Volatility surged on Friday, February 21st, following news of the ByBit hack and a sharp S&P 500 options expiry sell-off, triggering a 4.7 percent drop on the day to nearly $95,000 before it recovered over the weekend.

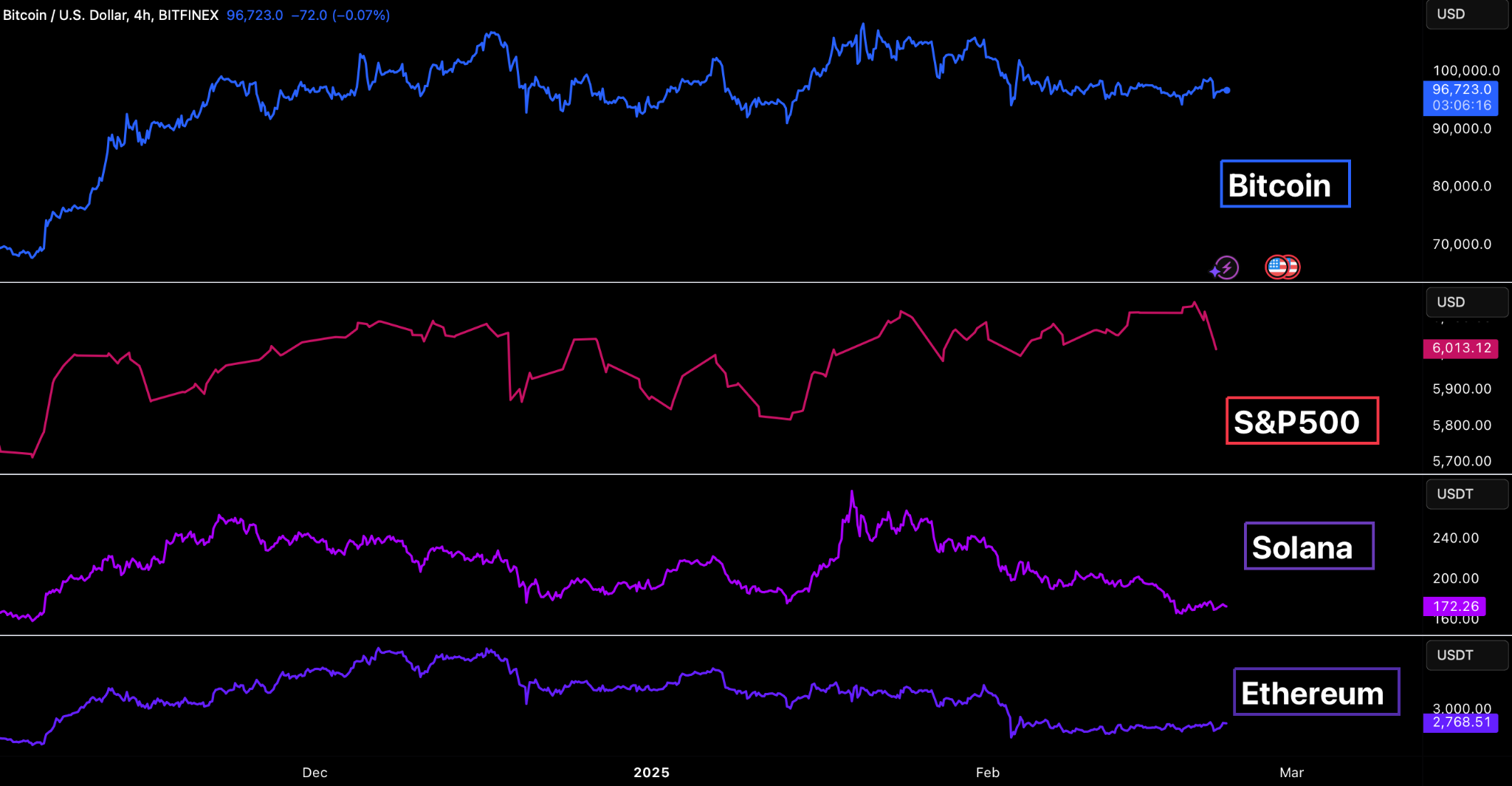

Across the broader crypto market, most major assets have entered a corrective phase following their late-2024 rallies. Bitcoin (-5.9 percent), Ethereum (-16.9 percent), and Solana (-33.1 percent) have all declined in February from rallies in November and December 2024, while Memecoins, which surged in December, have fallen sharply by -37.4 percent.

