,Anoma is a new generation of blockchain protocol that introduces intents (a user’s desire expressed on the blockchain), fractal scaling, and multi-asset shielded pools.

,Anoma is being built by Heliax and has raised $26 million from investors such as Polychain Capital, Fifth Era, Maven 11 Capital, and Coinbase Ventures.

Preface

Bitcoin is widely accepted to have started the crypto revolution, achieving its goals of a decentralized currency and store of value. Ethereum, on the other hand, was the first blockchain that enabled smart contracts, allowing developers to build decentralized applications (dApps). Since Ethereum, most advancements have been aimed at solving blockchain scalability and fragmentation, the latter being a direct result of efforts to solve blockchain scalability issues.

Thus, there are currently two generations of blockchain protocols, which , Journal du Coin, aptly termed as:

Scriptable settlement (Bitcoin)

,2. Programmable settlement (Ethereum et al.)

Enter Anoma.

What is Anoma?

Anoma breaks the mold and pioneers a new generation of blockchain protocols — humanized programmable settlement. What does this mean? Anoma is a Proof-of-Stake (PoS) network of blockchains and calls itself an “intent-centric, privacy-preserving protocol for decentralized counterparty discovery, solving, and multi-chain atomic settlement.

Let’s break it down.

Intent-Centric

Transactions are a foundational block to blockchains that allow users to transmit messages and assets across the network. Transactions are validated by validators and form a permanent and immutable chain of information. Anoma breaks this down further to introduce , intents.,An intent is a user’s desire expressed on the blockchain and describes what they want to buy or sell. Users can also customize their intents to add constraints. For example, a user can express a desire to purchase an NFT at a particular price, but not before another asset, say ETH, is sold at a particular price.

