Record-breaking ETF inflows, totalling $2.28 billion over three days, signal renewed institutional demand for Bitcoin. BlackRock’s IBIT ETF alone drew $1.1 billion in net inflows, reversing prior outflows seen during pre-election de-risking. This surge in demand marks a notable shift, with buying interest absorbing selling pressure at all-time highs and stabilising market dynamics. A marked increase in the Aggregated Spot Cumulative Volume Delta shows that there has been strong buying across major exchanges post-election. With open interest (OI) in Bitcoin futures and perpetual contracts also reaching an all-time high of $45.43 billion, the market signals heightened speculative activity, yet remains relatively stable as OI and price are in equilibrium at elevated levels.

In addition, the current wave of profit-taking is comparatively modest, compared to the March all-time high, when realised profits peaked at $3.1 billion. We believe this reflects a maturing market that has recalibrated its fair value expectations.

While the momentum is promising, the $82,000-85,000 zone could act as a psychological resistance point. We anticipate some consolidation or a potential pullback to $77,000 to close the CME gap before Bitcoin continues its climb on higher time frames. The market’s resilience, bolstered by institutional participation and newfound demand, sets a robust foundation for Bitcoin’s price discovery in uncharted territory.

The US economy currently shows signs of strength, driven by strong consumer confidence, steady growth, and easing inflation pressures. Following Donald Trump’s election, markets are reacting positively, with optimism around his pro-growth policies, including tax cuts and regulatory rollbacks. However, these policies bring inflation risks, especially if tariffs and stricter immigration rules are enacted, potentially increasing prices and wage costs.

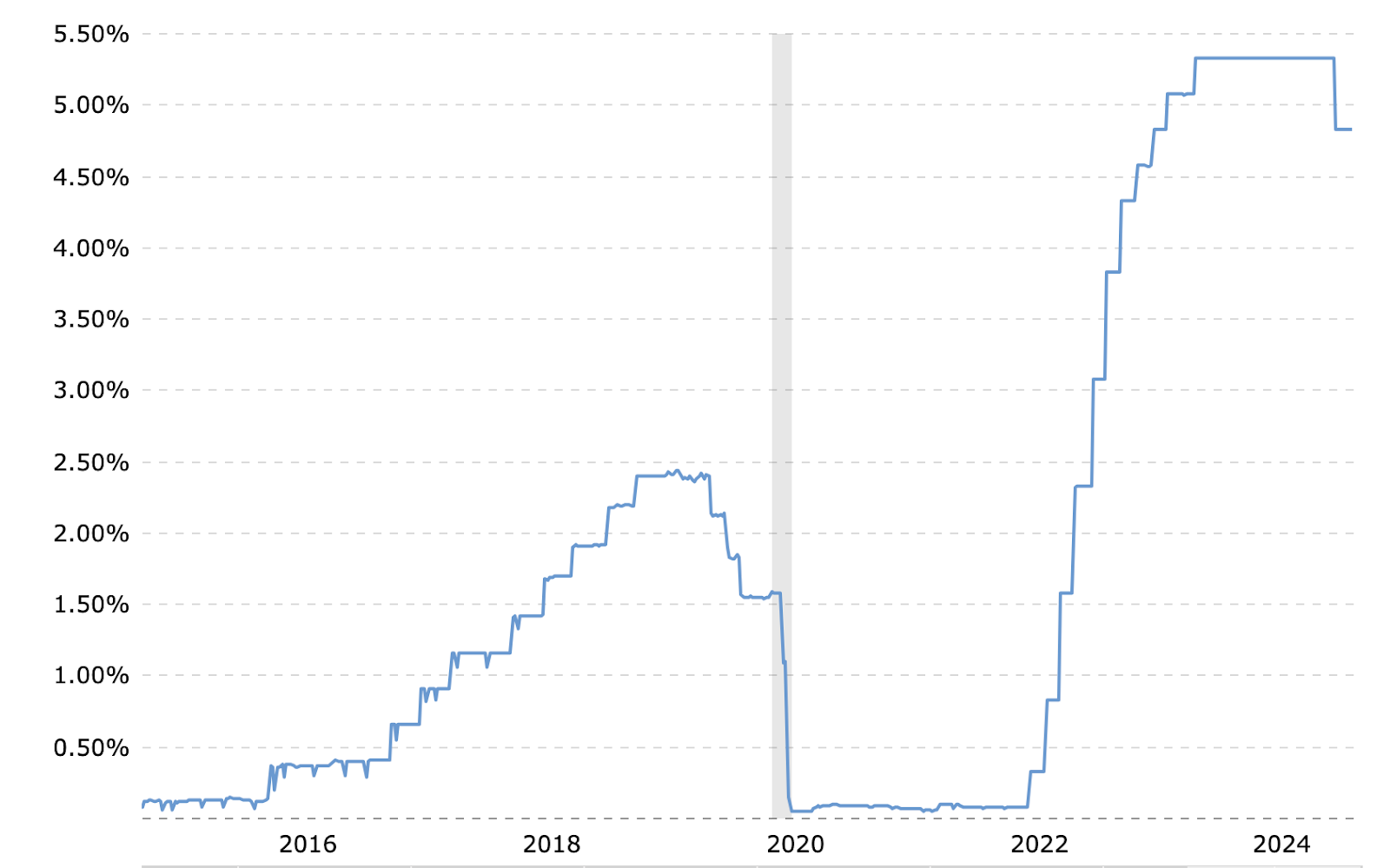

The Federal Reserve’s recent 0.25 percent rate cut, coupled with strong productivity and a stable labour market, reflects confidence in sustained growth.

However the Fed has signalled caution about further cuts, and has indicated that it will remain flexible as it waits for clearer fiscal signals before making further adjustments. Consumer sentiment has also been at its highest since April, fueled by falling gas prices and diminishing short-term inflation concerns. This optimism supports consumer spending, suggesting robust economic performance in the coming months. However, inflation risks and policy uncertainties present potential challenges, making this an economically optimistic yet cautious period.

For crypto, the Trump election victory has been perceived as very positive, sparking a surge in Bitcoin’s price and lifting crypto-centric stocks amid hopes of reduced regulations and the potential for a national Bitcoin reserve.

This week, we also saw Tether expanding its use case through the successful financing of a $45 million crude oil transaction in the Middle East, marking its entry into the commodities market.

Through its new Trade Finance division, Tether is positioning USDt as a transformative tool for faster, cost-effective global trade, with ambitions to extend into diverse sectors beyond energy.

On the regulatory front, the SEC has again delayed its decision on options for spot Ethereum ETFs, citing concerns over investor protection and market stability. This cautious approach reflects ongoing scrutiny of crypto markets, even as Ethereum ETFs have gained traction since July.

Have a great trading week!

The post appeared first on Bitfinex blog.