With the Binance Visa Card, you can use the crypto assets in your Binance account to spend and transact at more than 60 million locations around the world, wherever Visa is accepted. In addition, you can now link your Binance Card virtually with Google Pay and Samsung Pay.

When you use your Binance Visa Card, you don’t have to worry about fees from our side. We charge zero subscription or maintenance fees, and transactions made in Euros are free of transaction charges (third-party fees may apply*). To make the deal even sweeter, for every purchase that you make with the Binance Visa Card, we are offering up to 8% cashback, the highest rate available in the market today! A virtual card will be available to you for immediate use upon approval of your application.

Sign up for a Binance Card today!

How Your Binance Visa Card Works

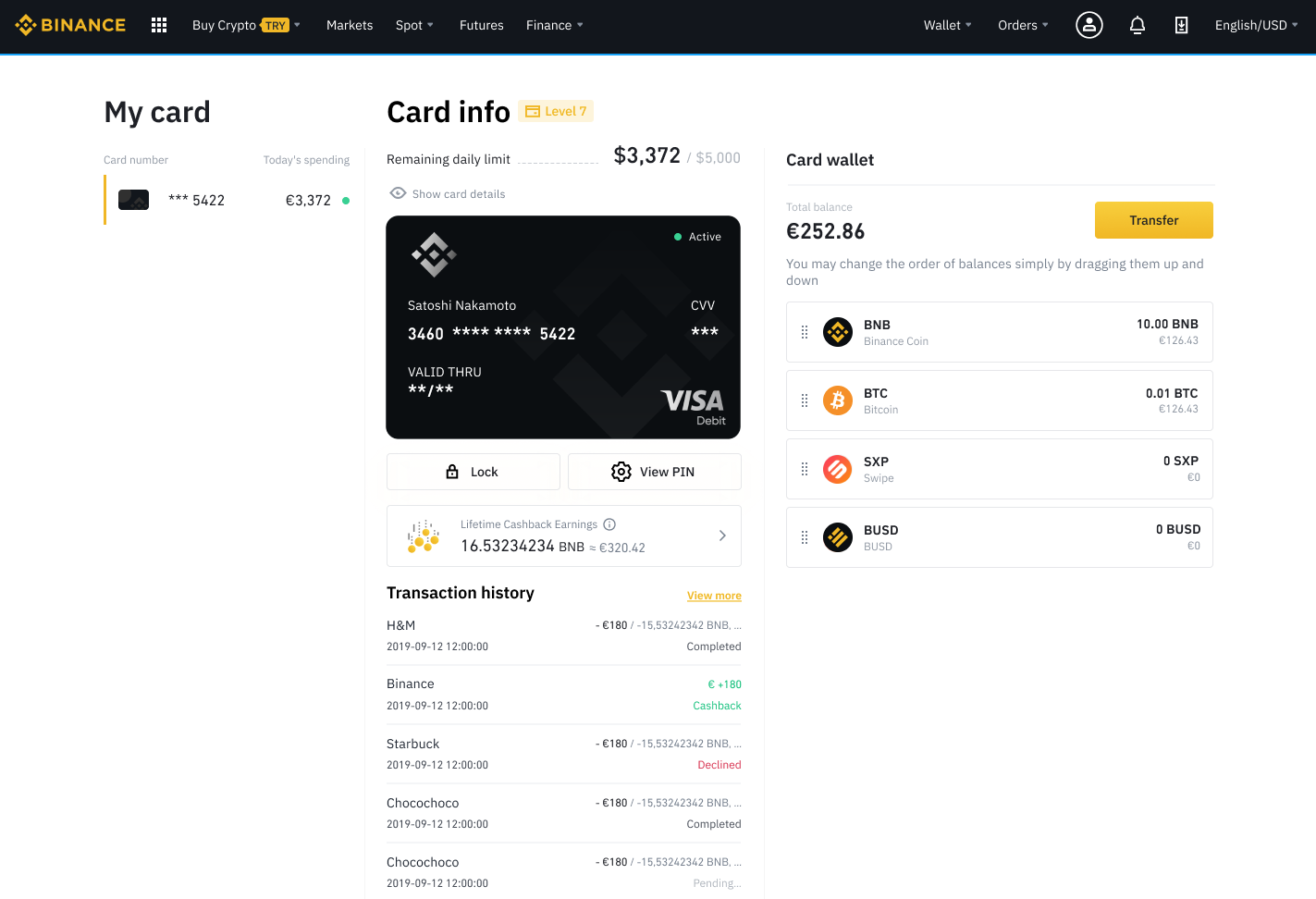

The Binance Card, powered by Swipe, works like your traditional debit card, but instead of fiat, you’ll be holding digital assets, such as BTC, BNB, SXP, and BUSD. Your card is linked to a Card Wallet within your Binance account, and you can replenish this wallet with funds stored in your Spot Wallet.

When you spend using your Binance Visa Card, it converts your crypto funds into your local currency automatically, allowing you to spend at 60 million locations around the world seamlessly. What makes this possible is Swipe’s technology, which powers the conversion and creates a frictionless user experience for both online and offline merchants.

You have the option to get both the physical and virtual forms of the Binance Visa Card. For those who want a physical card, we will process these within the next couple of months.

How to Get a 8% Cashback on Your Fee-Free Binance Card

Aside from being able to link your crypto to your real-world fiat spending, the Binance Visa Card also offers distinct advantages, such as zero transaction fees, maintenance fees, or subscription fees, and the most generous cashback rates in the market.

The Binance Visa Card offers cashback for every purchase that you make with the card. The cashback percentage will depend on your card level, which is then based on the amount of BNB held in your Binance account.

In other words, the more BNB you hold (based on the average amount of BNB you held over a 30-day period), the higher your cashback rewards will be, and you’ll receive that cashback in the form of BNB. Here’s a breakdown:

Card Level | Average BNB Held Within 30 Days | BNB Rewards on Your Purchases |

1 | 0 | 1% |

2 | 10 | 2% |

3 | 50 | 3% |

4 | 200 | 4% |

5 | 500 | 5% |

6 | 2,000 | 6% |

7 | 6,000 | 8% |

For example, you have 200 BNB in your Spot Wallet, 2,000 BNB in your Futures Wallet, and 20,000 BNB in your Launchpool account. We add all your BNB balances in your Binance account, regardless of where you use it, to determine your cashback rate. No need to worry about arbitrary rules or restrictions. In this case, you will have 22,200 BNB in total, which grants you the 8% cashback rate!

We will continue to provide additional benefits and perks to this program, including special campaigns with more digital assets.

Sign up for a Binance Card today!

* Third-party fees may apply. Cashback rewards are paid in BNB to your card wallet on a weekly basis. Transactions on digital wallets, digital banking services, crypto exchanges, stored value products, money remittance services, and certain other categories are excluded from the BNB cashback program. Please read this FAQ for more details.