Celo’s ecosystem is built around its focus on stable-value currencies and social payments. The platform supports the creation and use of stablecoins, like the Celo Dollar, pegged to fiat currencies to minimise volatility and encourage cryptocurrency adoption for everyday transactions. Like all stablecoins, this feature is potentially advantageous for users in regions with unstable currencies, providing a more reliable store of value and means of exchange. Celo says it has an elastic coin supply mechanism that adjusts the supply of stablecoins to match demand, maintaining their value stability. Celo’s governance model allows the community to propose and vote on new stablecoins, contributing to a diverse monetary ecosystem that can cater to local and regional needs.

Celo’s says it is also committed to sustainability and community empowerment, and claims that it has carbon-negative operations and support for projects delivering Universal Basic Income (UBI) and social dividends. The platform’s open governance model and incentive mechanisms encourage participation and innovation within the ecosystem. Celo aims to deepen its alignment with the Ethereum ecosystem, enhancing scalability through L2 rollups and making strides toward becoming the fastest EVM-compatible L1 blockchain. Celo’s current focus is on refining tokenomics, providing a top-tier developer experience, and offering building blocks for wallets and applications.

What is the CELO Token?

As the native utility token of the Celo platform, CELO facilitates a variety of operations and governance within the ecosystem. Its primary use cases include transaction fee payments, participation in governance through voting, and as collateral for the issuance of stablecoins, such as the Celo Dollar (cUSD) and Celo Euro (cEUR). This multifaceted utility not only underscores CELO’s importance in maintaining and securing the network but also empowers token holders with a significant influence over the platform’s future development and policy decisions.

One of the key functionalities of CELO is to enable users to pay for transaction fees on the network. Unlike many other blockchain platforms that require the use of a native stablecoin or the platform’s primary token for transaction fees, Celo’s approach allows users to pay fees in various tokens, including CELO and its stablecoins. This flexibility aims to significantly enhance user experience, especially for those using the platform for daily transactions and DApps.

CELO is instrumental in the governance of the Celo ecosystem. Token holders have the privilege to propose, vote on, and implement changes to the platform’s protocol and other key decisions. This governance mechanism ensures that the development and evolution of the Celo platform are directly influenced by its community, aligning with the project’s ethos of decentralisation and democratisation of financial systems. The governance process covers a wide range of proposals, from technical upgrades and adjustments to the network’s parameters to decisions about the allocation of resources from the Celo Community Fund.

CELO serves as an important element in the ecosystem’s stability mechanism. The platform’s algorithmic stablecoins, like cUSD and cEUR, are pegged to their respective fiat currencies and are backed by a reserve of multiple crypto assets, including CELO. Token holders can participate in the stability mechanism by locking their CELO tokens as collateral to mint new stablecoins, contributing to the liquidity and overall economic resilience of the platform. This not only stabilises the value of the stablecoins but also incentivizes CELO holders by allowing them to earn rewards through participation in the platform’s staking and stability mechanisms.

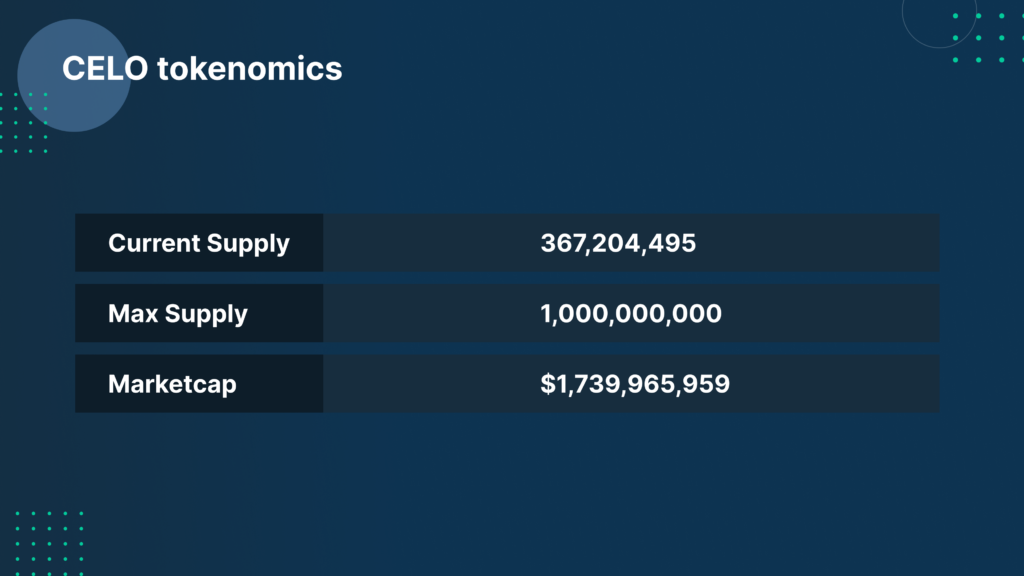

CELO Tokenomics

How to buy CELO with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy CELO with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for CELO. Learn how to trade on Bitfinex here.

How to buy CELO with fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy CELO.

Also, we have Bitfinex on mobile, so you can easily buy CELO currency while on-the-go.

[ AppStore] [ Google Play]

CELO Community Channels

Website | X (Twitter) | Discord | Medium | Github

The post appeared first on Bitfinex blog.