The downturn has been exacerbated by macro-driven uncertainty, as well as Bitcoin’s increasing correlation with traditional markets. The S&P 500’s failure to rally above the 6,000 level has dampened risk appetite across asset classes, contributing to a decline in speculative participation across risk assets.

Bitcoin, SPX And Major Crypto Asset Performances In 2025. (Source: Bitfinex, S&P)

Institutional demand has also slowed significantly. Bitcoin ETF inflows, which peaked at 18,000 BTC per day in November 2024, have reversed into net outflows, with $360 million withdrawn on February 20th alone.

This declining institutional engagement, paired with a notable drop in leveraged trading activity, signals a broader market contraction.

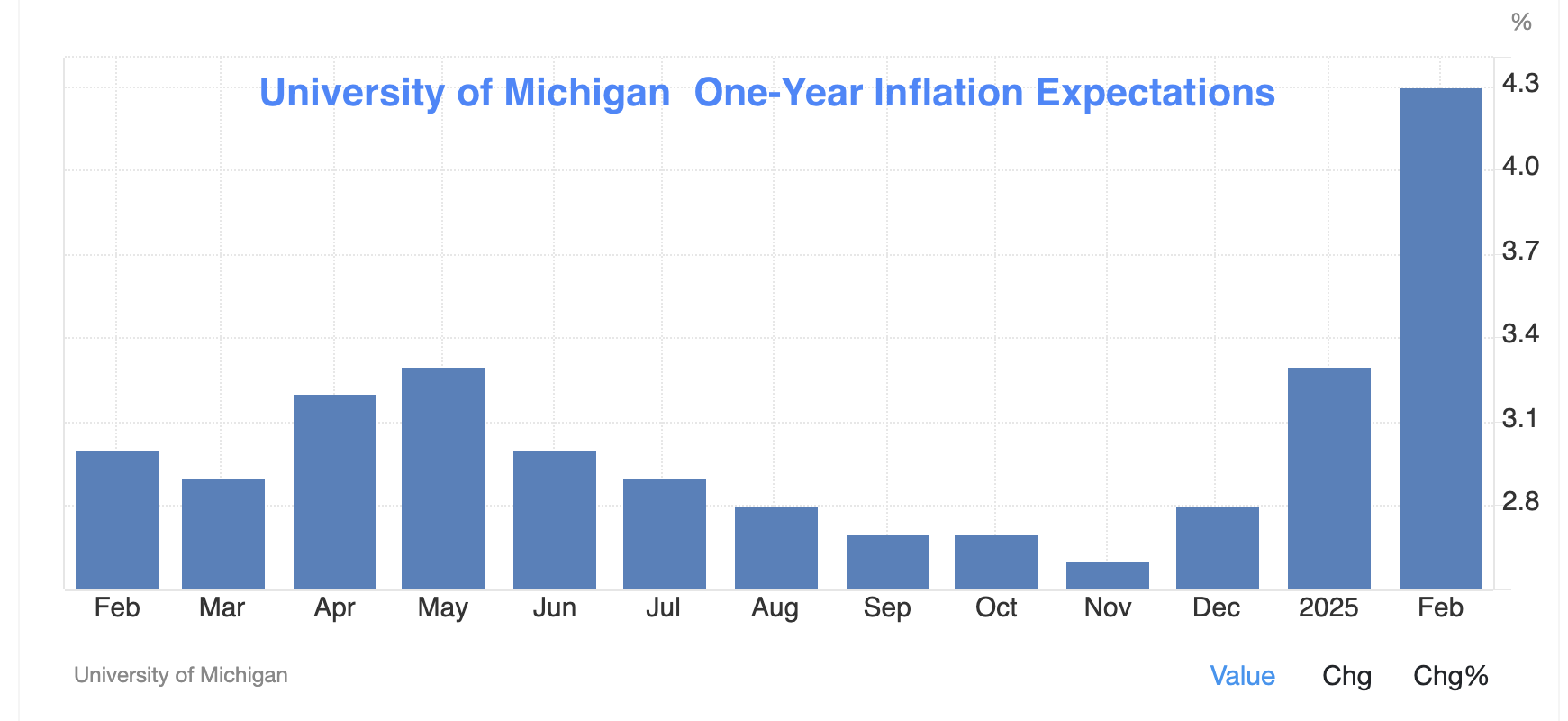

Bitcoin remains at a critical juncture after nearly 90 days of consolidation. As market participants await a catalyst, Bitcoin’s next major move will likely be dictated by macroeconomic trends and could be decisive.The US economy is also facing increasing challenges as consumer confidence weakens and inflation expectations rise, posing a potential setback to the Federal Reserve’s progress in controlling price growth. The latest University of Michigan survey shows a sharp decline in consumer sentiment, reaching its lowest level in over a year. Households are bracing for higher inflation, with expectations climbing to 4.3 percent over the next year, up from 3.3 percent in the previous month. This shift in sentiment suggests consumers are growing more cautious, which could slow spending and economic activity. The White House’s proposed tariffs on imports are adding to inflationary pressures, reversing some of the progress made in disinflation over the past two years.

University of Michigan- One-Year Inflation Consumer Expectations

