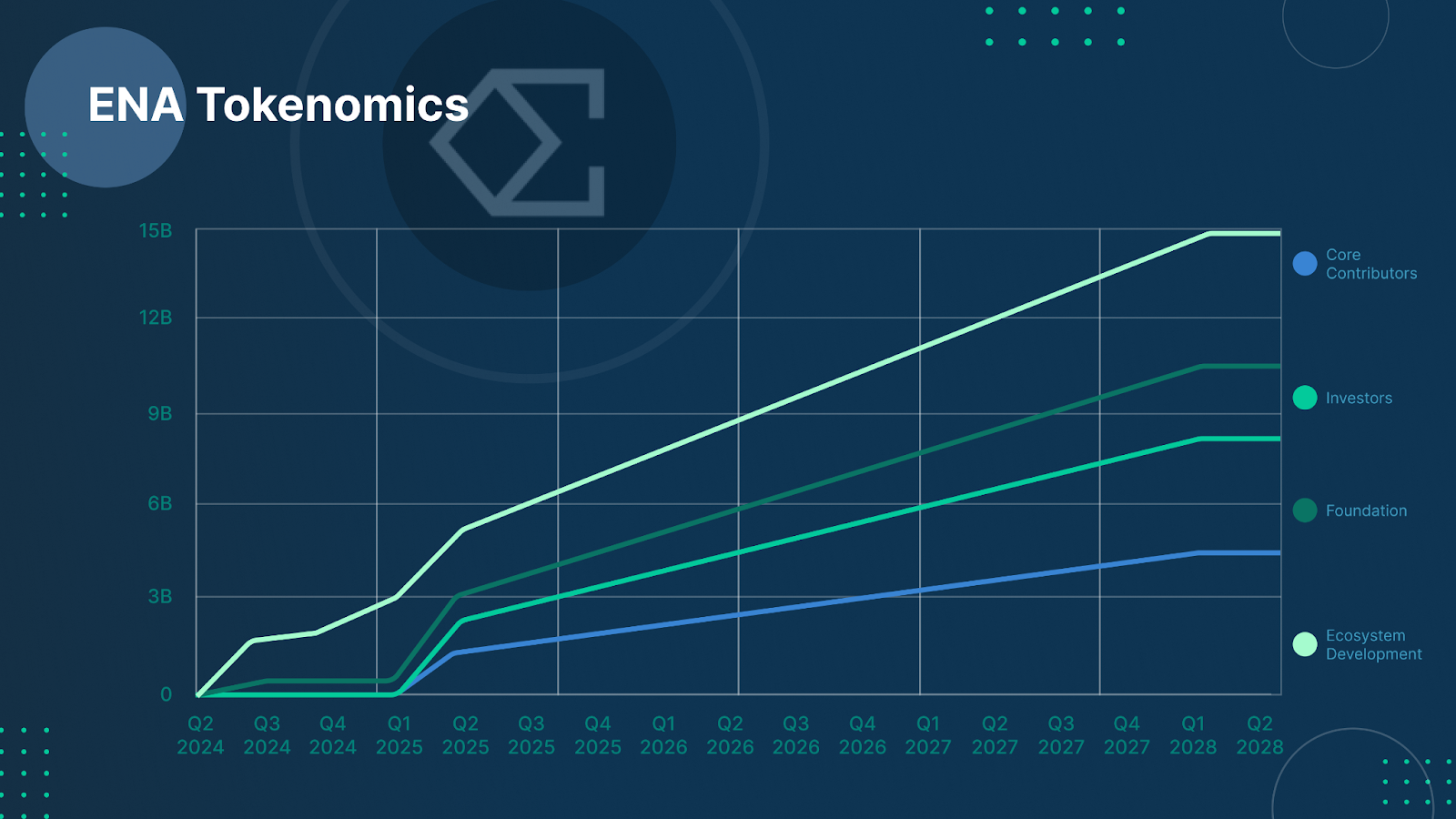

ENA Tokenomics

How to Buy ENA on Bitfinex

How to buy ENA with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy ENA with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for ENA. Learn how to trade on Bitfinex here.

How to buy ENA with fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy ENA.

Also, we have Bitfinex on mobile, so you can easily buy ENA currency while on-the-go.

[ AppStore] [ Google Play]

ENA Community Channels

Website | X (Twitter) | Discord | Telegram | Github

The post appeared first on Bitfinex blog.