Crypto Trading 101 | What Is Market Sentiment?

Discover the importance of understanding crypto market sentiment to navigate the volatile cryptocurrency landscape effectively.

Your understanding of crypto market sentiment, also known as crypto investor sentiment, is crucial when navigating the cryptocurrency market. It essentially reflects the overall attitude and psychology of investors in the crypto space.

This sentiment can significantly influence the direction of cryptocurrency prices by affecting supply and demand dynamics. So, being aware of market sentiment is essential for making informed decisions in the crypto market.

As an investor, you can use market sentiment to gauge how others feel about a particular asset, helping you predict cryptocurrency price movements. When prices are on the rise, it's known as a bullish sentiment, and when they're falling, it's a bearish sentiment.

By combining market sentiment indicators with other analysis methods, you can enhance your strategies for entering and exiting the market effectively.

Understanding Crypto Market Sentiment

If you're into technical analysis or day trading, understanding market sentiment is crucial. It affects your technical technical indicators because short-term price changes in the crypto market are often driven by sentiment.

To make the most of your investments, it's essential to keep an eye on how other market participants are feeling and act quickly based on that information.

Just like any other asset, cryptocurrency prices are influenced by supply and demand. Whether you're into fundamental or technical analysis, it's worth adding crypto market sentiment analysis to your toolkit as a crypto trader. It can provide valuable insights into the market.

However, it's important to note that positive market sentiment doesn't always guarantee market growth. Sometimes, a strong and optimistic market mood can precede a price drop or a bearish trend. Investor sentiment doesn't always align with the underlying fundamentals.

So, keep in mind that market sentiment alone may not tell the whole story.

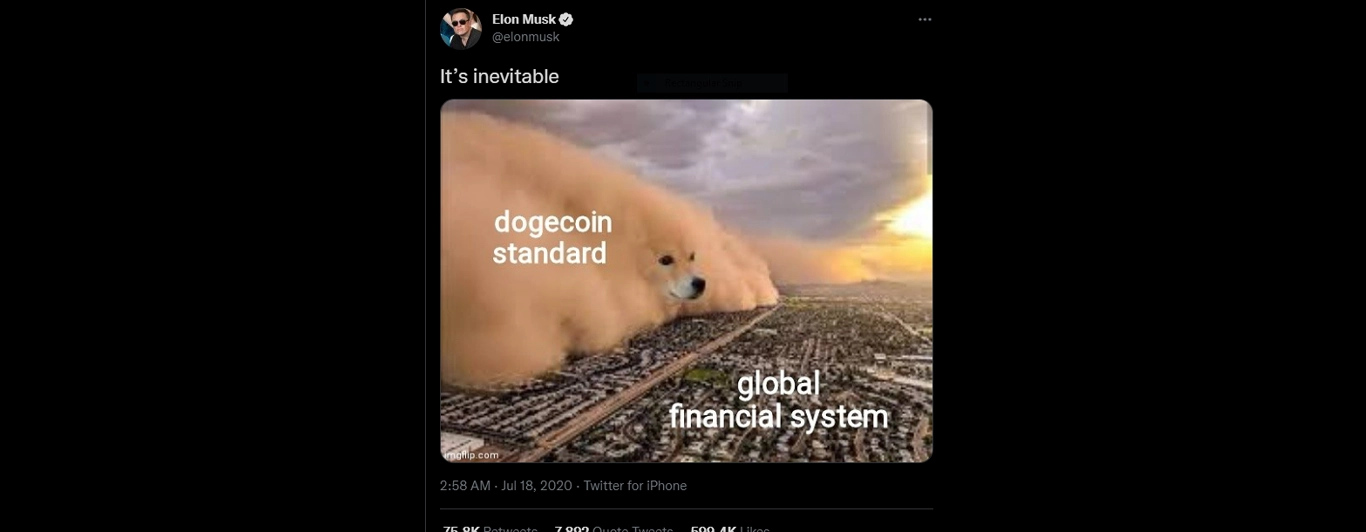

One prime example: the 2020 Dogecoin bull run.

