Since the November 2022 bottom was reached following the collapse of FTX, Bitcoin’s bull market corrections have ranged between 18-22 percent, but the February pull back from the January all-time high of $109,590 extended to 28.3 percent, one of the most significant since the bear market ended.

The announcement on Sunday, March 2nd of a US crypto reserve by President Donald Trump triggered a sharp reversal with a 20 percent rise from local lows and over 12 percent on the day, but subsequent selling pushed Bitcoin down to approximately $92,000, and until there are more details of the proposed crypto reserve, we believe broader macro conditions, including the performance of the S&P 500, will heavily influence Bitcoin’s trajectory in the coming weeks. The market remains fragile, and without renewed institutional inflows, sustained bullish momentum may prove elusive.

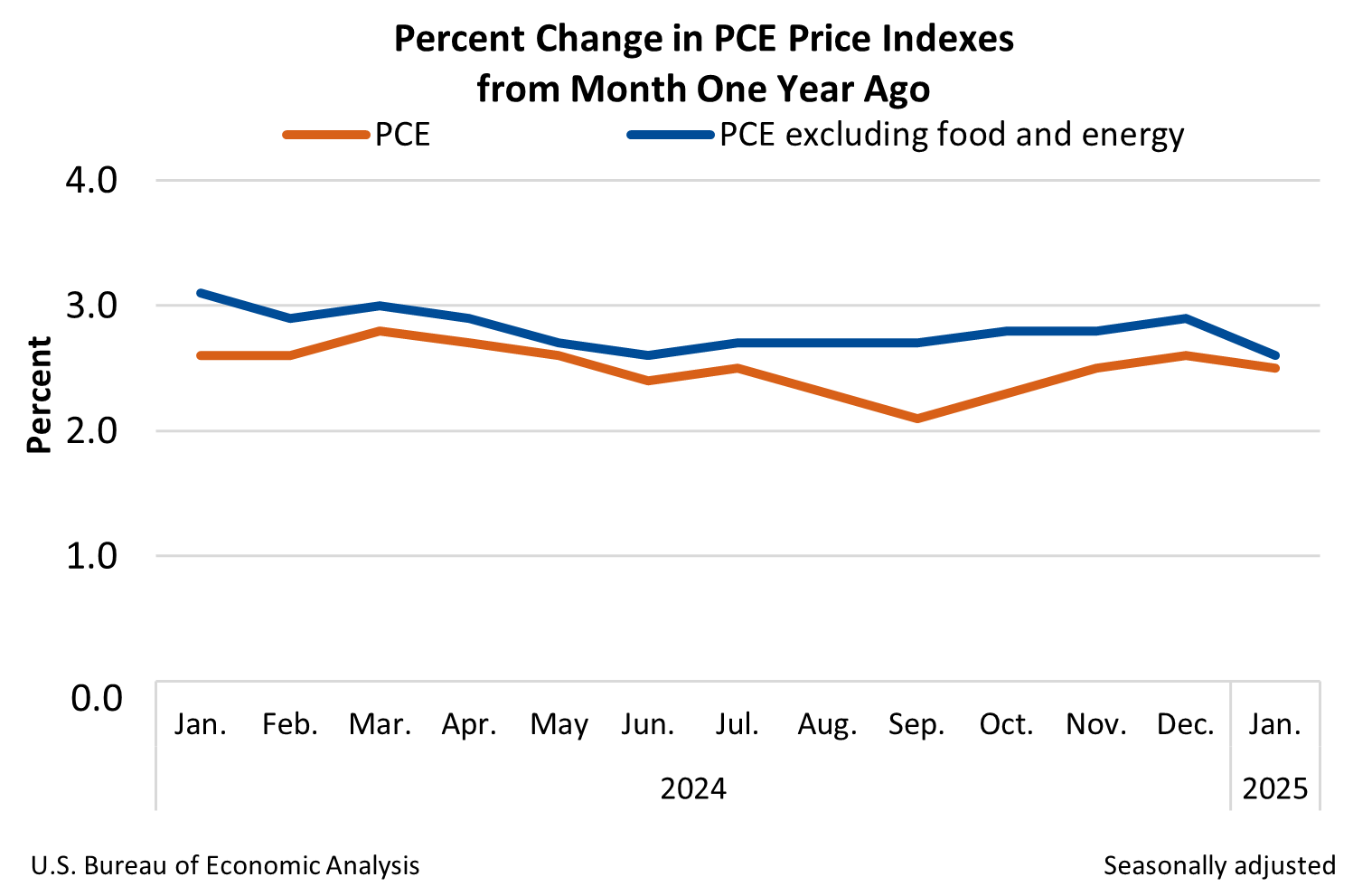

The US economic landscape remains complex, with persistent inflation, declining consumer confidence, and slowing growth shaping the outlook. January’s Personal Consumption Expenditures inflation data revealed a 2.5 percent annual increase, exceeding the Federal Reserve’s target of 2 percent. Despite the usual post-holiday dip in household spending, personal income rose by 0.9 percent in January, keeping the inflationary pressure up. Rising service costs and new import tariffs are also expected to further complicate the Fed’s ability to adjust interest rates, making a rate cut in the near term unlikely.

