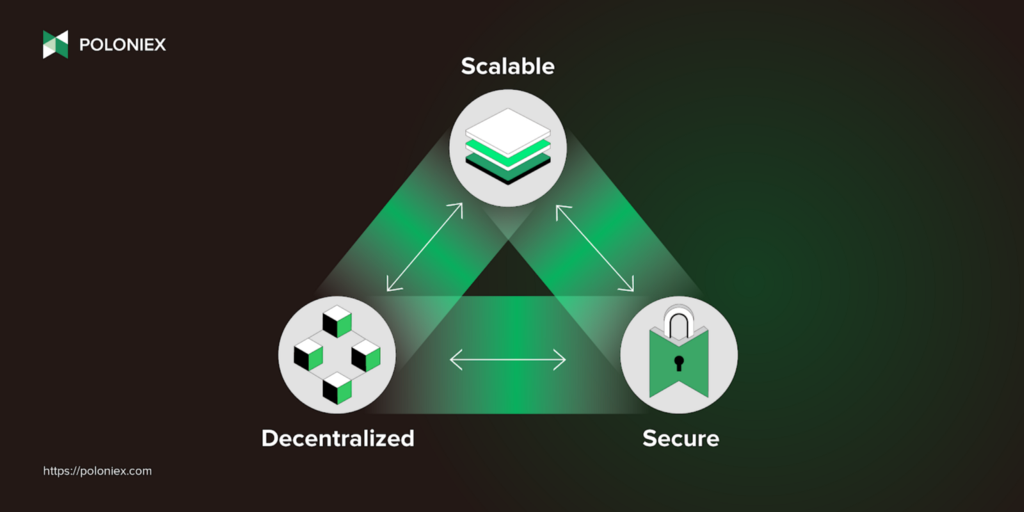

The current blockchains that we use, however, as they experience increased popularity, face increasing challenges as they hit their own unique roadblocks. Commonly referred to as the ‘Blockchain Trilemma’, many popular decentralized networks face a scenario where, in the pursuit of either decentralization, security, or the ability to quickly and effectively scale, they are forced to sacrifice one of the three.

Blockchains like Core are specifically designed to overcome this problem. In Core’s case, it leverages the Proof of Work consensus mechanism of the Bitcoin blockchain, and a modified Proof of Stake mechanism, called Delegated Proof of Stake.

TL;DR

Core is a new blockchain that leverages the advantages of Bitcoin’s proof of work network and the attributes of a delegated proof of stake consensus mechanism to achieve a network that is secure, decentralized, and scalable all at once.

How does Core work?

The Core network is a blockchain meant to maximize security, scalability, and decentralization by employing the use of its consensus mechanism called Satoshi Plus. True to its name, Satoshi Plus leverages the upsides of the PoW framework of the Bitcoin network, *plus* taking advantage of powers granted by the newer, more scalable DPoS model of network consensus. This blockchain is also what we call ‘Turing-complete’, meaning that, given enough time, it can solve any computational problem. In practice, this means developers can build more complex applications. The end result? A better ecosystem. And speaking of ecosystem, the network is also EVM (Ethereum Virtual Machine) compatible so that it can run Ethereum smart contracts and dApps. This helps developers build and port their builds with convenience.

Equally important in all of this is that Core leaves behind the shortcomings of said mechanisms. That is, PoW’s weak scaling makes it very hard for developers to build applications that go beyond Bitcoin’s store-of-value proposition; advanced Web3 applications are what builders deeply want for the space. Satoshi Plus also aims to do away with Proof of Stake (PoS) networks’ (such as Ethereum) tendency to become more centralized. On paper, a PoS framework should allow for more decentralization but in practice, centralized financial custodians (CeFi) tend to contain a high percentage of voting power on any given network.

A quick glance at Etherscan, which is a publicly viewable display of the transactions and wallets on the Ethereum blockchain, shows that 8 out of 10 of the biggest holders of ETH are exchanges like Binance, Kraken, Gemini, etc. Since the network moved to PoS with the merging of its Beacon Chain consensus engine, this means that these entities wield a considerable amount of voting power.

Satoshi Plus

Satoshi Plus is the consensus mechanism by which the Core network is secured, and leverages hash power generated by miners on the Bitcoin blockchain as well as a Decentralized Proof of Stake mechanism. Keeping in mind the concept of the blockchain trilemma, the former helps it achieve decentralization while the latter helps the network achieve a level of scalability that PoW networks might not achieve due to their low transaction throughput. Together, these two consensus mechanisms help secure Core.