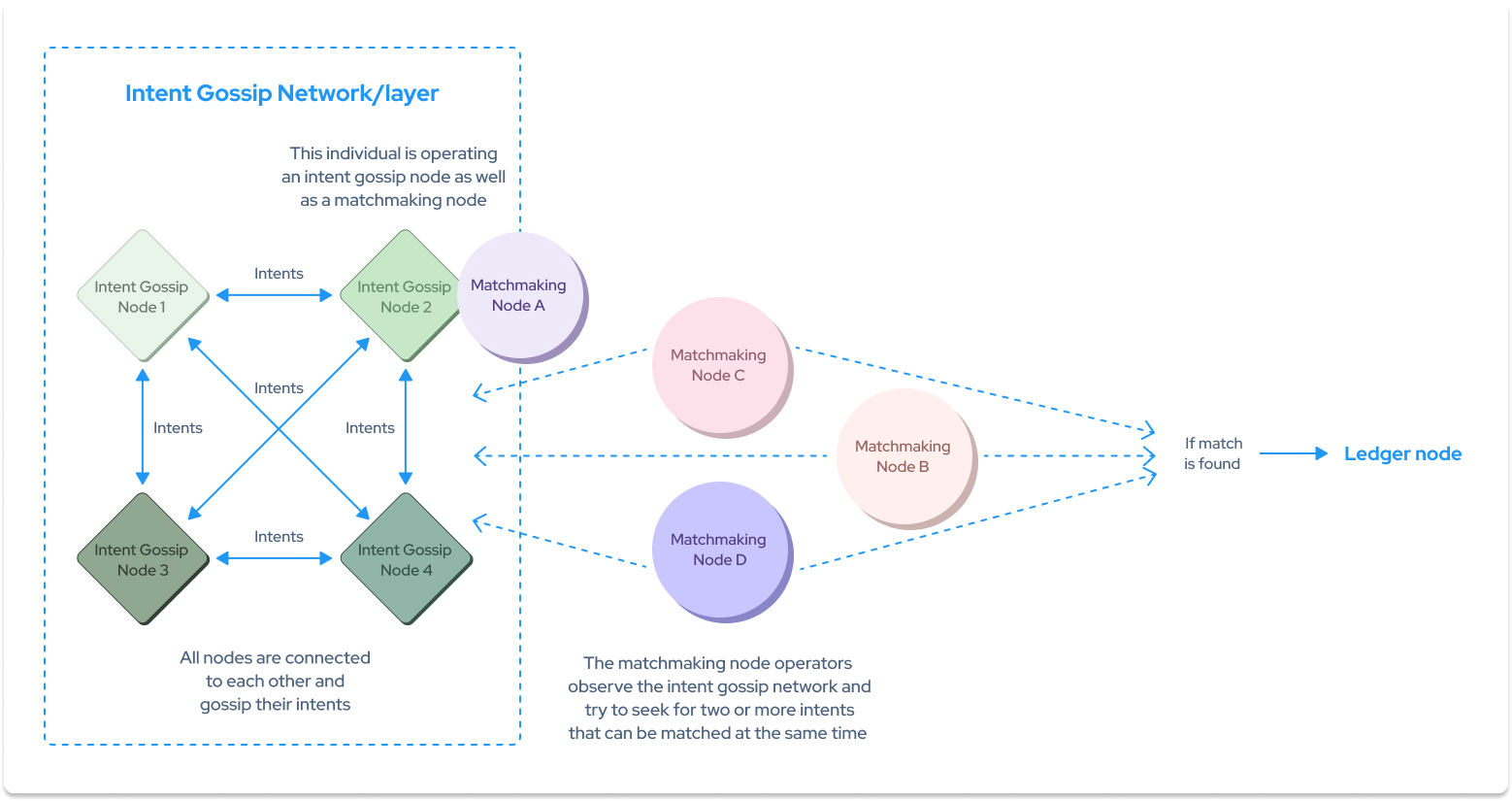

Source: Anoma

Intents are propagated on the network as “gossips”, which are communicated by intent gossip nodes. On the other side, matchmaking nodes seek to match compatible intents by running solver algorithms. This functions similar to the matching engine of an orderbook exchange, but at the network level. Thus, users on Anoma are able to find counterparties through a decentralized network of gossip and matchmaking nodes.

Privacy

Anoma provides composable privacy via the use of zero-knowledge proofs, more specifically , zk-SNARKs, (Succinct Non-Interactive Arguments of Knowledge), preserving the privacy of users and their transactions. Anoma uses zk-SNARKs in its multi-asset shielded pool (, MASP,), which allows all assets to share the same shielded pool, which in turn increases the anonymity set for users.

