The motivation behind EigenLayer is to address the fragmented security landscape in Ethereum’s decentralised ecosystem. Normally, every new decentralised service needs to establish its own security network, leading to duplication and inefficiency. EigenLayer’s pooled security model allows these services to tap into the existing security infrastructure provided by Ethereum stakers. This reduces capital requirements for stakers and enhances security guarantees for the services that adopt the protocol, encouraging more innovation on Ethereum without the need to independently bootstrap trust networks.

EigenLayer’s architecture is centred around a system of delegation and validation. Ethereum stakers can either delegate their staked ETH to operators or act as operators themselves, running the software needed to secure decentralised services known as Actively Validated Services (AVSs). These AVSs include applications that require high levels of security, such as DeFi platforms, cross-chain bridges, or oracles. By restaking ETH, stakers can choose which AVSs to support, contributing to the security and functionality of the network while earning rewards. The mutual opt-in process between stakers and operators ensures a flexible and permissionless system for securing decentralised services.

EigenLayer significantly expands Ethereum’s security model by introducing a restaking mechanism that allows staked ETH to secure a broad range of decentralised services. It optimises capital efficiency by reusing existing staked assets, thus reducing the barriers to security for new protocols. By facilitating a shared security pool, EigenLayer enhances the trust and reliability of the services built on Ethereum, encouraging greater innovation and scalability within the blockchain ecosystem.

What is the EIGEN Token?

The EIGEN token plays a critical role within the EigenLayer protocol, designed to secure AVSs through a unique staking mechanism. Unlike traditional staking models, which focus on securing a single blockchain, EIGEN staking is designed to resolve intersubjectively attributable faults, issues where consensus among users can be achieved, but which may not have objective, cryptographic proofs. The token is used to facilitate a fork-aware staking model, where malicious actors can be slashed through social consensus rather than just cryptographic enforcement. This makes EIGEN essential for securing services that rely on subjective decision-making, such as decentralised oracles and AI systems.

A primary use case for EIGEN tokens is to provide crypto economic security for AVSs. These are decentralised services that need an additional layer of security but operate outside Ethereum’s native consensus layer. By staking EIGEN, operators and validators can secure these services, ensuring their reliability and trustworthiness. This extends the security framework of Ethereum into new areas, such as data availability layers, cross-chain bridges, and decentralised finance (DeFi) applications, without requiring these services to bootstrap their own security networks. The modular nature of EIGEN staking enables developers to build complex, secure decentralised systems using the existing crypto economic infrastructure provided by Ethereum and EigenLayer.

Another crucial function of the EIGEN token is its role in the governance and slashing mechanisms within EigenLayer. Validators and operators who stake EIGEN are subject to slashing penalties if they are found to be acting maliciously or failing to meet service requirements. This slashing mechanism can be triggered through social consensus, ensuring that services remain secure even when objective proofs are not available. Additionally, EIGEN’s governance model allows stakers to participate in the decision-making process around slashing rules, validation requirements, and other critical aspects of EigenLayer’s security architecture. This gives stakeholders a direct influence on how the ecosystem evolves and ensures that security measures remain adaptive to the needs of the broader community.

The introduction of EIGEN also fosters a marketplace for security on the Ethereum network, enabling services to leverage pooled security from restaked ETH and EIGEN tokens. This marketplace allows AVSs to buy security from validators while validators can sell their staking power, creating a dynamic system where both parties can optimise for risk and reward. In addition, the versatility of the EIGEN token allows it to be used for intersubjective staking, providing crypto economic guarantees for digital tasks that cannot be resolved purely through mathematical or cryptographic proofs, such as censorship resistance or data availability verification. As the ecosystem matures, the EIGEN token is expected to play an even larger role in securing a diverse array of decentralised services.

Join the discussion about EigenLayer on our Discord!

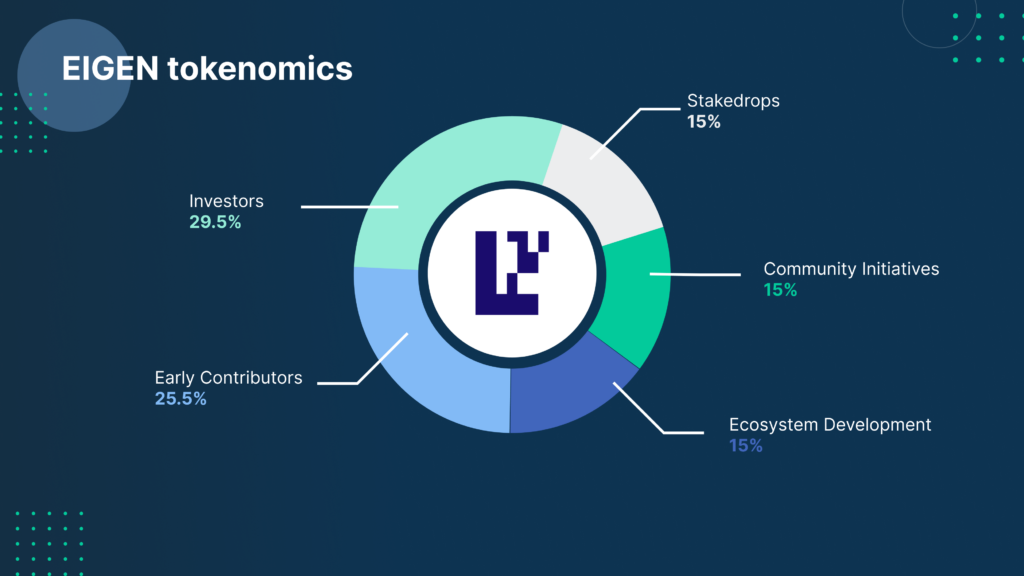

EIGEN Tokenomics

How to buy EIGEN with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy EIGEN with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for EIGEN. Learn how to trade on Bitfinex here.

How to buy EIGEN with fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy EIGEN.

Also, we have Bitfinex on mobile, so you can easily buy EIGEN currency while on-the-go.

[ AppStore] [ Google Play]

EIGEN Community Channels

Website | Discourse | X (Twitter) | Discord | Youtube

The post appeared first on Bitfinex blog.