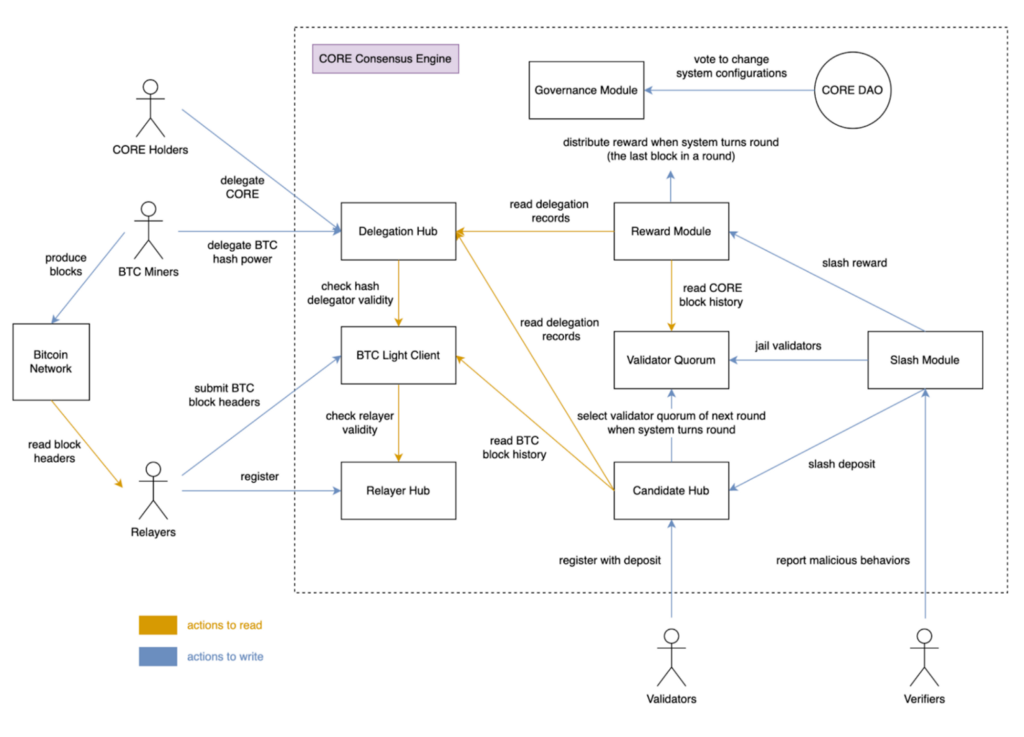

This system is unique, so let’s take a closer look at its components in order to break down how exactly it works. First up, the participants that make up this whole thing:

Validators: pictured at the bottom of the above visual, ‘validators’ are responsible for producing blocks and validating transactions on Core. Validators must register and lock up a refundable CORE deposit which will be used in the validator set. Of course, in the interest of decentralization, anyone and everyone can participate.

Relayers: In the bottom left of the visual, we see our ‘relayers’, which relay BTC ‘block headers’ to the ‘BTC light client’ in the consensus engine. As with validators, relayers must register and lock up CORE in order to participate.

BTC Miners: These are the very same miners that secure the Bitcoin network. Miners delegate hash power to a validator. This validator can be run by them or a 3rd party. BTC miners must verify and sync identity to participate.

\* It should be noted that delegation hash power does not take away from that hash power securing Bitcoin. Rather, it is re-purposed.

$CORE holders: Consistent with other DPoS chains, $CORE holders can delegate their holdings to the validators that actively participate in the validation process.

Verifiers: Verifiers report malicious actors on the network. The punishment for malicious behavior could be reward or stake slashing or the jailing of validators, which are of course removed from the validator set.

Next up, we have the mechanisms through which our participants act:

Validator elections: This is how the top 21 validators are chosen to participate in the validator set. A validator is ‘elected’ according to their hybrid score each round. Live validators are updated every 200 blocks for a more stable TPS (transactions per second). TPS describes a network’s throughput.

Hybrid score: Core has a protocol function that determines validators based on their resulting score. It derives its score from BTC hash power and the amount of CORE delegated to the validator (this will be expanded on later).

Round: This is the cycle time, set to 1 day, in which Core updates the validator quorum and distributes rewards. At the end of each day, the top 21 validators are elected to the validator set, and therefore bear the responsibility of producing blocks for 1 round. At the end of each round, all the rewards that are accumulated are distributed. Validator quorum is also determined at the end of each round.

Slot: Slots are 3-second divisions of each round, and are the time in which a validator produces a block (or fails to produce). With this time division, validators produce blocks in a round robin style, meaning each of them has a chance to produce a block.