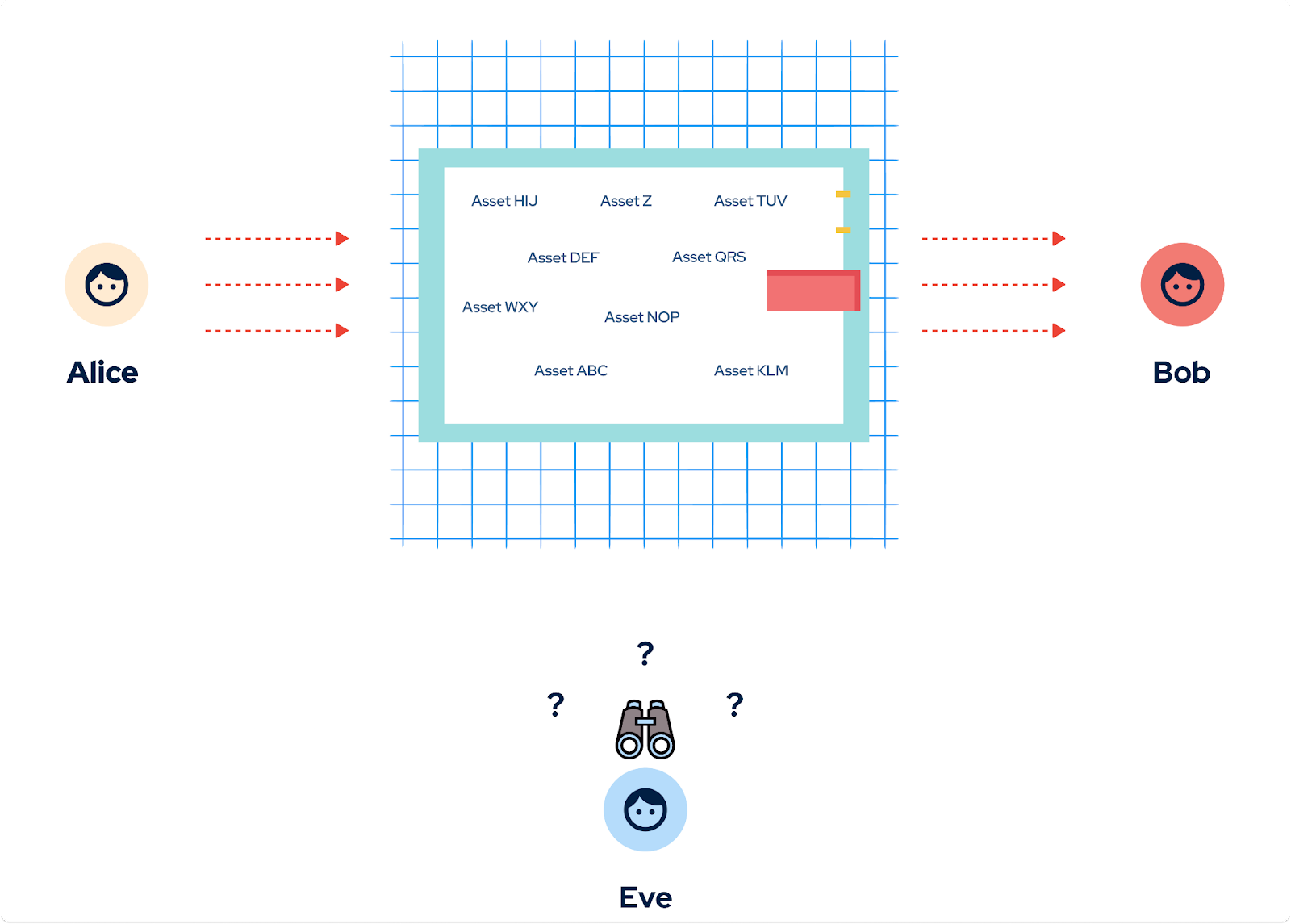

Source: Anoma

Users will be able to send and receive assets via the MASP, shielding their transactions from prying eyes as onlookers would not be able to tell which transaction belonged to a particular user, as well as the type of asset used.

