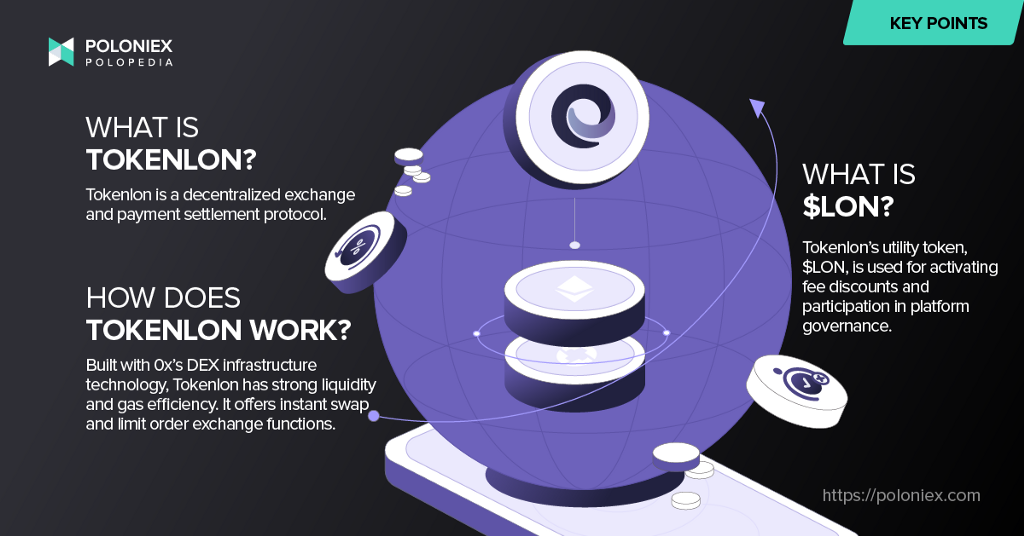

What is Tokenlon?

Tokenlon is a DEX, or decentralized exchange and payment settlement protocol. One of the things that sets it apart from other DEX’s is that it utilizes an improved version of something called Request for Quotation (RFQ) architecture.

Tokenlon was founded in 2018 and originally launched as a decentralized trading platform within imToken, a crypto wallet service, seeking to combine the advantages of both centralized and decentralized exchanges.

When it launched, two of its most touted aspects were its ability for token-to-token trading and a function called Instant Exchange, which works to deliver speedy settlement at fair prices for users.

Later on, Tokenlon became the independent decentralized exchange it is today, where it offers 129 tokens and 208 trade pairs.

Tokenlon’s characteristics are as follows:

Permissionless: Anyone can access without permission.

Trustless: Because Tokenlon’s operation is based on the execution of smart contracts, the exchange is transparent and secure to be transparent and secure without having to trust a third-party.

Anti-censorship: Without a centralized entity controlling who has access to the exchange, anyone is able to interact with the exchange.

Robustness: the exchange is able to run 24/7 uninterrupted even during protocol upgrades and configuration, and because Tokenlon’s administrator account, which is responsible for the execution of protocol upgrades and configuration, is a multi-signature account, which means that the protocol won’t suffer a failure at a single point of operation.

A bit about DEXes

In order to really understand what Tokenlon provides, we need to understand what a decentralized exchange is, and how it is different from its centralized counterparts.

Firstly, unlike a centralized exchange, a DEX is a Peer-to-peer exchange, which means that assets are traded directly between two parties and without intermediary. This is made possible by the fact that DEX’s backend is on the blockchain. And because of their decentralized nature, DEX’s are less prone to the sort of hacks that occur when dealing with centralized institutions.

Another pain point users that DEXes solve is the concern by privacy-focused users towards KYC, or Know-Your-Customer protocols. With a DEX like Tokenlon, you don’t have to sign up and provide KYC, but rather just plug in your crypto wallet in order to interact with the exchange.

In many cases a DEX’s transactions are recorded on-chain, which does tend to bring up the problem of higher gas fees. Of course, with solutions like 0x, only settlement is done on-chain which is much more efficient fee-wise.

How does Tokenlon work?

Tokenlon utilizes a Request for Quotation order matching model, which helps give users the best prices for each trade pair. How this works is it aggregates volume from various other DEXes. Thus far, it has been able to aggregate volume from Uniswap V2, Uniswap V3, Curve and Sushiswap, with plans to aggregate more liquidity pools in the future.

Currently, Tokenlon’s exchange functions are as follows:

Instant Swap: Available on the ETH mainnet. Swap between tokens instantly, with or without ETH to pay for gas fees in your wallet

Limit Order: Available on Arbitrum — an Ethereum Layer 2 network. Place an order at the exact intended price. Once the price hits your order price, your order will be executed.

Tokenlon boasts a swap success rate of 99% due to its on-chain broadcasting mechanism.

What is $LON and what can you do with it?

LON is Tokenlon’s native utility token. It is used to align all parties involved in the ecosystem and incentivize participation and expansion of the ecosystem.

LON token Utilities

Fee discount: Tokenlon currently charges a standard 0.30% fee for most transactions. By holding LON, users can get corresponding fee discounts based on the number of tokens held. The more LON held by a user, the higher fee discount received

Governance: LON will give the community the right to participate in the governance of Tokenlon. LON holders can improve Tokenlon by initiating Tokenlon Improvement Proposal (TIP) proposals and voting, such as determining the use of the treasury, fee parameters, buyback parameters, supporting assets, and product features.

How to acquire $LON

LON is available on multiple exchanges like Poloniex! You can acquire LON through trading a USDT trading pair: LON/USDT

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