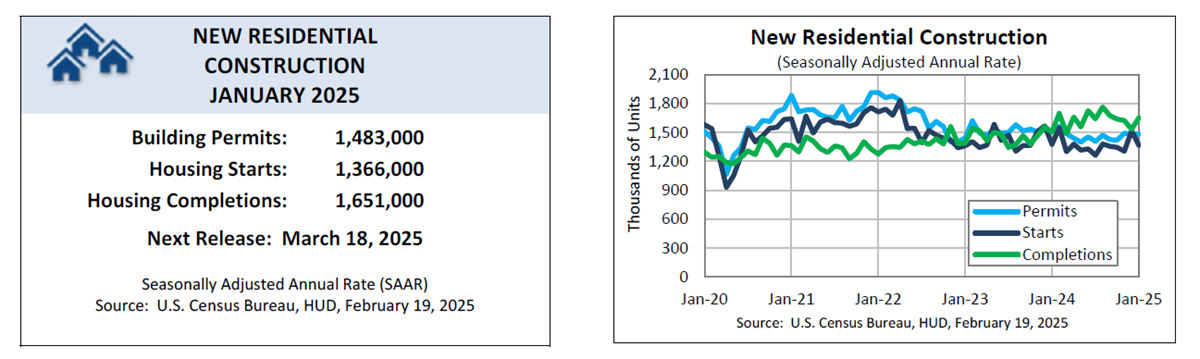

Meanwhile, the housing market is experiencing a slowdown, with new home construction dropping by 8.4 percent in January. While severe winter storms played a role in disrupting projects, the bigger concern is the long-term impact of higher material costs due to tariffs and persistently high mortgage rates.

New Residential Construction (US Census Bureau)

Builders are struggling to start new projects, as rising expenses make construction less profitable. The lack of new supply is keeping home prices elevated, further complicating the Federal Reserve’s efforts to bring inflation down to its 2 percent target. With no major policy shifts expected to ease supply constraints, housing affordability is unlikely to improve in the near future.

The cryptocurrency industry is experiencing a mix of bullish momentum and heightened risk as major events shape the market. Strategy

Meanwhile, the US Senate confirmed Howard Lutnick as Secretary of Commerce, a decision that could shift regulatory attitudes toward digital assets. Lutnick, a long-time proponent of Bitcoin and an investor in Tether, is expected to push for less restrictive policies that could encourage mainstream adoption of cryptocurrency. His stance on trade, particularly support for President Trump’s tariff policies, may also have broader implications for financial markets, potentially affecting institutional crypto investment.

On the downside, Bybit suffered a $1.5 billion hack, making it one of the largest crypto security breaches in history. The attack highlights persistent vulnerabilities in crypto asset security. While Bybit has assured users of its solvency, the breach raises concerns over security protocols and the growing sophistication of cyber threats.

The post appeared first on Bitfinex blog.