Multi-Chain

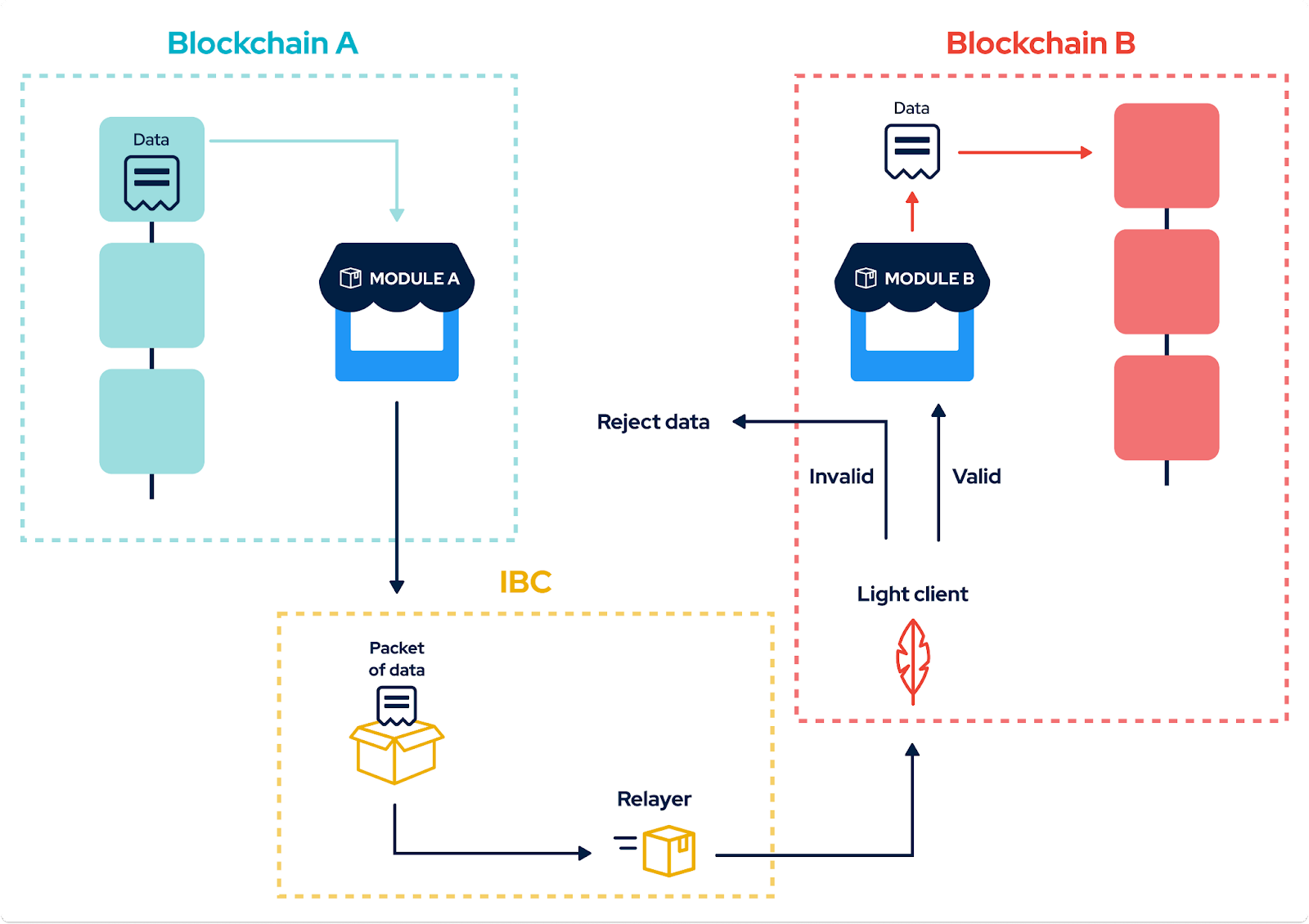

Source: Anoma

Anoma uses the inter-blockchain communication protocol (IBC) for communication between its blockchains and the wider , Cosmos, ecosystem. IBC utilizes relayers to facilitate data transfer between blockchains. While relayers are usually run by node operators, they can be run by anyone with the capacity to do so, earning fees in the process. In the above illustration, User A wants to send data from Blockchain A to Blockchain B. Once the transaction is submitted, Module A is triggered, sending it to Blockchain B via the relayer. Before it is accepted by Module B, the transaction is authenticated via a light client. Note that there can be multiple modules on each blockchain that can communicate with each other via IBC relayers. Thus, with IBC, users can send assets, both fungible and non fungible, to Anoma in order to utilize features such as its MASP.

Fractal Scaling

Fractals are patterns that repeat at different scales — in nature, we see fractals in tree branches, river deltas, and snowflakes, etc. Thus, Anoma introduces fractal scaling to solve the blockchain scalability issue. The idea is that separate instances of Anoma can be launched in localized functions, both geographically and socially, in order to scale in response to user and activity growth. Each instance of Anoma is highly customizable and can be configured based on user needs and behavior. For example, fractal instances can be launched in major cities to accommodate transactions at the local level, while still allowing interactions across the global network. Similar to sharding, this approach to scaling disperses transactions from the main blockchain into fractal instances that run in parallel, thus increasing overall network throughput. In this way, the network as a whole can scale without running into the same issues of centralization and performance that have plagued other large-scale projects.