The Dogecoin surge happened because of a big social media buzz, which made people feel optimistic about it. Many investors bought Doge simply because of the positive social media hype, without really looking into the coin's details or goals. It's worth noting that a single tweet from a cryptocurrency industry influencer like Elon Musk can have a big impact, either positive or negative, on the market.

Benefits of Market Sentiment Analysis

Before you start a cryptocurrency trade, it's crucial to make use of all the available information. Just like technical and fundamental analysis, understanding the overall market sentiment is equally vital.

For instance, analyzing the market can help you decide whether that " fear of missing out" (FOMO) on a trade is based on solid reasoning or just a gut feeling. By combining fundamental and technical analysis with market sentiment analysis, you as a trader can:

Get a better understanding of short-term and medium-term price movements.

Keep your emotions in check while trading.

Spot potential profitable price trends more effectively.

Market sentiment is widely used in price analysis. Nowadays, many traders are using data from social media networks to make their trading decisions.

How to Perform Crypto Market Sentiment Analysis

To understand the market's overall mood, you should gather various views, opinions, and ideas. However, it's essential not to depend solely on market sentiment. It's wise to consider all available data before making any financial decisions.

To understand the market's fundamental tone, consider checking relevant social media platforms where the industry and traders discuss a digital asset.

You may need to join Telegram channels, Reddit discussions, Discord, and official project forums to engage directly with the community.

Be cautious of fraudsters posing as project officials on these platforms. Always conduct thorough research before making any judgments.

Analyzing social media networks is just the tip of the iceberg. On top of using social media pages, you should also consider doing the following:

Use data collection tools to track social media mentions.

Stay updated on industry news from trusted cryptocurrency media like CoinDesk, CoinTelegraph, Cryptohopper, Cryptopolitan, The Block, and more.

Keep an eye on large cryptocurrency holders' activity, known as whale activity, using tools like Whale Alert.

Utilize market sentiment indicators to understand the overall sentiment of the community and investors. For example, check indexes like the Fear and Greed index, which aggregate various sources to summarize the current market sentiment.

Assess the level of excitement around a crypto project by using Google Trends. For instance, a significant search volume for "how to buy Bitcoin" could indicate a positive market sentiment towards Bitcoin.

Market Sentiment Indicators

As a crypto investor, you have access to different market sentiment indicators that show whether the market or a specific cryptocurrency is feeling bullish (positive) or bearish (negative). These indicators often present sentiment visually or on a scale.

It's a good practice to use multiple indicators to get a clearer picture of the market's sentiment.

While most sentiment indicators focus on Bitcoin, you can also find an Ethereum sentiment index. One widely used sentiment indicator is the Bitcoin Crypto Fear and Greed index.

It aims to measure the prevailing emotions and overall sentiment in the Bitcoin market by combining data from various sources and presenting it as a single number on a scale of 0 to 100.

The Bitcoin Crypto Fear and Greed index is a valuable tool for you as an investor, offering insights into market sentiment. When this index hits 0, it signifies that market participants are gripped by extreme fear, while a score of 100 signals extreme greed.

During periods of rapid cryptocurrency price surges, it's common for investors to become greedy, potentially triggering a "fear of missing out" (FOMO) among those watching from the sidelines, and prompting additional capital to flow into the market.

Conversely, when cryptocurrency prices are plummeting, you might feel the urge to sell your holdings. The index's goal is to capture these extremes in both fear and greed, providing guidance for you as you navigate the cryptocurrency market.

Bottom Line

Market sentiment analysis is a powerful tool for cryptocurrency investors and traders. This is especially important because the crypto industry and blockchain technology are relatively new and can experience significant price swings based on crowd sentiment.

By using the methods discussed in this article, you can begin conducting market sentiment analysis and make well-informed investment decisions.