Epoch: The cycle length that the system has to check validator status. This allows the system to exclude jailed validators from quorum and keep TPS consistent and stable. One epoch= 200 slots, or 10 minutes.

What is PoW’s role?

Okay, so we have the participants and we’ve defined some of the processes that define this engine. Now, let’s break it down by consensus mechanism. First up is Proof of Work.

In the Core network, BTC miners can participate by either delegating their hash power to a Core validator or running their own validator by synchronizing their identity on both the BTC and Core blockchains using their public and private keys. When transactions are submitted, the blocks mined by the BTC miner are synced with the Core network through relayers. The network calculates the BTC hash power of each validator in each round by tracking the number of blocks produced by each miner in the BTC network over the preceding week’s same day.

As was mentioned before, a quite elegant attribute of how Core leverages BTC hash power is that miners merely delegate their power. That is, helping secure the Core network does not take away from securing the Bitcoin network, so network security can be achieved without miners expending any extra computing power.

What about DPoS?

Like other blockchains such as Tron, Core uses a system called Delegated Proof of Stake. However, this is employed in tandem with the Bitcoin Proof-of-work system and the hash power that it generates. As mentioned before, the DPoS system works by electing a rotating group of 21 validators that are voted on by token holders that delegate their own holdings. This is in an attempt to solve the problem of high barrier-to-entry for smaller token holders who do not themselves hold a requisite amount of $CORE to run a validator. One can consider the 32 ETH required to run an Ethereum validator when defining the existing prohibitive nature of some Proof of Stake networks. But, how are validators chosen? Let’s go into the aforementioned ‘hybrid scores’ that determine who is included in the validator set.

Hybrid scores: scores are calculated using a function that takes into account a validator’s hash power and staked $CORE. The function is as follows:

S = rHp/ tHp ∗ m + rSp/ tSp ∗ (1 − m) (1)

S = score

rHp = delegated hash power (count of BTC blocks produced)

tHp = total hash power on the Core network

rSp = stake of $CORE delegated to validator

tSp = total stake on Core

M = a dynamic weighting employed by Core.

As would be expected, the highest hybrid scores get chosen, and validators are ranked 1 to 21 by this score. The sequence repeats from the first rank after it reaches the last.

So, why would a network want to have less validators instead of more? After all it seems that more validators would mean more decentralization right? Well, this limited validator design is able to offer higher TPS and better scalability, and of course the PoW component grants this whole system its decentralization. Contributing further to the cause of decentralization is the fact that $CORE holders can also participate by delegating their tokens to validators. Furthermore, the DPoS mechanism grants the network a degree of fault tolerance and resistance to possible attacks.

The CORE token

$CORE, the native token of the Core network, is what helps secure it.

The token has a hard cap of 2.1 billion tokens, meaning it functions on the scarcity principle of value. Going further, a certain percentage of rewards and transaction fees, to be determined by the Core DAO, will be burned. In order to ensure the longevity of the network’s reward mechanism, participants will have their rewards paid out over a period of 81 years.

The reward distribution is tabulated at the end of each round, 90% of the total rewards going to validators, and the remaining 10% going to something called the System Reward Contract, under which verifiers and relayers are paid.

Governance

The Core network is guided by a decentralized autonomous organization, also known as a DAO. Currently, the Core team itself controls the Core DAO but when “sufficient decentralization” occurs, according to their whitepaper, control will be handed over to the CORE community. Participants in the DAO will be able to change the number of validators, regulate governance parameters, and set the percentage of burned block rewards and transaction fees.

This brings us to the exact method by which the Core DAO will achieve said decentralization. The path towards complete decentralization is something called “Progressive Decentralization”. As mentioned just above, the Core team will at first handle the operations of the DAO in the pursuit of getting the project to a healthy product-market fit and rate of growth. After the network achieves a certain level of maturity, operations will be gradually opened up to the entire Core community.

The DAO has 3 phases of decentralization: Off-chain governance, then limited on-chain governance, and finally full on-chain governance.

The future of Core

So, what’s on the horizon for Core? Like many other networks, the Core DAO realizes that the future of Web3 is cross-chain. There are various ways to achieve this, an L0 relay or hub chain model being two avenues that are cited in Core’s documentation.

Core is also focused on scalability which may see the network leveraging Ethereum scaling solutions such as rollups. This plan of growth also includes fostering the adoption of the chain by other projects and DAOs.

How to acquire $CORE?

$CORE is available on multiple exchanges like Poloniex! You can acquire $CORE through trading a USDT/CORE trading pair.

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.