Naturally, security reduces as a user moves to fractal instances further away from the main blockchain. However, this is not necessarily an issue, as different levels of economic activity require different levels of security. Moreover, with , Interchain Security,, , Mesh Security,, and , Interchain Alliance, in development, fractal instances could potentially increase their own security without much cost.

Team & Backers

Anoma is being built by , Heliax,, a “public goods lab” researching and developing open-source protocols and products. Heliax was founded by , Adrian Brink, and , Awa Sun Yin,. Both founders have vast experience in the blockchain space and have been working together on infrastructure and research projects on Tendermint, Cosmos, Solana, and Near, among others.

Source: Anoma

In terms of backing, Anoma raised $26 million in November 2021 in an investment round led by Polychain Capital, with participation from Fifth Era, Maven 11 Capital, and Coinbase Ventures, among others.

Namada

, Namada, is a PoS Layer 1 blockchain developed by Heliax and will be the first fractal instance of the Anoma network. Namada will be focused specifically on private asset transfers, thus being a proving ground for MASPs on Anoma. At launch, the blockchain will be interoperable with Ethereum or any IBC-enabled blockchain. This means that Namada will support any fungible or non-fungible token sent over a custom two-way Ethereum bridge or via IBC.

Private asset transfers will be facilitated via MASPs allowing NFTs, ETH, DAI, ATOM, KUJI, etc or any Namada-native assets to share the same shielded set and be indistinguishable from the outside. The protocol will incentivize users that hold shielded assets, since they’re essentially providing liquidity to facilitate the matchmaking of user-submitted intents.

Namada’s Cubic PoS (CPoS) mechanism compounds staking rewards automatically — this means that users won’t have to claim and re-stake rewards. Transaction fees can be paid in multiple assets as approved by governance.

Namada’s , Trusted Setup ceremony, and , public testnets, will be coming soon.

Final Thoughts

While there have been many efforts around privacy protocols and networks, the recent , sanction, of Tornado Cash, a currency mixer, by the US Treasury and subsequent arrest of its developers have caused concern and fear around the use of similar privacy-preserving protocols. Despite privacy protocols having been used by bad actors, privacy is also a basic human right that must be preserved. Furthermore, privacy improves user experience when it comes to payments — just as with traditional methods of digital payments. Thus, we see privacy-preserving protocols such as Anoma to be important for adoption.

Inspired by nature, fractal scaling is not unlike sharding, with a focus on localizing fractals not just based on geographical localities, but by function or communities. This allows the network to scale and run transactions in parallel while optimizing user experience to one that is not unlike that of the real-world, where activities and social interactions happen in localities — like transactions between people in the same cities, or interaction between users within the same gaming community.

One potential risk identified is: Anoma relies on bridges to facilitate inflow and outflow from Ethereum and other IBC-enabled chains into the Anoma network — this is not unique to Anoma, but an inherent risk that any interoperable chain or protocol relying on bridges face. As we have seen from the many bridge , hacks, and the recent , critical security vulnerability, found in IBC that was patched, bridges are not 100% safe. Thus, there will need to be layers of security measures to ensure the safety of user funds at all times.

Anoma’s introduction of intents as one of the basic blocks of a blockchain is exciting as it prioritizes user-centric design at the protocol level and opens up a wide range of opportunities for other protocols to build on top of. How this works in reality in terms of UI/UX is still unknown so we look forward to seeing it in action on testnet.

Disclosure: Members of Bybit may be invested in some or all of the tokens and projects mentioned within the following article. This statement discloses any conflict of interest and is not a recommendation to purchase any token or participate in any of the mentioned ecosystems. This content is purely for educational purposes only, and should not in any way be construed as investment advice. Please exercise caution and practice your own due diligence if you are planning to partake in any of these projects in any way.

Further Reading:

, MASP,

, zk-SNARKs,