According to data from TradingView, BTC gained 8.5% week-over-week as prices reached their highest level in more than a month. The price of BTC reached a high of $24,250 on Wednesday July 20, but has since given up some gains after news emerged that electric car maker Tesla had sold about 75% of its holdings in the bellwether cryptocurrency. Tesla sold $936 million worth of BTC in the second quarter, more than a year after purchasing $1.5 billion of the cryptocurrency.

As of Monday morning (UTC), BTC has descended another leg lower, with Bybit’s BTC Perpetual Contracts market changing hands at $21,911, down by over 3.5% from the previous day.

Since reaching a six-week high, BTC appears to be losing its bullish momentum as the bears drove prices back into the symmetrical triangle pattern (highlighted in the chart). This pullback has brought BTC down to its 20-day exponential moving average at $21,845, while forming a falling wedge pattern on the 4-hour chart. If the bulls are successful in driving the price above the wedge, BTC may retest Wednesday’s high of $24,250 where a decisive break and close above this level could signal the resumption of the uptrend.

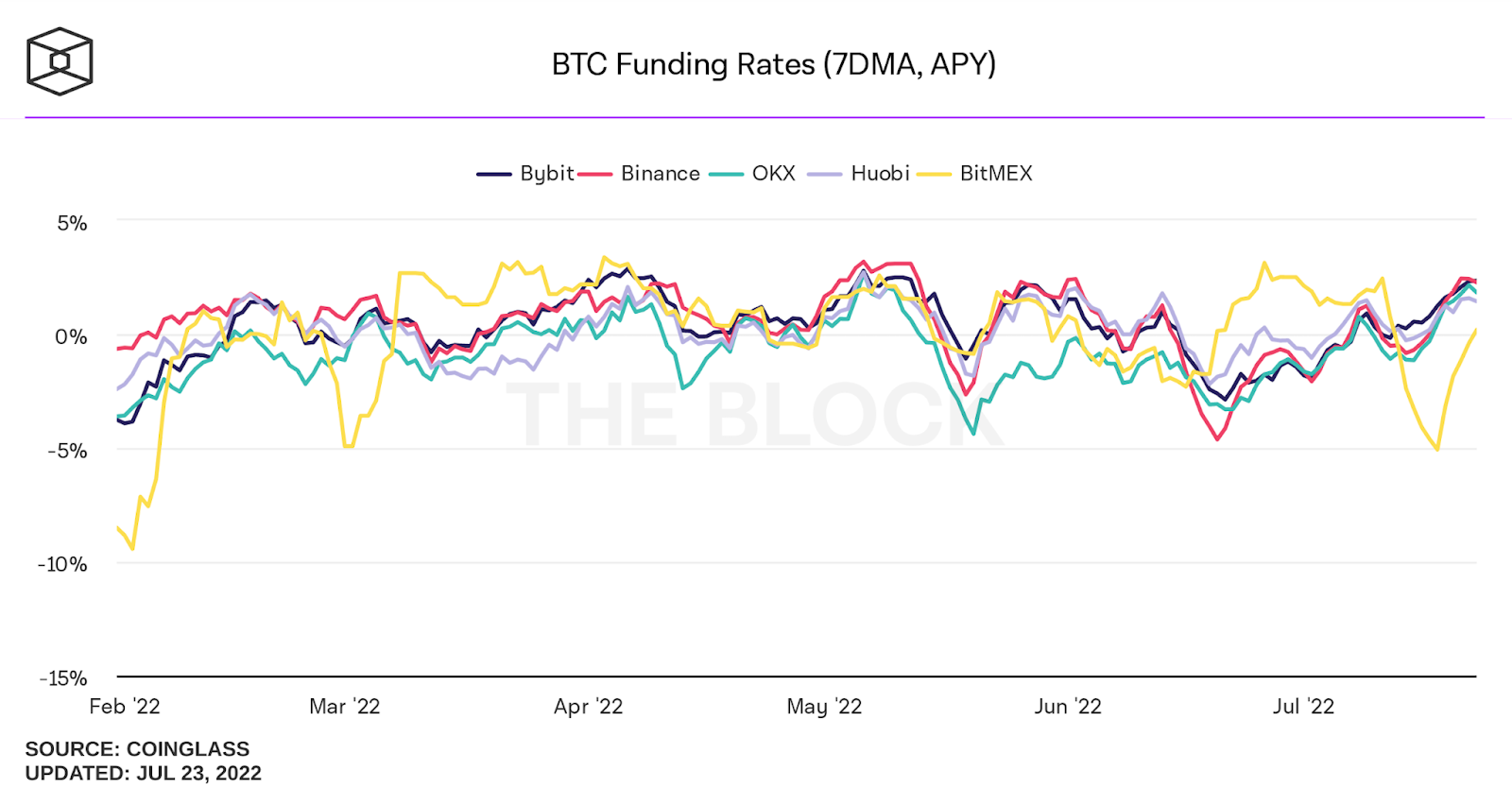

Meanwhile, BTC funding rates have started to shift upwards gradually, according to derivatives data by Coinglass. This means that more leveraged longs are accumulating positions at the current depressed levels.

Historically, crypto funding rates tend to correlate with the general trend of the underlying asset. Thus, investors should follow developments in funding rate data very closely indeed.

Check Out the Latest Prices, Charts and Data for BTCUSDT !

It has been a stellar week for most altcoins, with some coins printing double-digit gains over the past week. CRV, the native token of Curve protocol, emerged as one of the best-performing major cryptocurrencies after rallying over 24% in the last seven days.

The primary reason for its bullish price action is the upcoming launch of Curve stablecoin, which was confirmed by Michael Egorov, the founder of Curve, at a web3 summit. With the new stablecoin project, Curve joins other DeFi giants, including Aave and Maker, in the race to launch a decentralized over-collateralized stablecoin.

In spite of its recent surge, CRV still stands at 97.77% below its all-time high of $60.50, recorded in August 2020, according to CoinMarketCap data. For bargain hunters, CRV's stablecoin project may create a long-term value opportunity.

A note of caution for short-term traders is that the daily relative strength index (RSI) reading has started to enter the overbought territory, which means early buyers of CRV may look to book profits ahead of the 200-day resistance zone at $2.18. As such, investors can expect to encounter some price volatility in the coming days following a week of tremendous growth. A healthy pullback towards its 20-day moving average of $1.18 (as of the time of writing) could present a good opportunity for investors to establish some long-term positions.

Check Out the Latest Prices, Charts and Data for CRVUSDT !

Market Movers (Week-on-Week)

New Derivatives Listings — What’s New on Bybit?

Trade with up to 25x leverage on our new trading pairs: