Altcoins have suffered significant losses, with meme coins like PEPE plunging 46.4 percent over the past month, while OM, LTC, and HYPE remain the only large caps posting gains.

Bitcoin’s Inter-Exchange Flow Pulse (IFP)—a useful indicator of market sentiment—has turned bearish for the first time since June 2024, suggesting potential downside. The IFP records moves in BTC exchange flows from derivatives wallets to spot wallets suggesting reduced risk appetite, and this can often lead to market corrections. Meanwhile, realised losses have spiked during recent re-tests of range lows, mirroring past capitulation events within the ongoing bull cycle.

Despite signs of near-term market heaviness, Bitcoin remains, however, structurally intact. Historically, 81-day consolidation phases resolve within 90 days, meaning a decisive breakout—up or down—could be imminent.

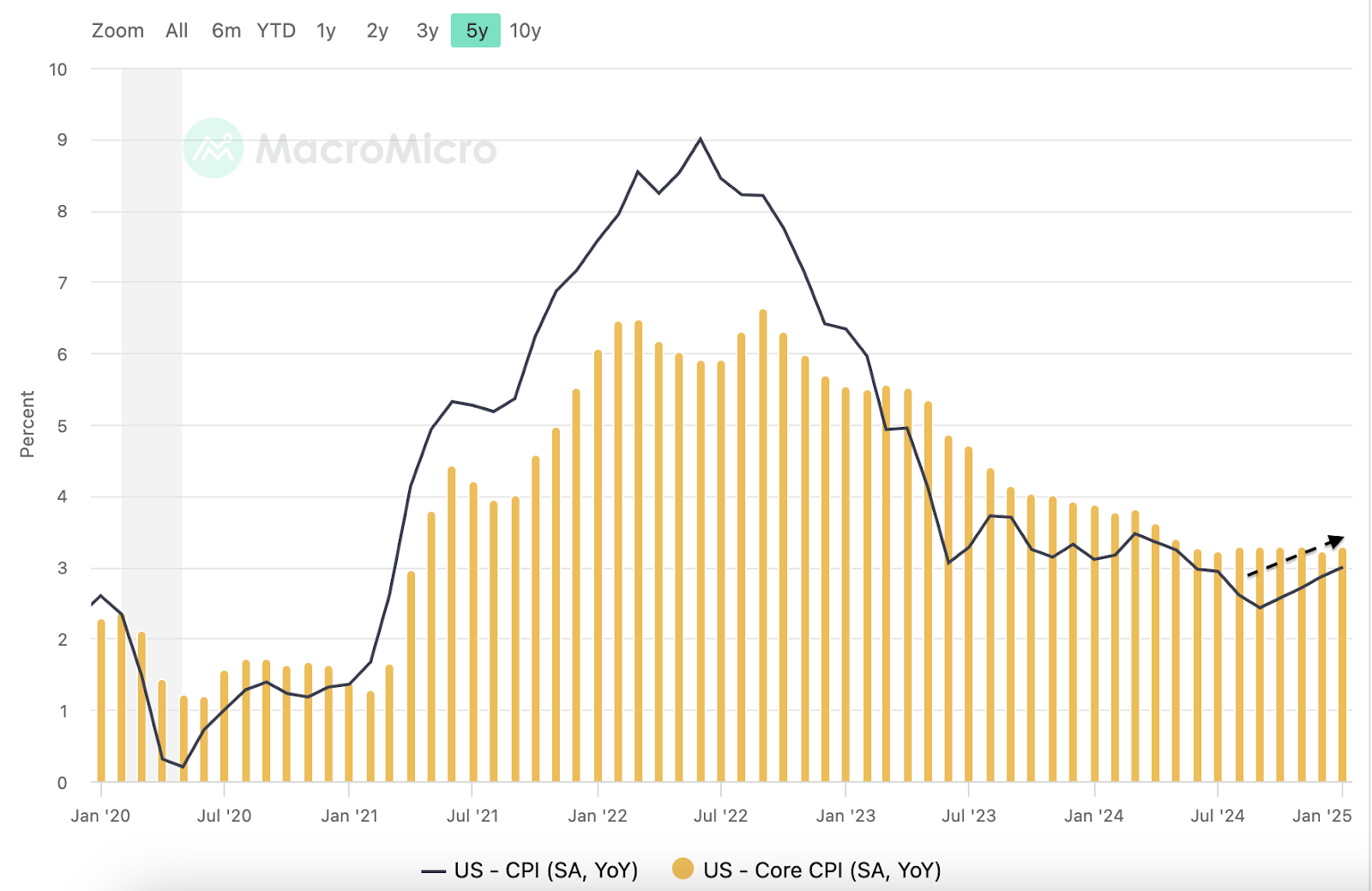

The US economic landscape is also facing a renewed challenge as inflation surged in January 2025, marking the most significant rise in consumer prices in nearly 18 months. The Consumer Price Index increased by 0.5 percent for the month, pushing the year-on-year inflation rate to 3 percent—exceeding market expectations. The unexpected inflationary surge comes at a time when the Federal Reserve has maintained restrictive monetary policies to control price stability, making an imminent rate cut unlikely. The labour market remains strong, with rising wages fueling consumer demand, further complicating efforts to control inflation.

Adding to inflation concerns, the Producer Price Index climbed by 0.4 percent in January, following a 0.5 percent rise in December, marking the sharpest two-month increase in nearly a year. The acceleration in wholesale prices indicates persistent inflationary pressures in the supply chain, making it more difficult for businesses to absorb rising costs without passing them on to consumers. Initially, markets priced in several interest rate reductions, but with inflation proving more stubborn than anticipated, the Federal Reserve may keep rates elevated for longer, impacting borrowing costs and business investment.

It is true that US retail sales sharply declined in January, falling by 0.9 percent, and marking the most significant drop in nearly two years. But this downturn was primarily attributed to adverse weather conditions, ongoing vehicle shortages, and wildfire disruptions. The coming months will be critical in determining whether this decline is a seasonal adjustment or an indication of broader economic headwinds.

In the meantime, Strategy, formerly known as MicroStrategy, has expanded its Bitcoin holdings once again, acquiring an additional 7,633 BTC last week. This brings its total holdings to 478,740 BTC, with an average purchase price of $62,473. Executive Chairman Michael Saylor remains steadfast in his long-term “buy and hold” strategy, reaffirming his commitment to not selling the company’s Bitcoin holdings. This latest acquisition, disclosed in a February 10 filing, further solidifies Strategy’s position as one of the largest institutional holders of Bitcoin, reinforcing confidence in the asset’s long-term value proposition.

Meanwhile, institutional adoption of Bitcoin continues to gain momentum as Abu Dhabi’s sovereign wealth fund, Mubadala Investment Company, made a significant investment of $436.9 million in BlackRock’s spot Bitcoin ETF during the fourth quarter of 2024. The investment coincided with BlackRock receiving a commercial license to operate in Abu Dhabi during the same period, further cementing the region’s role as a crypto-friendly jurisdiction.

The post appeared first on Bitfinex blog.