Consumer sentiment has also taken a hit, with the Conference Board’s Consumer Confidence Index dropping to 98.3 in February, marking its sharpest decline in three and a half years. Job market concerns are growing, with more consumers reporting difficulty finding jobs and fewer expecting new opportunities in the coming months. Trade policies and rising prices for essential goods, including food and housing, continue to erode confidence.

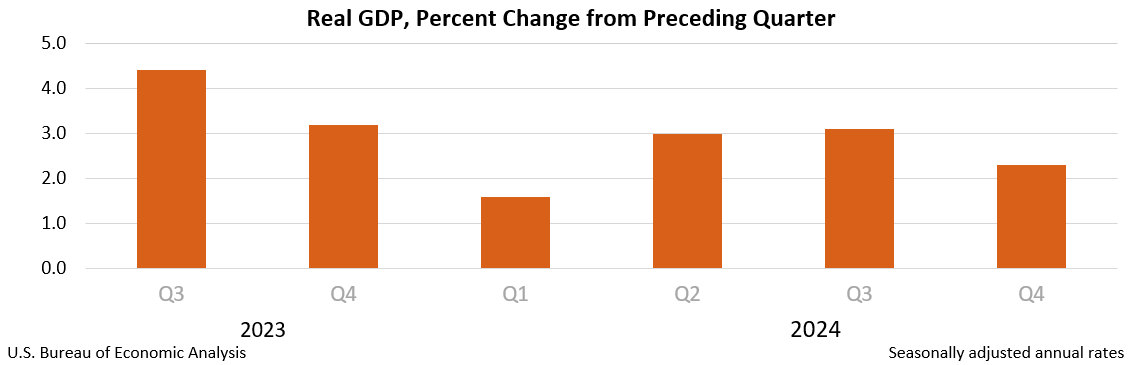

Meanwhile, the US economy expanded at a slower rate of 2.3 percent in the fourth quarter of 2024, down from 3.1 percent in the previous quarter. This slowdown is attributed to harsh winter weather, declining retail activity, and uncertainty over trade policies. Although government spending and exports provided some support, consumer spending and business investment weakened. The widening trade deficit, which reached a record $153.3 billion in January, further highlights the challenges facing the economy. With inflationary pressures and sluggish consumer sentiment persisting, economic growth in early 2025 is expected to remain subdued unless key policy adjustments or favourable economic conditions drive renewed momentum.

Trump’s announcement of a US Crypto Strategic Reserve, indicated that it would include major cryptocurrencies, including Bitcoin and Ethereum, and follows his executive order in January to clarify crypto regulation while banning a central bank digital currency (CBDC). This move confirms a major shift in the government’s approach to digital assets, reinforcing the US as a global leader in crypto ahead of the White House Crypto Summit on March 7.

Meanwhile, MetaMask has announced plans to integrate Bitcoin and Solana into its wallet, allowing users to interact with these networks without requiring additional wallets. Solana, which has seen rapid adoption due to the popularity of memecoins, will be supported starting in May, while Bitcoin support is expected in the third quarter of 2024.

On the regulatory front, the US Securities and Exchange Commission (SEC) has clarified that most memecoins do not fall under federal securities laws, as they do not generate income or depend on managerial efforts. However, the SEC has cautioned that projects falsely labeling themselves as memecoins to bypass regulations or engaging in fraudulent activities will still be subject to legal action. This distinction provides some regulatory clarity while also underscoring the risks of investing in misleading crypto projects.

Meanwhile, the SEC has once again delayed its decision on whether to permit the Cboe to list options for Ether ETFs, pushing the deadline to May. A similar decision on Nasdaq ISE’s request to list options for BlackRock’s iShares Ethereum Trust is expected in April. The introduction of options for ETH ETFs is seen as a crucial step toward institutional adoption, especially considering that spot Ether ETFs have already attracted $11 billion in net assets since their launch in mid-2024.

The post appeared first on Bitfinex blog.