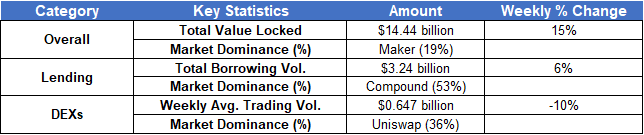

The weekly average trading volume of decentralized exchanges declined by 10%, which was partly due to a large drop in volume following the oracle exploit in DeFi protocol Compound. Uniswap’s trading volume dominance dropped by 3% to 36%, as competitor SushiSwap saw a rebound in both its total value locked and its token price following the news of a merger with yearn.finance.

Ethereum 2.0 successfully launches Beacon Chain

On the first day of December, the long-awaited Ethereum 2.0 scaling upgrade finally went live with the launch of the Beacon Chain. The upgrade introduces proof-of-stake to the Ethereum ecosystem and establishes shard chains to increase the capacity of the network and improve transaction speeds.

According to data from BitInfoCharts, the daily transaction volume on Ethereum remained above 1 million for an extended period of time following the liquidity-mining boom in July. It reached an all-time high of 1.4 million transactions on Sept. 17.

As user activities on Ethereum skyrocketed, the network experienced bottlenecks. Gas fees spiked, causing transaction fees to surge to over $14 per transaction for a simple transfer — reducing the accessibility of DeFi to a broader population. Thus, Ethereum 2.0 is crucial in the capacity expansion of the network.

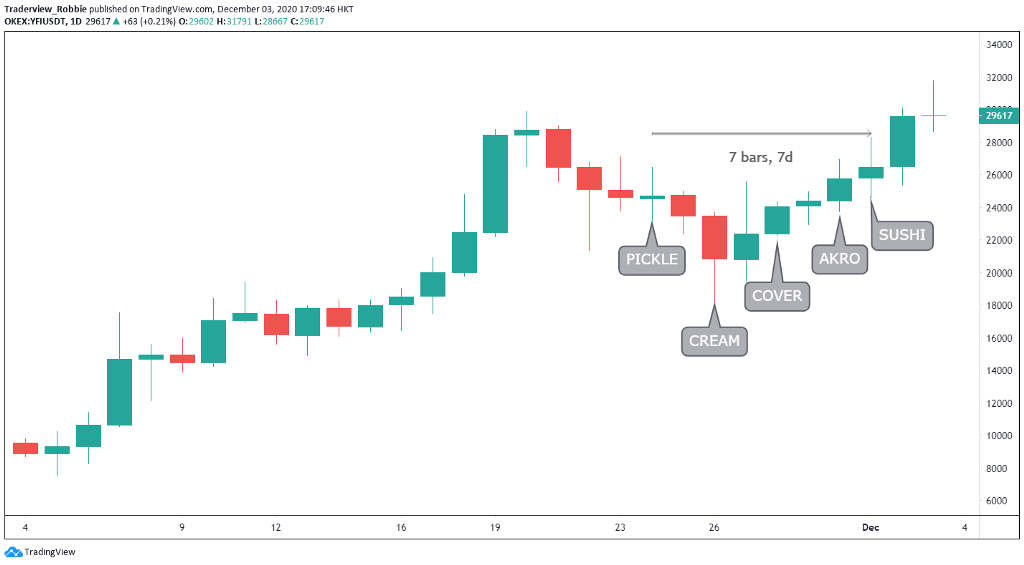

Yearn.finance announces fifth merger, with SushiSwap

On the first day of December, yearn.finance founder Andre Cronje announced that his team entered into a merger with SushiSwap to combine their development resources. Additionally, Sushiswap will help yearn.finance launch its upcoming project, Deriswap, which would combine swaps, options and loans into one platform.

Yearn.finance recently announced four other mergers or partnerships — with Pickle Finance, Cream Finance, Cover Protocol and Akropolis.

After completing these mergers, yearn.finance will have the opportunity to build more complex products in the DeFi world through several automated investment strategies, SushiSwap’s automated market maker, Cream Finance’s lending and borrowing system, and Cover Protocol’s insurance products.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.